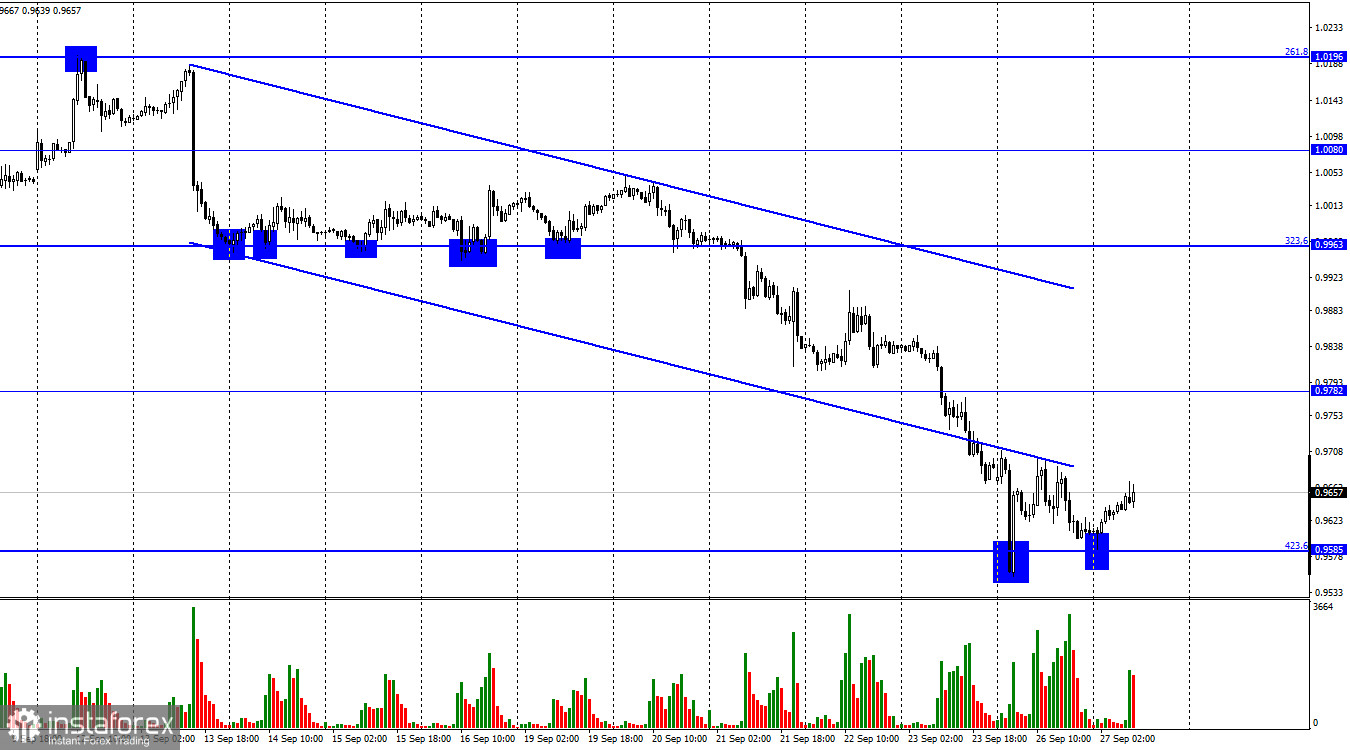

On Monday, EUR/USD dropped to the retracement level of 423.6% located at 0.9585 on the H1 chart and then rebounded from it twice. So, the pair reversed in favor of the European currency and started to rise slowly towards 0.9782. Yesterday, the information background was mixed. On the one hand, there is news about parliamentary elections in Italy and the new UK Prime Minister. Some Conservative MPs are preparing to send letters of no confidence in Liz Truss. Yet, I doubt that such news could have hit the pound or the euro so hard. The speech by Christine Lagarde was far more important. She assured markets that the ECB would continue to raise the rate in order to slow demand even despite a decline in business activity and a high threat of a recession. This is a positive factor for the European currency as the EU regulator will pursue monetary tightening and may soon catch up with the US Fed.

However, there was no significant rise, and the euro/dollar pair is trading at its lowest levels in 20 years. Therefore, bears are still in control of the market despite any news background. The recent COT report showed a rapid surge in buy contracts although this fact didn't support the euro in any way. This indicates that the overall market sentiment remains bearish and is not changing. Consolidation below the retracement level of 423.6% may push the price lower to 0.9000. The existing downward channel also confirms the bearish sentiment. This week, Christine Lagarde will give another speech as well as some FOMC members. Their rhetoric is unlikely to change, so traders won't have to choose a new strategy and adjust it to new approaches of the ECB or the Fed.

