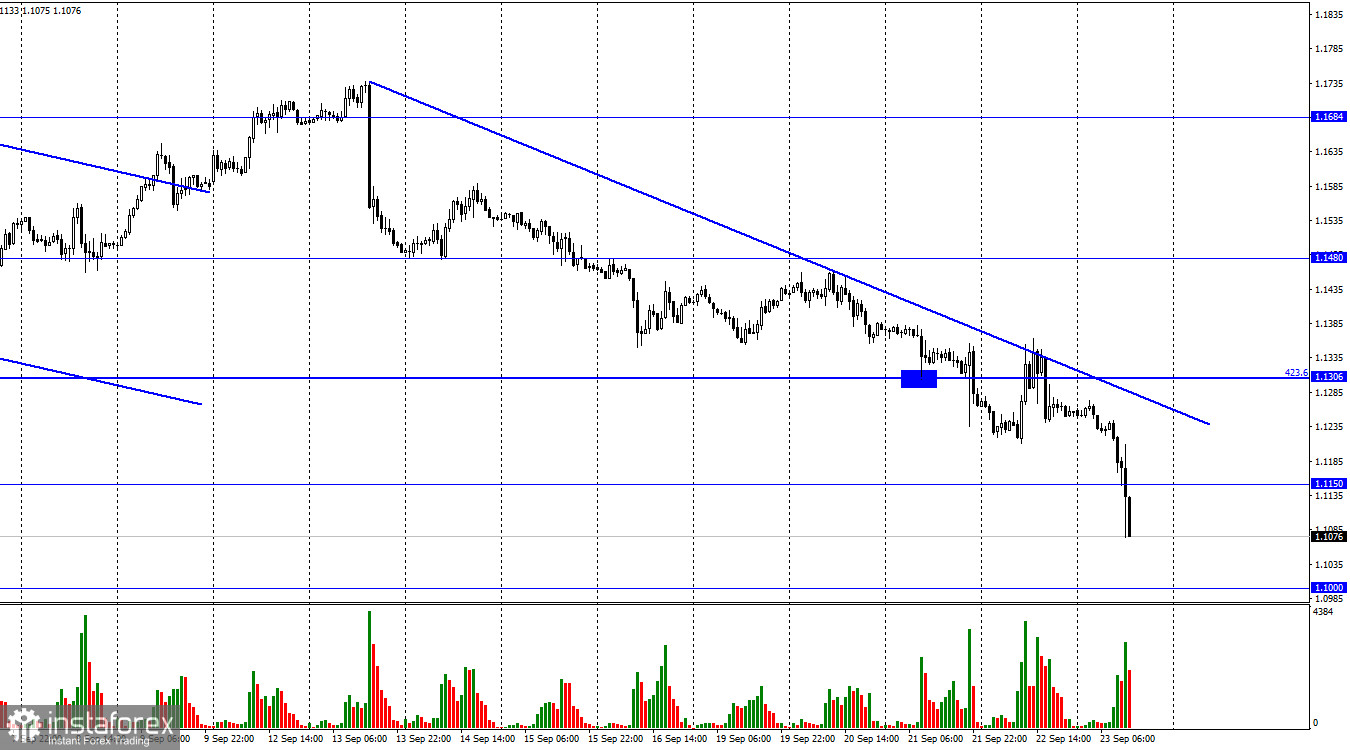

According to the hourly chart, the GBP/USD pair resumed the process of falling in the morning and, at the moment, managed to fall by 200 points. It is in addition to the 200 that were already lost earlier this week. Thus, thanks to two Fed and Bank of England meetings, the pound fell by 200, and on Friday morning, "due to business activity," it fell by another 200. From my point of view, business activity in the UK did not affect the desire of traders to get rid of the pound. All three indices turned out to be slightly weaker than traders' expectations. Still, it is unlikely that the massive sales of the British pound can be attributed to weak business activity, which had been falling for several months in a row before. Traders now don't even need good reasons to keep getting rid of the pound. The Fed raised the rate by 0.75% again. The Bank of England raised the rate by 0.50%, but, from the point of view of traders, the efforts of the Bank of England can be neglected (as it has repeatedly been before).

As I have already said, it's about geopolitics, which has deteriorated sharply this week. The world and traders are waiting for a new escalation of the conflict in Ukraine in the coming months, and while there is no escalation yet, they are trying to get out of the most insecure assets. The British pound was not in great demand earlier in 2022, and now it is just flying into the abyss. Thus, now there is no reason to even talk about when the growth of the British will begin. At this rate, the pound sterling will also go below 1.0000, which has never happened to it in my memory. Well, Friday's remaining business activity indices in the United States are unlikely to correct the shocking picture in the foreign exchange market. The fall of the pound after the Fed and the Bank of England meetings turned out to be smaller than on Friday, when the news scale was smaller. We must wait for positive news from Ukraine and Russia, for negotiations, and world peace. Without this, both the euro and the pound may continue to fall for a long time.

