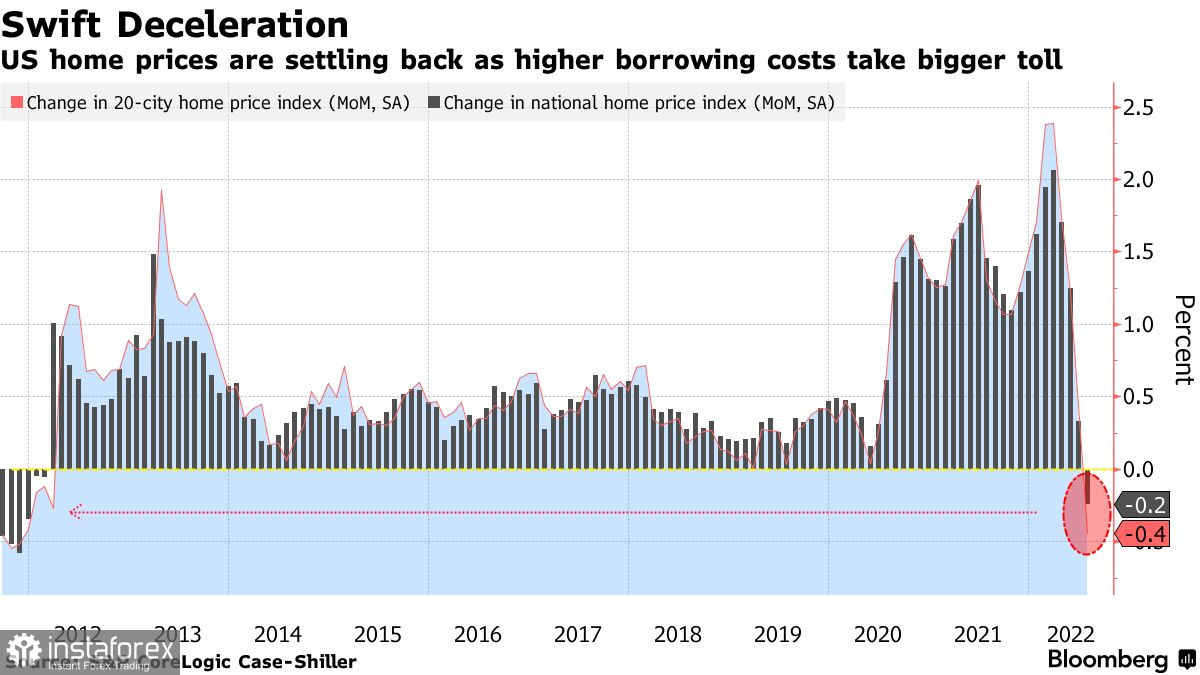

More experts are coming to a conclusion that the extended boom in the US housing market is over. House prices in the US have eventually dropped for the first time in a decade.

According to the industry survey, the nationwide indicator embracing 20 cities fell 0.4% in July 2022 which has been the first decline since March 2012. Referring to S&P CoreLogic Case-Shiller, the last crash in the real estate market came to end in 2012. This paved the way for a ten-year-old cycle of increasing house prices. Its final stage which lasted for two years looked like robust property buying in the wake of the coronavirus pandemic.

Now the Federal Reserve is sure to dampen active house purchases because the policymakers are committed to their battle against soaring inflation. Mortgage rates have doubled this year. Obviously, this averted a lot of would-be buyers and scaled down sales. The steepest slump in prices on month in July has been recorded in San Francisco (-3.6%), Seattle (-2.5%), and San Diego (-2%).

Nevertheless, house prices remain at elevated levels. There are also signs of unsatisfied demand for housing properties. In this context, sales of new homes in the US increased unexpectedly in August. It has been the highest rate of sales since March 2022. Perhaps buyers are striving to jump on the bandwagon, bearing in mind the growing costs of borrowing. New home sales expanded in all regions, including a 29% spike in Southern states where sales rates have been the highest this year.

Yesterday, the market got to know a report on durable goods orders. The indicator, excluding aircraft and military vehicles, climbed 1.3% last month. The US Commerce Department reported that orders for durable goods with a lifespan of at least 3 years dipped 0.2% in August due to a decline in orders for commercial vessels. Excluding transport equipment, durable goods orders rose 0.2%, extending growth for 2 months in a row.

The actual rise in core durable goods orders surpassed expectations.

It means that business investments which are a driving force for production capacity still remain at decent levels, even on the back of higher borrowing costs and feeble economic conditions.

The economic data was bullish for the US dollar which continued its stunning rally. The euro is still weighed down. Trading forces in the EUR/USD pair are seeking balance at around a one-year low. The main task for the buyers is to defend support of 0.9550. It is quite a challenge due to weak economic data on the EU. A breakout of 0.9550 will push the euro to new one-year lows at about 0.0500. In turn, a breakout of this area will open the door towards 0.9560 and 0.9405. Global jitters dampen the risk-on mood and demand for risky assets. For a start, the bulls need to return the price back to 0.9600 which will allow it to climb to 1.9640. The ultimate highs for the euro are seen at 0.9700 and 0.9770.

The pound sterling is again coming under pressure. It suggests the overall weakness of the sterling under current fundamentals. Speaking about an upward correction, once GBP rebounds to 1.0700, the buyers will dive into the action in the middle of the week, reckoning a correction after the recent slump. There is a fair chance for an upward correction, so the door will be open toward highs at 1.0760 and 1.0830. The highest target is defined at 1.0920. If the currency pair remains under selling pressure, the buyers will have to try hard to keep the price at 1.0630. Unless the level is defended, we could see another robust sell-off towards 1.0570 and 1.0520.