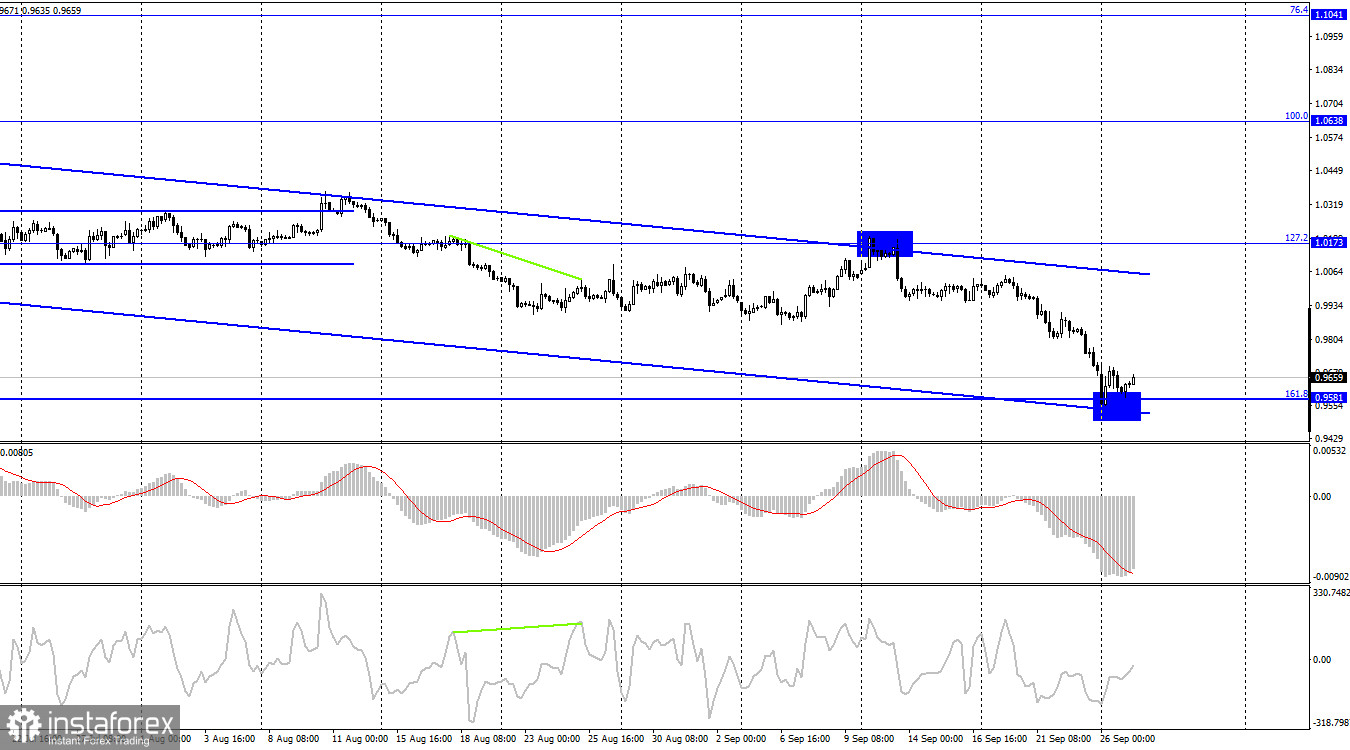

On the 4-hour chart, the pair dropped to the retracement level of 161.8% located at 0.9581. A rebound from this level will activate the upside momentum of the euro and may send the price towards the upper line of the downward channel. Yet, I doubt that this upward movement will be strong as traders are convinced to sell the euro. A strong hold below 0.9581 will make a further decline more likely.