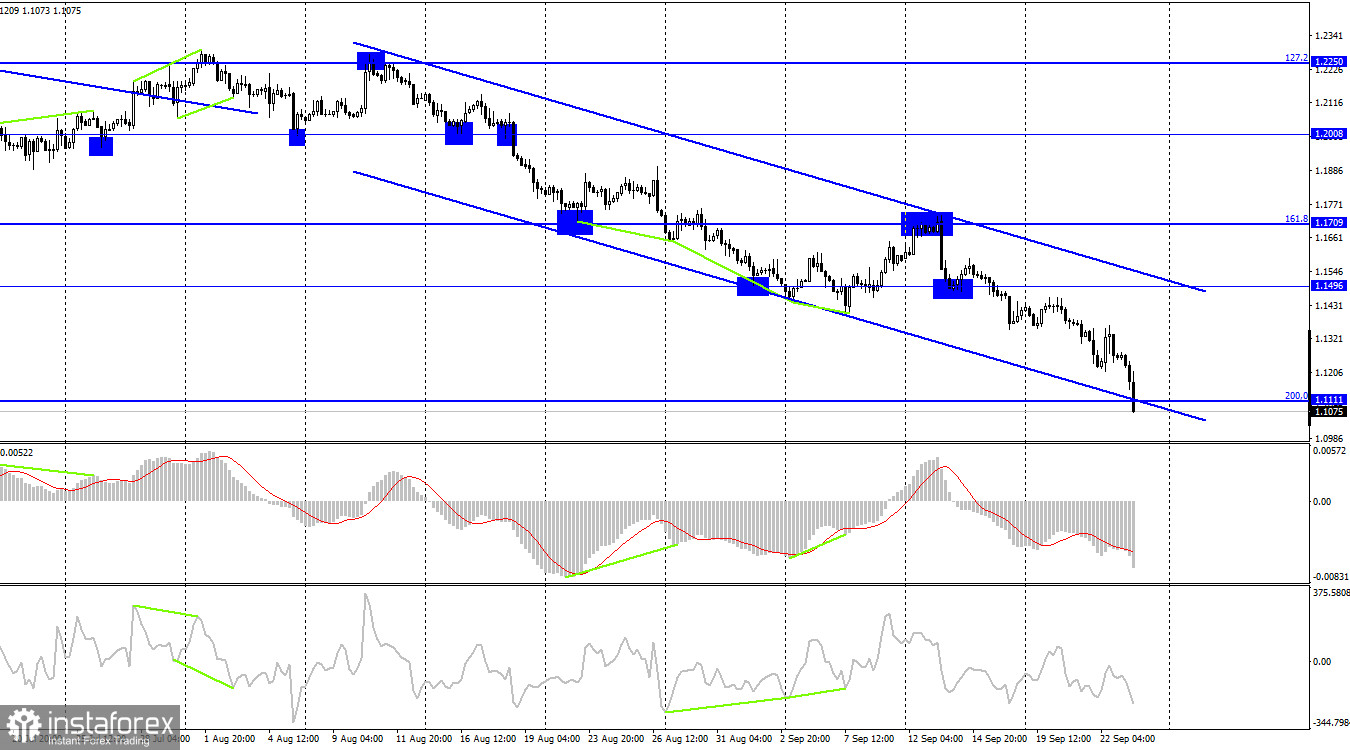

On the 4-hour chart, the pair dropped to the Fibo level of 200.0% (1.1111). Fixing the pair's rate below this level will allow us to expect a continuation of the fall in the direction of the corrective level of 261.8% (1.0146). There are no brewing divergences in any indicator today, but any "bullish" divergence on such a strong trend is a maximum pullback up by 100-150 pips. And "bearish" divergences are not formed in the fall. The downward trend corridor again characterized the mood of traders as "bearish."

