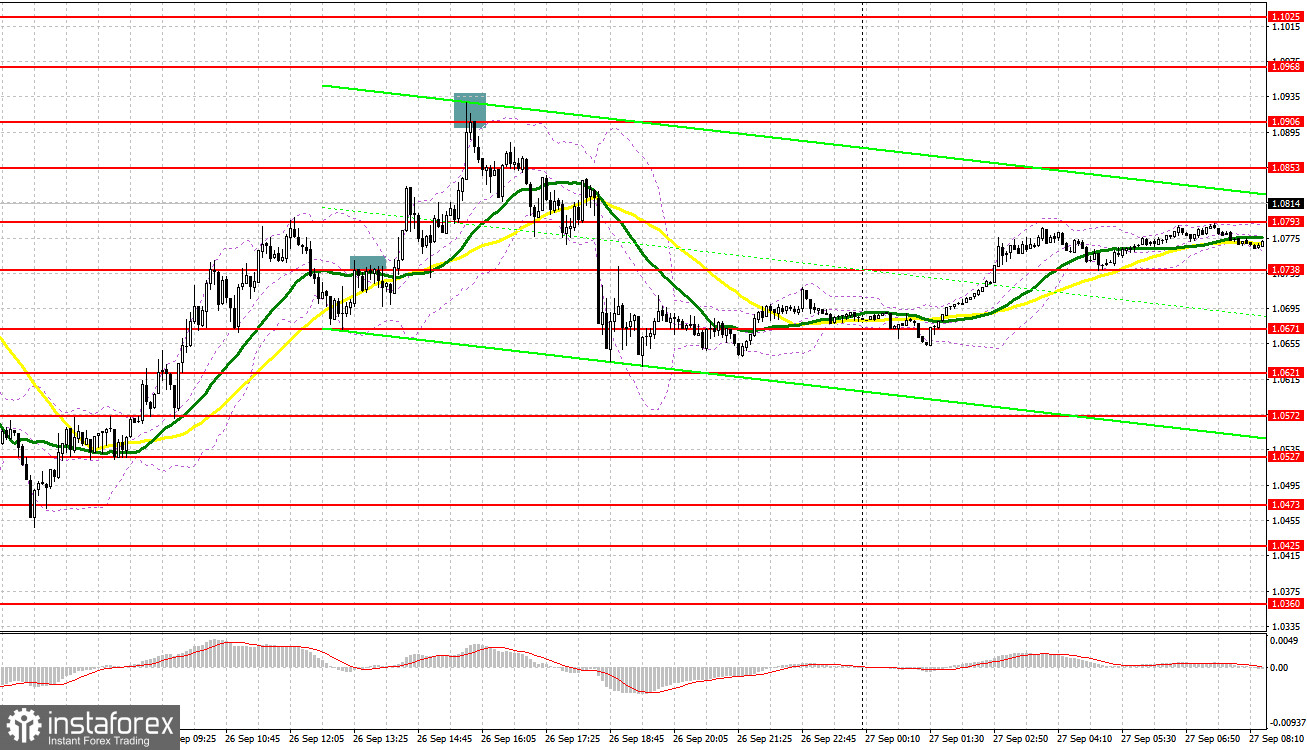

Yesterday was an extremely volatile day for the British pound, and it seems that today will be no different. Let's take a look at the M5 chart to get a picture of what happened. The pound managed to recover after a mass sell-off in early trade yesterday. In my previous review, I focused on 1.0569 and considered entering the market at this level. A signal to buy the pound came after a breakout and a retest of the 1.0569 mark, and the price instantly surged to 1.0633. Due to an increase in bearish activity at this level, a false breakout occurred, generating a sell signal. This triggered a sell-off, and the quote fell to 1.0569. I ignored the buy signal that came because I did not believe in such a strong recovery of the price. When the pound surged to 1.0699, another false breakout made a sell signal, but the quote dropped by about 25 pips. During the North American session, bears successfully defended the 1.0738 mark, the price declined by about 30 pips, and the pound advanced. A false breakout at 1.0906 produced a sell signal, which resulted in a slide of about 100 pips.

When to go long on GBP/USD:

