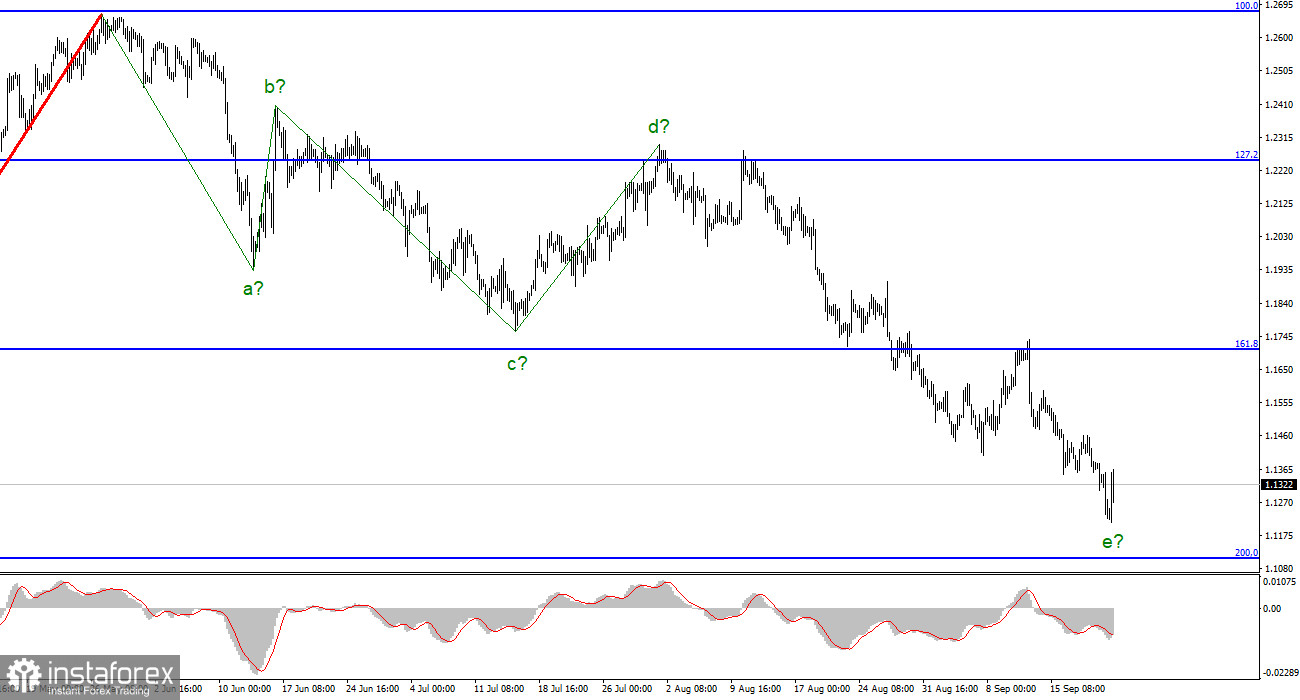

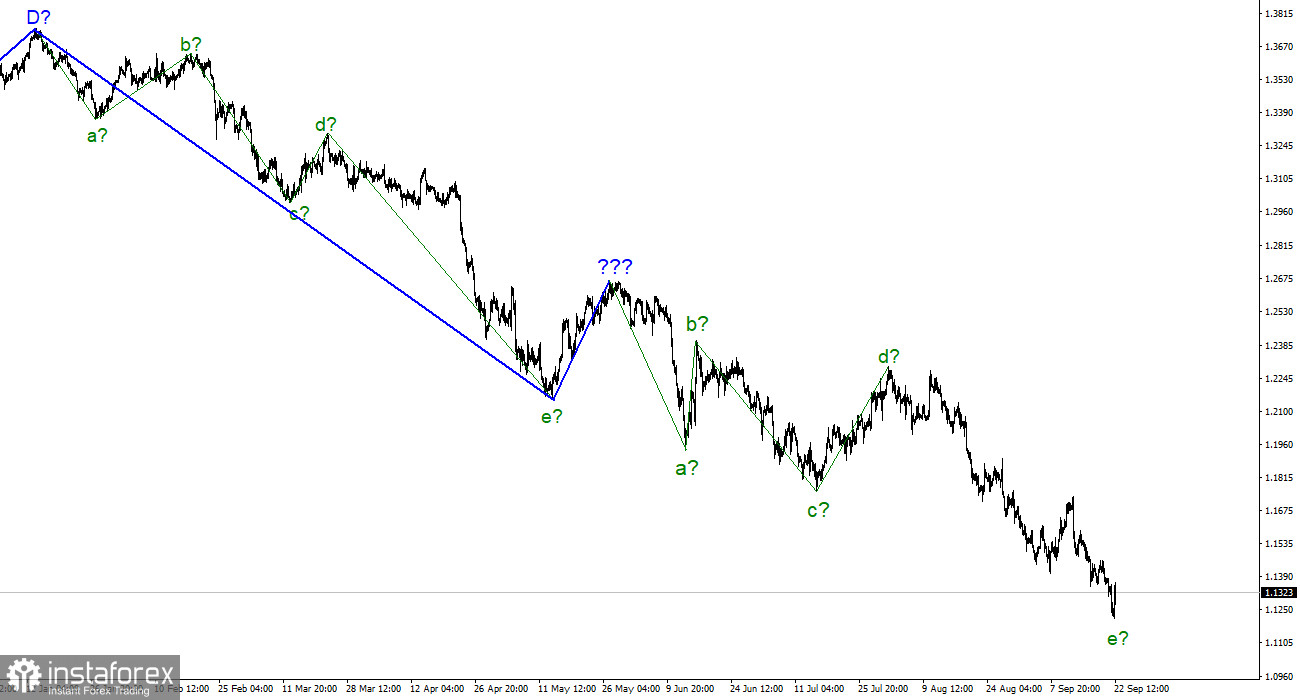

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but still does not require any clarification. The upward wave, built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend continues its construction. We have completed waves a, b, c and d, so we can assume that the instrument is inside wave e. Within this wave, waves of a lower scale are being viewed, and I can assume that the last increase in quotations is wave 4 in e. If this is true, the decline in quotes continued until today within the framework of wave 5 in e, which can already be completed thanks to today's departure of quotations from the achieved low. The wave markings of the euro and the pound in the last waves do not coincide, but there is nothing wrong with that. We just got used to the fact that both instruments move almost the same. Now, there are some differences, but both downward trend sections can still be completed in the near future.

Through the joint efforts of the Fed and the Bank of England, the pound remains afloat

The exchange rate of the pound/dollar instrument on September 21 decreased by 110 basis points (less than the euro), and today it has increased by 60. Yesterday's decline in demand for the pound was largely due to the deterioration of the geopolitical situation. Still, the evening FOMC meeting and its results also put pressure on the British. Nevertheless, the Fed did not raise the rate by more than 75 basis points, which became a lifeline for the British pound. Today, the Bank of England raised the rate by 50 basis points and, one might say, fired into this lifeline. The demand for the Brit has certainly increased. However, given the current state of things, I cannot be sure that it will continue to increase to ensure the instrument's longer-term growth.

Let's analyze: the Fed rate increased by 75 points, and the Bank of England – by 50. Even by these two parameters, we see that the market can continue to treat the dollar with more love as the rate gap grows. In addition, yesterday's news about mobilization in Russia means that it makes no sense to expect the end of the military conflict in Ukraine in the next year or two. We need to expect a deterioration in the geopolitical situation, and both of these factors do not work for the benefit of the British or the Europeans. Thus, the news background of this week speaks more in favor of a further decline in the pound than its increase. I don't want to bury the pound ahead of time since wave e has taken a pronounced five-wave form, and therefore it can be completed, but the news background can once again spoil everything.

General conclusions

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I advise now selling the instrument with targets near the estimated mark of 1.1112, equivalent to 200.0% Fibonacci, for each MACD signal "down." Inside the fifth wave, it is necessary to sell more cautiously since the downward section of the trend can end at any moment. It may even be necessary to refrain from selling for a while since the probability of the completion of wave e is still high.

The picture is very similar to the Euro/Dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same five waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.