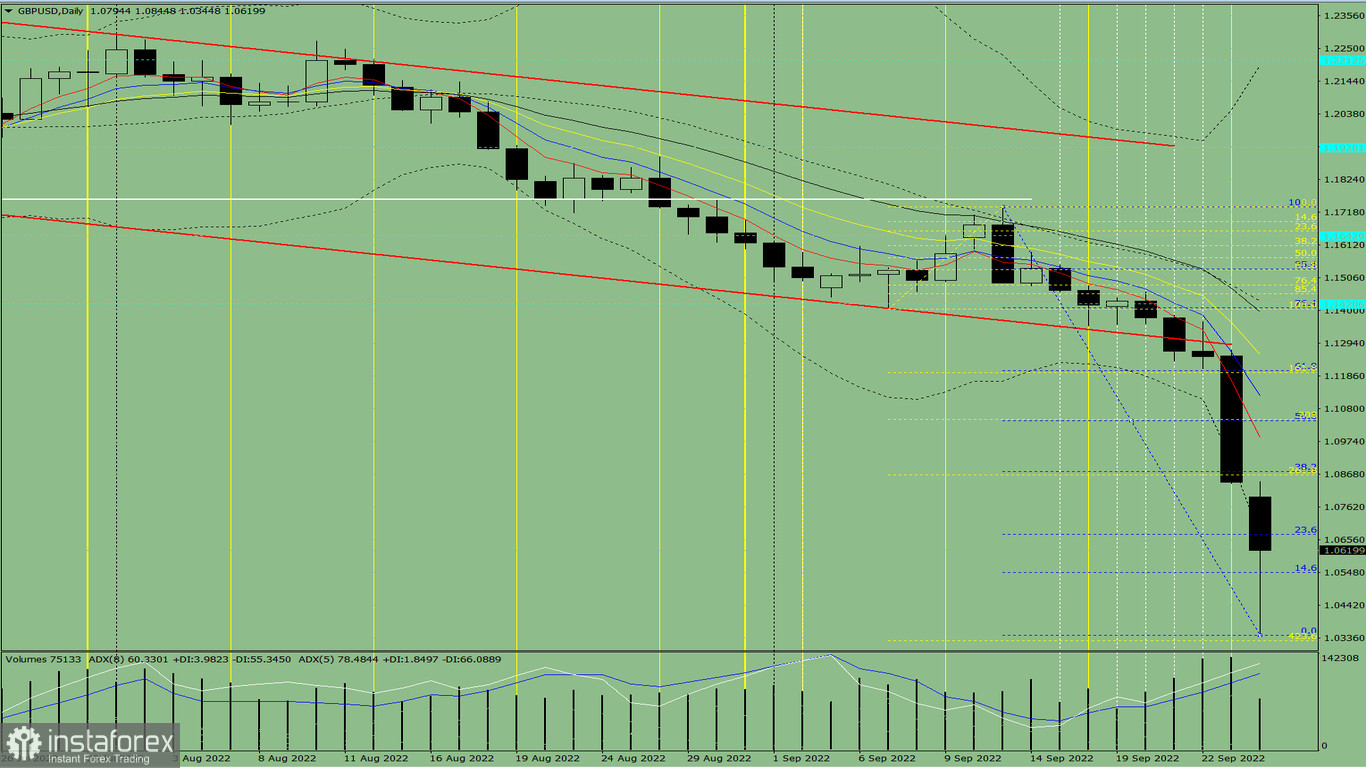

Trend analysis (Fig. 1).

The pound-dollar pair may move downward from the level of 1.0841 (close of Friday's daily candle) to the target at 1.0326, the 423.6% Fibonacci retracement level (yellow dotted line). After testing this level, an upward movement is possible with the target of 1.0548, the 14.6% retracement level (blue dotted line). Upon reaching this level, the price may continue to move upwards with the target of 1.0671, the 23.6% retracement level (blue dotted line).

Fig. 1 (daily chart).

Comprehensive analysis:

- Indicator analysis – down;

- Fibonacci levels – down;

- Volumes – down;

- Candlestick analysis – up;

- Trend analysis – down;

- Bollinger bands – down;

- Weekly chart – down.

General conclusion:

Today the price may move downward from the level of 1.0841 (close of Friday's daily candle) to the target at 1.0326, the 423.6% Fibonacci retracement level (yellow dotted line). After testing this level, an upward movement is possible with the target of 1.0548, the 14.6% retracement level (blue dotted line). Upon reaching this level, the price may continue to move upwards with the target of 1.0671, the 23.6% retracement level (blue dotted line).

Alternative scenario: from the level of 1.0841 (close of Friday's daily candle), the price may move downward with the target at 1.0326, the 423.6% Fibonacci retracement level (yellow dotted line). After testing this level, an upward movement is possible with the target of 1.0548, the 14.6% retracement level (blue dotted line). From here, the price may resume its downward move.