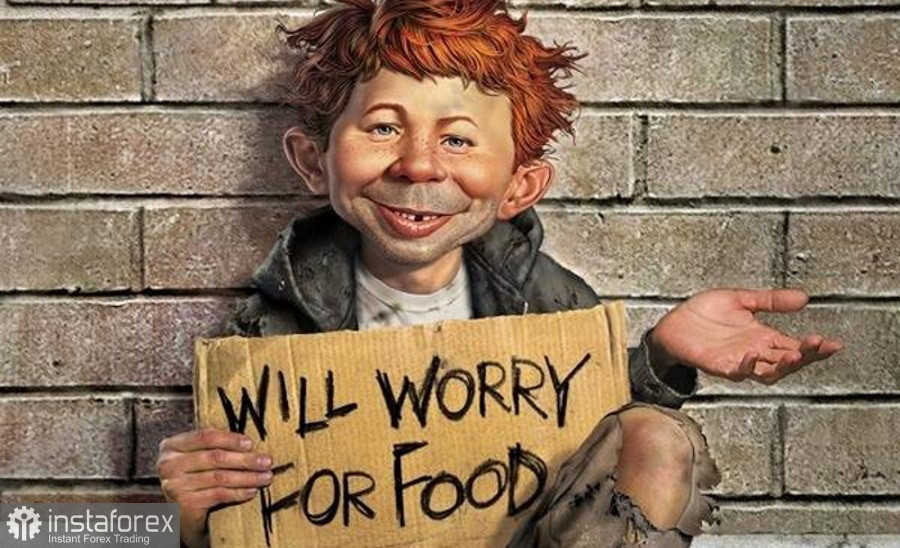

While the greenback is strengthening against risk assets, the United States is facing food insecurities. This derails the efforts of the Biden administration to reduce food shortages. In fact, the situation could exacerbate as the country is balancing on the verge of a recession.

A recent survey finds that nurses, service personnel, shop assistants, and roofers are among those Americans already turning to banks for financial support. The government stopped providing temporary assistance for needy people due to a spike in inflation. The situation is getting out of hand as the US Federal Reserve proceeds with aggressive tightening, and the economy keeps slowing. Many economists now say there is a 50% probability of a recession in the United States in the next 12 months.

American low-income respondents say they now have to choose between paying utility bills and buying food. Some deliberately started delaying utility payments after they stopped receiving monthly child tax credits, which expired in December. Meanwhile, inflation drove up the cost of essentials.

According to the survey, those people will be among the most vulnerable if the economy slides into a recession. Families hit hardest by inflation are most likely to lose their jobs and face food insecurities.

The Biden administration is now hosting listening sessions to hold a conference similar to the one called for by Richard Nixon in 1969, aimed at providing low-income Americans with assistance for purchasing food. Elsewhere, the pound lost about 10% when the United Kingdom's finance ministry announced financial aid and tax cuts to support households. Meanwhile, the Bank of England is still hawkish and keeps rising interest rates to tame inflation. The United Kingdom's bond market tumbled by over 24% in a year. The US government will unlikely adopt a similar approach as it poses an enormous threat to the economy and households.

EUR/USD bulls have lost control over the market and are now facing serious challenges on their way. In early European trade, the euro was under strong pressure. Currently, trading activity on EUR/USD is seen near the yearly low. Today, bulls should protect 0.9550 support, which could be challenging given disappointing macro results. The euro will plummet to the new yearly low of 0.9500 if it breaks through 0.9550. Meanwhile, in case of a breakout through this barrier, targets will stand at 0.9460 and 0.9405. It will become possible to access any prospects for the asset when bulls return to 0.9600, with the target at 0.9640. More distant targets are seen at the highs of 0.9700 and 0.9770.

Pressure on the sterling is gradually rising, which reflects the current weakness of the trading instrument. Speaking of a correction, bulls could become more active by the middle of the week when the price gets back to the level of 1.0700. In case of a corrective move to the upside, targets are seen at the highs of 1.0760 and 1.0830. A more distant target stands at 1.0920. If the pressure remains strong, bulls should consolidate above 1.0630. Otherwise, a mass sell-off could start, and the pound could drop to the lows of 1.0570 and 1.0520.