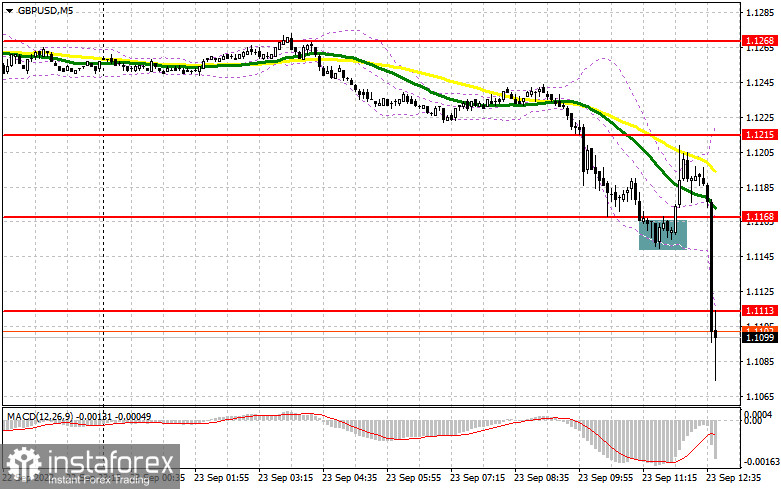

In the morning article, I turned your attention to the level of 1.1168 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and try to figure out what actually happened. The pound/dollar pair broke below 1.1215. It drifted lower to 1.1168 due to risk aversion. A buy signal appeared after a false breakout of 1.1168. It triggered a small correction of 40 pips. In the afternoon, the technical outlook completely changed.

Conditions for opening long positions on GBP/USD:

During the European session, the pound sterling collapsed due to the UK's downbeat PMI data. Investors are now convinced that by the end of the year the economy is likely to slide into a recession. They were hardy surprised by weak figures as the Bank of England also warned about such a scenario yesterday. In the second half of the day, the United States is going to reveal the same report. However, it will not help the pound sterling offset its early losses even if the reading turns out to be worse than expected. Bears may close Take Profit orders, which could lift up the pair. If the pressure on the pair persists, bulls should protect the new support level of 1.1079, which was formed after a major sell-off. Only a false breakout of this level, similar to the one I have mentioned above, will provide a buy signal. After that, a correction to 1.1139 may occur. In my opinion, bears will return to the market again. A breakout and a downward test of this level could occur only if the US PMI Indices are negative. The pair is likely to regain momentum, pushing the price to 1.1203. A more distant target will be a high of 1.1268 where I recommend locking in profits. If GBP/USD falls and bulls show no activity at 1.1079, the situation will only worsen. Bulls will have to close Stop Loss orders. The pound sterling could tumble to a yearly low of 1.1025. I recommend opening long positions there only when a false breakout takes place. You can buy GBP/USD immediately at a bounce from 1.0968 or 1.0906, keeping in mind an upward intraday correction of 30-35 pips.

Conditions for opening short positions on GBP/USD:

Bears are still holding the upper hand. They managed to push the pair to the target level. I would not be surprised if in the afternoon the pound sterling performs a small upward correction. If so, a false breakout of the resistance level of 1.1139 may take place. GBP/USD is sure to slump to a yearly low of 1.1079 where larger buyers may return to the market. Only a breakout and an upward test will generate an excellent sell signal. The pair is likely to decline to a low of 1.1025 where I recommend locking in profits. A more distant target will be the 1.0968 level. If GBP/USD rises and bears show no energy at 1.1139, bulls may initiate a further correction. In this case, it is better to postpone short positions, awaiting a sell signal after a false breakout of 1.1203. You can sell GBP/USD at a bounce from 1.1268 or 1.1314, keeping in mind a downward intraday correction of 30-35 pips.

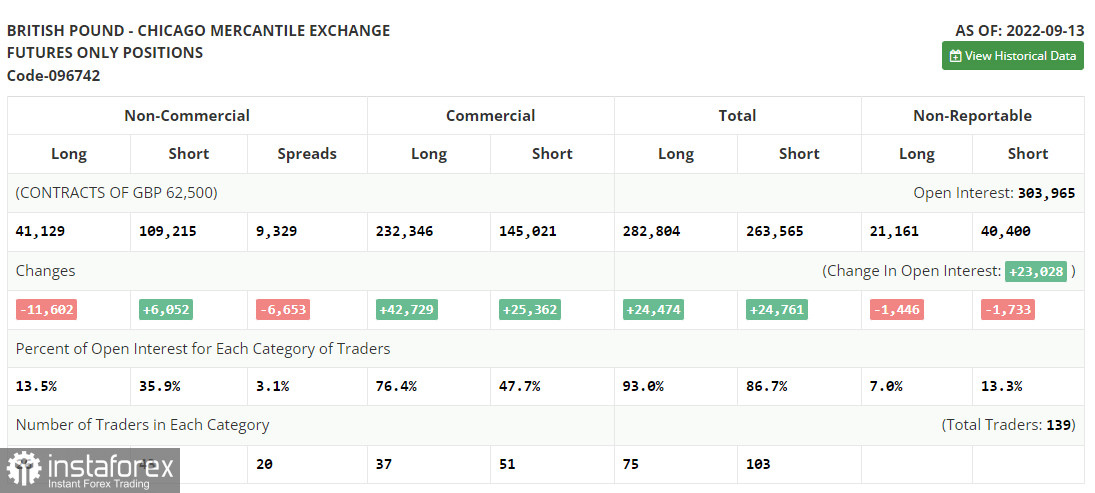

COT report

The COT report for September 13 logged an increase in short positions and a drop in the long ones. This fact once again proves that the pound sterling is following a strong downtrend, which is very difficult to stop. This week, both the Federal Reserve and the Bank of England will hold a meeting. The BoE is expected to raise the benchmark rate. This decision may have a negative effect on the economy, which is slipping toward recession. The worsening of the economic conditions is proved by macroeconomic figures. The recent speech provided by BoE Governor Andrey Bailey is reflecting the regulator's aggressive approach. On the one hand, higher interest rates should boost the British currency. On the other hand, traders are selling off the currency amid the economic slowdown and cost of living crisis. Against the backdrop, demand for the US dollar is mounting. The greenback is also gaining popularity thanks to the key interest rate hike. The recent COT report unveiled that the number of long non-commercial positions declined by 11,602 to 41,129, whereas the number of short non-commercial positions added 6,052 to a total of 109,215. As a result, the negative value of the non-commercial net position jumped to -68,086 from -50,423. The weekly closing price collapsed from 1.1504 to 1.1526.

Signals of technical indicators

Moving averages

EUR/USD is trading below 30- and 50-period moving averages, indicating a further decline

Remark. The author is analyzing the period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

If GBP/USD edges higher, the indicator's upper broader at 1.1314 will act as resistance.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.