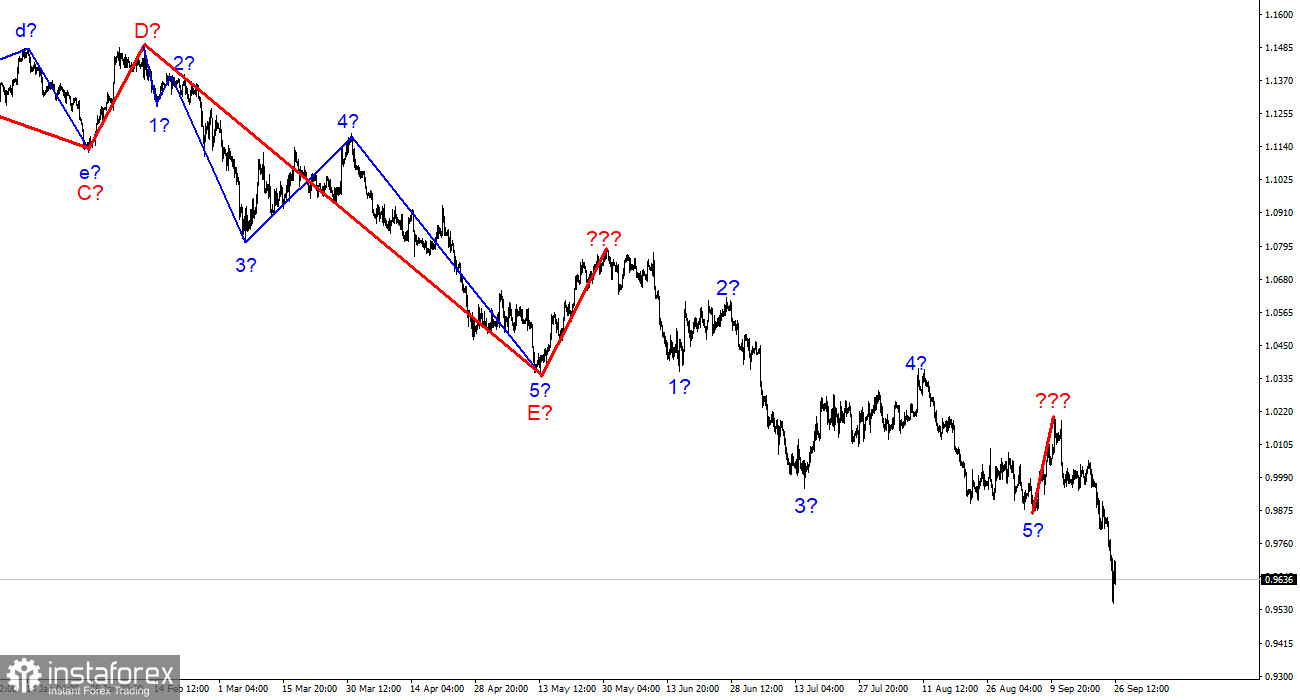

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. We saw the completion of the construction of the next five-wave impulse descending wave structure, then one correction wave upward, after which the low waves of 5 were updated. These movements allow me to conclude that the pattern of five months ago was repeated when the 5-wave structure down was completed in the same way, one wave up, and we saw five more waves down. There is no question of any classical wave structure (5 trend waves, 3 correction waves) right now. The news background is such that the market even builds single corrective waves with great reluctance. Thus, in such circumstances, I cannot predict the end of the downward trend segment. We can still observe the pattern of a strong wave down "a weak corrective wave up" for a very long time. The goals of the downward trend segment, which has been complicated and lengthened many times, can be found up to 90 figures, and maybe even lower.

The market should be blamed for the fall of the euro currency.

The euro/dollar instrument fell by 130 basis points on Monday and then rose by 80. For the European currency, the first day of the week passed relatively calmly, as the pound sterling fell by 400 points simultaneously. On Saturday, I questioned the assumption that the business activity indices caused a strong fall in the euro and the pound on Friday. As we can see, Monday has already shown us this is the case. After the usual statistical data (and there was nothing terrible or beautiful in the indexes), the instruments do not pass by several hundred points. The normal reaction to the indices is a movement of 30-50 points. Even before Friday's reports, most indices were below the key 50.0 mark, meaning the market was not shocked by the sudden decline in business activity.

