The GBP/USD currency pair also traded more calmly on Tuesday than on Monday. Some recovery has begun, but it is still very difficult to call this upward movement even a "correction." Rather, it is not even a rollback but a rebound. The market faced a serious level of support several hundred points from the price parity, so stop orders and take profit worked, which led to a sharp departure of quotes. Recall that the collapse occurred after the new Finance Minister, Kwasi Kwarteng, presented a plan for economic recovery in Parliament, which implied a reduction in several tax rates and the abolition of some tax increases. After that, the yield of UK Treasury bonds shot up, which means a drop in demand for this type of security. And along with this, massive sales of the pound followed, which were observed before the statements of Kwarteng.

Thus, the pound fell before the presentation of the recovery plan, the Bank of England meeting, and the Fed meeting. What has changed, other than that the fall has just accelerated? Accordingly, we can conclude that there are plenty of reasons for the market to get rid of the pound as soon as possible, not just one or two. After all, do not forget about geopolitics, which puts pressure on risky currencies. Do not forget about the British recession, which can last two years, if not more. Do not forget about Brexit, which continues to harm the GDP. It is even difficult for us now to guess where the pound may fall.

On the one hand, a strong rebound of quotations from the level of 1.0358, now the new absolute minimum of the pair, may mean a transition to forming a new upward trend. But it will take a week or two to determine whether this is true. After all, given the geopolitical or fundamental background, the market may decide to resume sales! A couple of weeks ago, we jokingly said that the pound would also go below parity at this rate. As you can see, now it's not a joke.

The pound has set a record.

Meanwhile, Britain continues to show that it cannot live without scandals and controversial political decisions and cannot help but create problems for itself. Liz Truss took office as Prime Minister on September 6. On September 27, it became known that some conservatives had begun sending letters to a special committee that could begin the procedure for issuing a vote of no confidence. That is, 21 days after the Conservatives chose Liz Truss as their leader, they have already begun voting to remove her from office. This is a political pun. Naturally, it all started with that notorious recovery plan, which implies tax cuts. It is reported that some parliamentarians seriously believe this plan could destroy the British economy, which is already on the verge of recession.

Although it is not clear to us personally, what exactly is the problem with Liz Truss, who, even at the first stages of voting, clearly spoke about her desire to lower taxes? And for the UK, such a measure is by no means an apocalypse, and taxes have been reduced before, in difficult times for the country and its citizens. However, there is a feeling that the tax cuts affect the interests of those conservatives who did not want to see Truss at the helm of the country but voted for Rishi Sunak, who was just against lowering tax rates. There is no unity within the Conservative Party now, not to mention the entire British government. If this is true, opponents will not succeed since the number of conservatives who voted for her is greater than those who voted for Sunak. And if it comes out, Liz Truss will set a record for short-term tenure as prime minister. This event is remarkable, and we will have something to watch for in the near future while the pound sterling is going to the bottom.

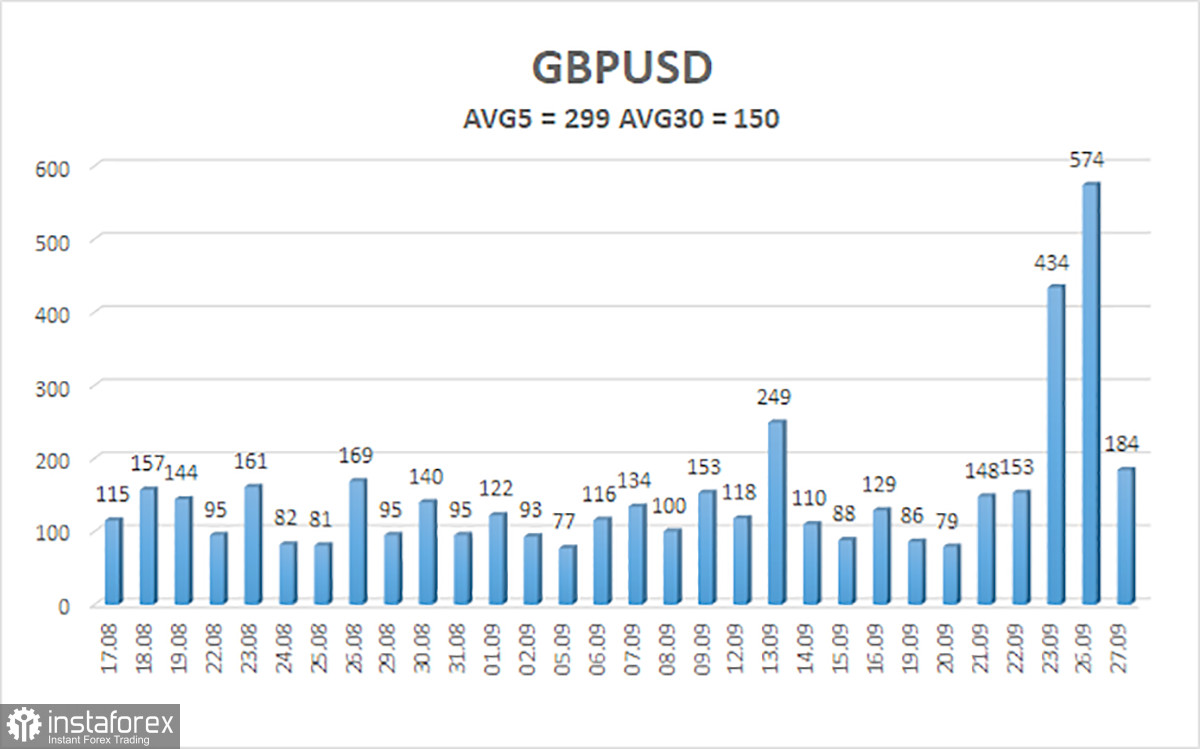

The average volatility of the GBP/USD pair over the last five trading days is 299 points. For the pound/dollar pair, this value is "very high." On Wednesday, September 28, thus, we expect movement inside the channel, limited by the levels of 1.0477 and 1.1077. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.0498

S2 – 1.0254

S3 – 1.0010

Nearest resistance levels:

R1 – 1.0742

R2 – 1.0986

R3 – 1.1230

Trading Recommendations:

The GBP/USD pair is still being adjusted in the 4-hour timeframe. Therefore, at the moment, new sell orders with targets of 1.0498 and 1.0477 should be considered if the Heiken Ashi indicator turns down. Buy orders should be opened when fixed above the moving average with targets of 1.1230 and 1.1475.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction to trade now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.