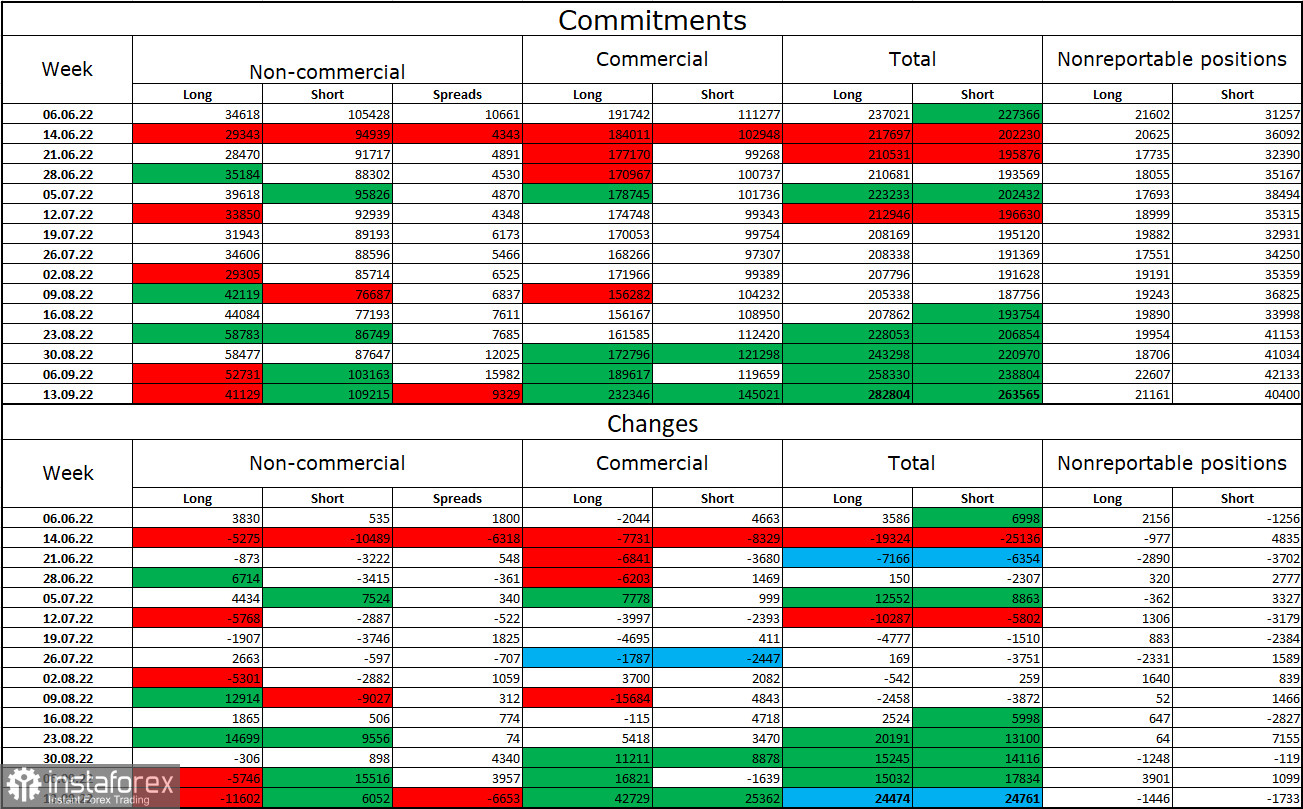

Commitments of Traders (COT) Report:

Over the past week, the mood of the "Non-commercial" category of traders has become much more "bearish" than a week earlier. The number of long contracts in the hands of speculators decreased by 11,602 units, and the number of short contracts increased by 6,052. Thus, the general mood of the major players remains the same – "bearish," and the number of short contracts still exceeds the number of long contracts. After the new report, I am even more skeptical about the possible growth of the British pound. The major players remain mostly in the pound sales, and their mood has gradually changed towards the "bullish" in recent months, but now we are seeing an increase in sales again. And the pound, meanwhile, continues to fall heavily, so changing the mood of traders to "bullish" will take a long time. And when this process begins, it is not clear at all.

News calendar for the USA and the UK:

UK – index of business activity in the service sector (08:30 UTC).

UK – index of business activity in the manufacturing sector (08:30 UTC).

UK – composite index of business activity (08:30 UTC).

US – index of business activity in the service sector (13:45 UTC).

US – index of business activity in the manufacturing sector (13:45 UTC).

US – composite index of business activity (13:45 UTC).

On Friday in the UK, all the reports had already been released and probably also influenced the mood of traders, which remains "bearish." American reports are unlikely to change that to "bullish." The influence of the information background on the mood of traders today may be slight but not strong.

GBP/USD forecast and recommendations to traders:

I recommended new British sales at the close under the level of 1.1496 on the 4-hour chart with a target of 1.1111. Now, these trades can be kept open with targets of 1.1000 and 1.0729. I do not recommend buying a pound yet.