The inexorable rally of the US dollar to 20-year highs is taking its toll on the gold market.

Prices ended last week near their lowest level since April 2020.

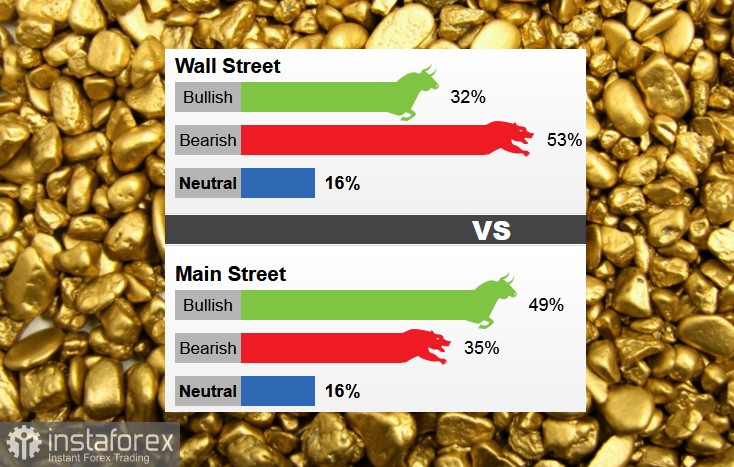

The extraordinary momentum of the dollar and rising bond yields turned Wall Street analysts into bearish sentiment. At the same time, according to the latest weekly survey, retail investors are more optimistic that prices may rise this week.

A total of 19 market professionals took part in Wall Street survey last week. Ten analysts, or 53%, said they are bearish on gold this week. At the same time, six analysts, or 32%, said they expect prices to rise in the near future, and three, or 16%, are neutral about the precious metal.

In the retail sector, 963 respondents took part in online surveys. A total of 469 voters, or 49%, called for gold to rise. Another 341, or 35%, predicted a fall in prices. The remaining 153 voters, or 16%, were in favor of a side market.

Retail investor sentiment improved from the previous week. The past week has been volatile for the gold market as the precious metal managed to maintain critical support levels even after the Federal Reserve raised interest rates by 75 basis points and signaled that the federal funds rate could exceed 4.5% next year.

Many analysts say gold has been able to withstand the US central bank's aggressive monetary policy as the threat of a recession continues to grow. Federal Reserve Chairman Jerome Powell said he didn't know if the central bank's move would send the US economy into recession but added that consumers should expect some trouble as lower growth is needed to contain inflation.

Similarly, analysts believe that the threat of a recession created some initial demand for gold as a safe-haven asset. However, that sentiment has been dampened by volatility in global currency markets as the British pound suffered its biggest price drop since 2016, when the country voted to leave the European Union.

The sell-off was triggered after Chancellor of the Exchequer Kwasi Kwarteng unveiled the government's new budget, with spending commitments of between £36bn and £45bn over the next four fiscal years. The massive spending initiative will be paid for with new debt.

Analysts note that the dominance of the US dollar can be felt in a wide-ranging sell-off in the commodity sector.

Although there is still some optimism in the market as many see gold as oversold and see any rally as a short term correction.

Marc Chandler, managing director at Bannockburn Global Forex, sees a short-term rebound as bond yields consolidate. He added that he is observing if support at $1,650 can hold.

Many analysts are bearish on gold as they expect the US dollar may still rise.