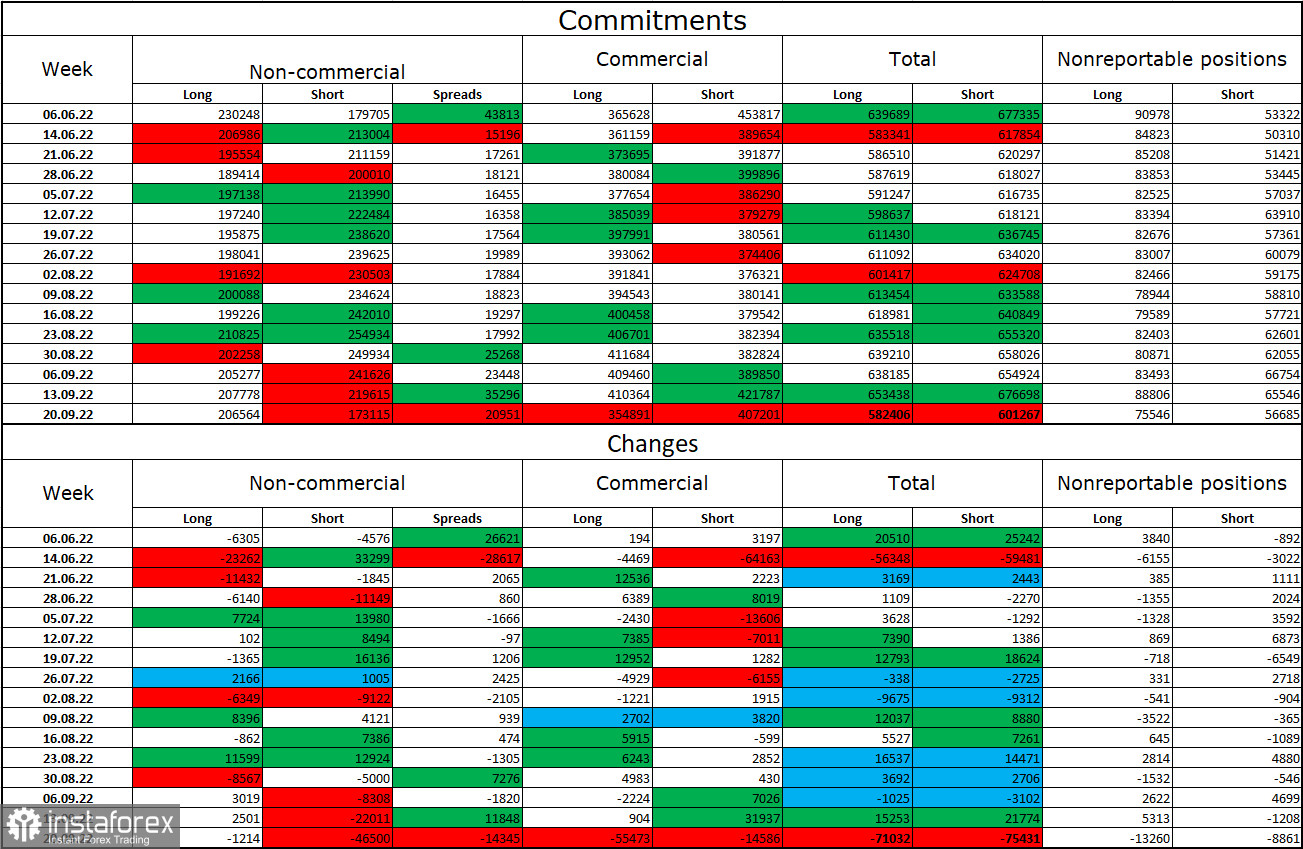

Commitments of Traders (COT) report:

Last week, traders closed 1,214 long contracts and 46,500 short contracts. This indicates that large market players became less bearish on the pair. The overall amount of opened long contracts stands at 206,000 while the amount of short contracts is 173,000. So, the market sentiment has become more bullish recently. Yet, the euro has failed to develop a sustainable uptrend. In recent weeks, there were some chances for the euro to recover. However, traders are hesitant to buy it and prefer the US dollar instead. The European currency has failed to show a proper advance over the past months. Therefore, I would advise you to focus on the main descending channels on the H1 and H4 charts. The pair may start to rise only when the price closes above these channels.

Economic calendar for US and EU:

EU - ECB President Lagarde speaks (11-30 UTC).

US - Core Durable Goods Orders (12-30 UTC).

On September 27, both economic calendars for the EU and US have one important event each. Today's speech by Christine Lagarde will most likely be similar to what she said yesterday. The impact of the information background on the market may be weak on Tuesday.

EUR/USD forecast and trading tips:

I would recommend selling the pair after its rebound from the level of 1.0173 (1.0196) on H4 with the targets found at 0.9900, 0.9782, and 0.9581. All these targets have already been tested. New short positions can be opened when the price closes below 0.9585. It is better to buy the pair when the quotes settle firmly above the level of 1.0173 on H4 with the target at 1.0638.