I can say the same about another news background. For example, today it became known about the victory in the elections in Italy of far-right parties, which, to put it mildly, are not too focused on the European values that Brussels preaches. At the moment, many analysts note that relations between Brussels and Rome may become seriously complicated, but there is no word that Italy may leave the European Union or may now adhere to a radically different policy than the one that has been in recent years. The government has changed, but what has changed for the country itself if it still remains in the European Union, where all decisions are made collectively and at the highest level, which presupposes the consent of the majority of the alliance members? Therefore, I personally believe that the election results, which, by the way, were not yet known at night, are also not the reason for a new decline in demand for the euro currency. It seems to me that the foreign exchange market has been in a state of shock due to too much negative economic, political and geopolitical news.

General conclusions.

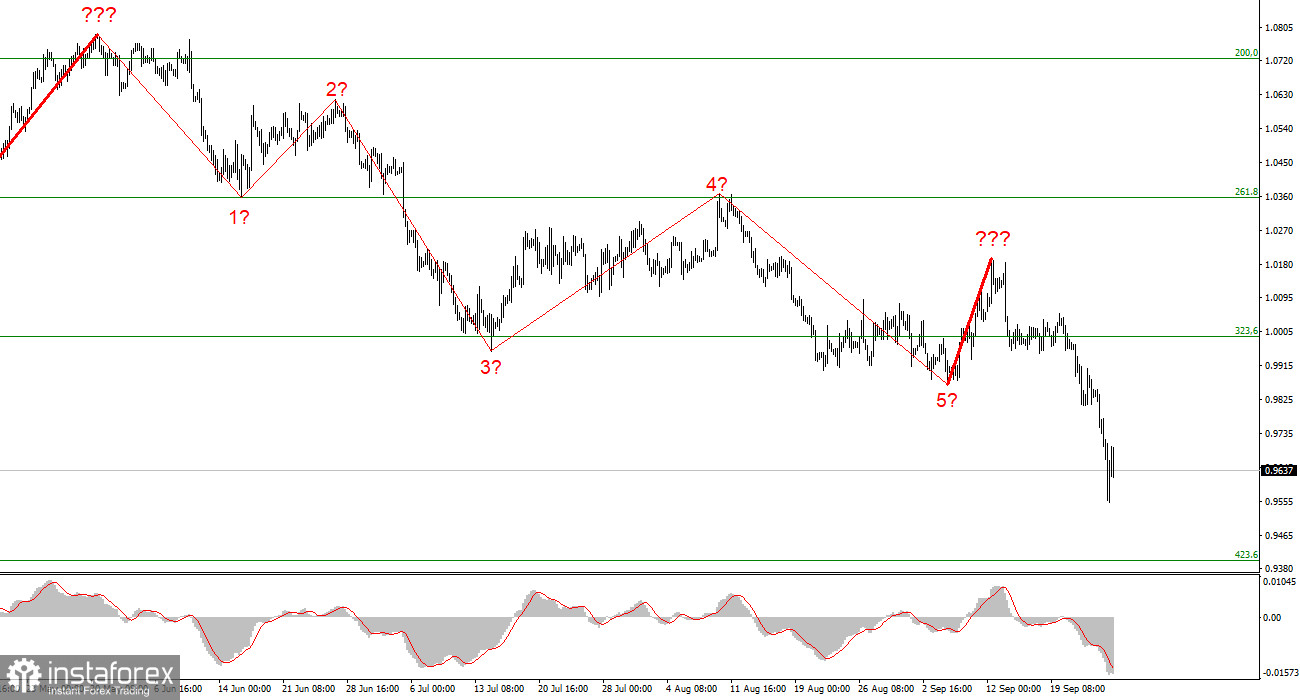

Based on the analysis, I conclude that the construction of the downward trend section continues, but can end at any time. At this time, the instrument continues to decline, so I advise careful sales with targets located near the estimated mark of 0.9397, which equates to 423.6% Fibonacci. I urge caution, as it is unclear how much longer the decline in the euro currency will continue.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any kind of length, so I think it's best now to isolate the three and five wave standard structures from the overall picture and work on them. One of these five waves can be just completed now, and the new one has begun its construction.