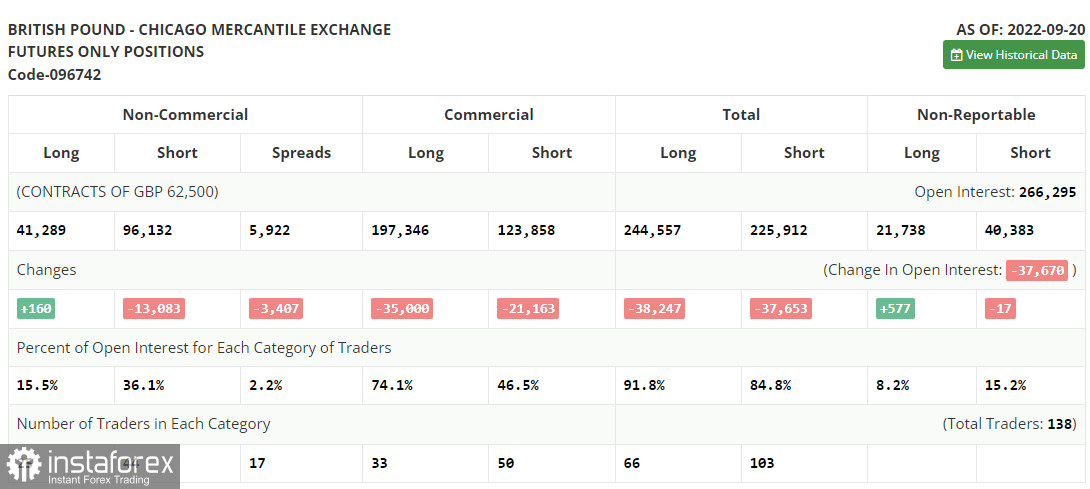

Before proceeding with technical analysis, let's see what happened in the futures market. The Commitments of Traders (COT) report for September 20 logged an increase in long positions and a decrease in short ones. Still, the report does not reflect on the current state of the market. Therefore, it is of little importance. The recent changes in the United Kingdom are now driving the pair. Last week, the Bank of England raised interest rates by 0.5%. It was followed by the announcement of unprecedented financial support for British households to help them cope with high energy prices from the UK's finance ministry. In addition, a tax cut aimed at boosting the economy was announced. However, all this will only accelerate stubborn inflation and exert additional pressure on the British central bank. In the wake of a mass sell-off, the pound plunged by as much as 1,000 pips. Investors took advantage of the situation and bought out the pound. The market has not hit the bottom yet. This week, the macroeconomic calendar in the United States contains a lot of important releases. Therefore, pressure on the GBP/USD pair may increase. According to the latest COT report, long non-commercial positions rose by 160 to 41,289. Short non-commercial positions dropped by 13,083 to 96,132. As a result, the negative value of the non-commercial net position grew to -54,843 versus -68,086. The weekly closing price tumbled to 1.1392 versus 1.1504.

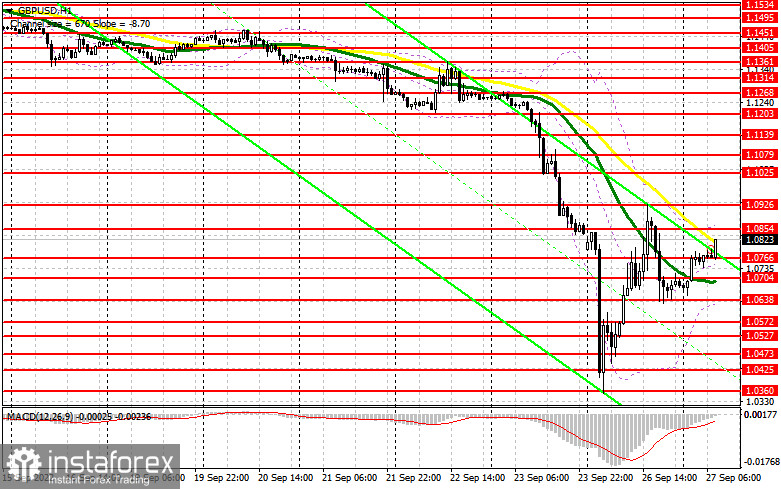

Due to an empty macroeconomic calendar in the United Kingdom, hardly any macro events will be exerting pressure on the pound today. Still, it is important to remember what state the bear market is in after the recent sell-off. Chances are the September decline will extend. The market may simply stabilize and come to a standstill. In the case of bearish GBP/USD, it will become possible to look for buy entry points after a false breakout at 1.0766, in line with bullish moving averages. The target is seen at 1.0854. Should the price reach the level, a correction to the upside will occur. Bulls may risk losing control over the market if the quote breaks through 1.0854 and retests the mark from top to bottom, with targets at 1.0926 and 1.102. It would be wiser to consider locking in profits at 1.102. If GBP/USD goes down when there is a lack of bullish activity at 1.0766, the pressure on GBP will increase. Then, long positions could be opened at 1.0704 and 1.0638 after a false breakout only. Long positions could be considered at 1.0572 on a bounce or around the 1.0527 low, allowing a 30-35 pips correction intraday.

When to go short on GBP/USD:

Protection of the nearest 1.0854 resistance is seen as the primary bearish goal for today. Bears should not let the price break through the range as it may allow bulls to get stronger after the recent mass sell-off. If the quote goes up, the pressure on the pound will increase after a false breakout at 1.0854. This will generate a sell signal with the target at the nearest 1.0766 support. A sell entry point will be created after a breakout and a retest of the level from bottom to top. The price will head to the low of 1.0704 with the target at 1.0638. A lower limit of the future sideways channel could form at this level. The pound could move sideways for several weeks. I would consider locking in profits in this range. If GBP/USD is bullish and there is a lack of bearish activity at 1.0854, bulls will be able to briefly regain control over the market, and the pair will return to 1.0926. Selling could be considered after a false breakout at 1.0926. If there is no activity at this level, the price could soar to the 1.1025 high, where GBP/USD could be sold on a bounce, allowing a 30-35 pips downward correction intraday.

Indicator signals:

Moving averages

Trading is carried out in the range of the 30-day and 50-day moving averages, signaling the possibility of a trend continuation.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

A breakout through the lower band at 1.0638 will increase pressure on the pair. Meanwhile, if the price breaks through the upper band at 1.0854, GBP will show growth.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.