EUR/USD

Higher timeframes

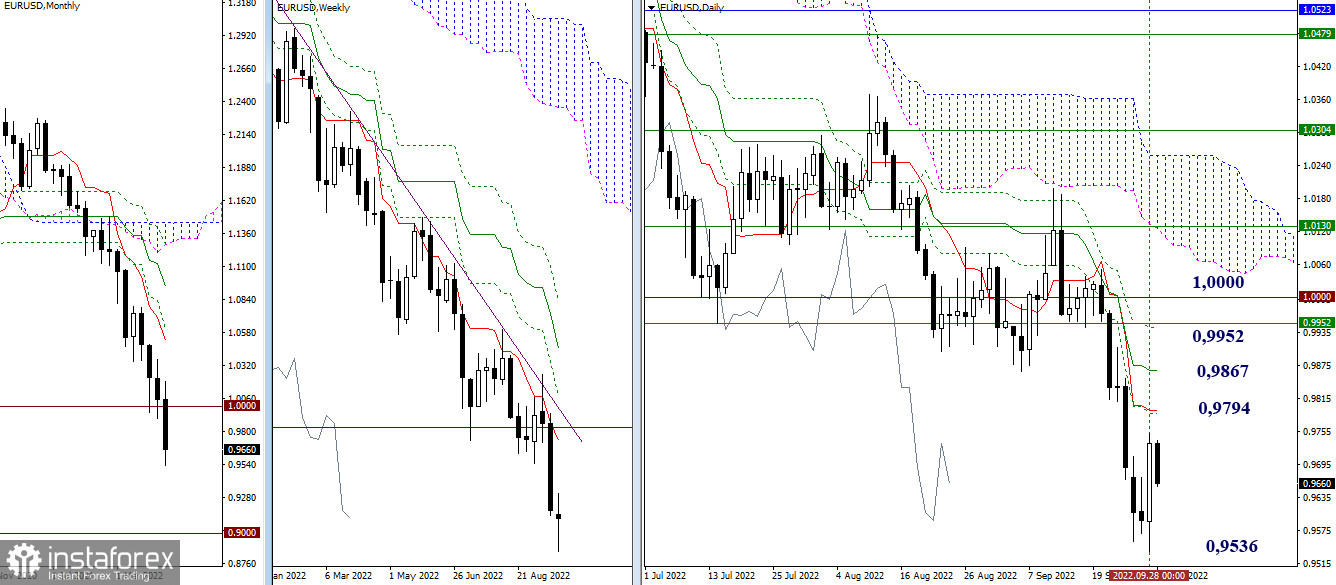

Despite updating the low, yesterday passed with the activity of bulls, who managed to start recovering their positions. If today the mood persists, and the planned potential gets the necessary development, then we can expect a test of resistance. The nearest resistances on this area today are located at the boundaries of the daily death cross (0.9794 - 0.9867 - 0.9945), and the end and strengthening of the indicated zone are 0.9952 (weekly short-term trend) and 1.0000 (psychological level). Bearish interests at the moment are to update yesterday's low (0.9536) and continue the downward trend, whose next benchmark may be the psychological level of 0.9000.

H4 – H1

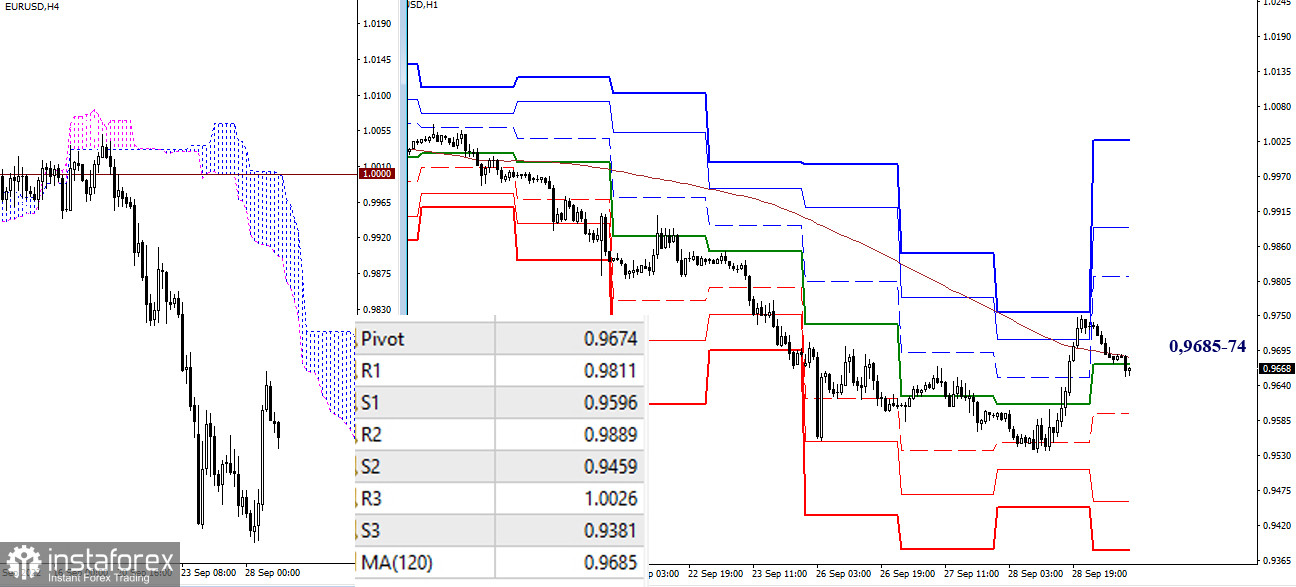

In the lower timeframes, work is now underway with the key level responsible for the current balance of power. Today, the weekly long-term trend joins forces with the central pivot point, located in the area of 0.9685–74. If bulls gain a foothold higher and deploy the moving average, the main advantage will shift to their side, and the road to new upward benchmarks will be opened. The upward benchmarks within the day are now located at 0.9811 - 0.9889 - 1.0026 (classic pivot points). If the work is carried out under key levels, there is a chance for a new strengthening of bearish sentiment. The downward benchmarks within the day today are at the support of the classic pivot points 0.9596 - 0.9459 - 0.9381.

***

GBP/USD

Higher timeframes

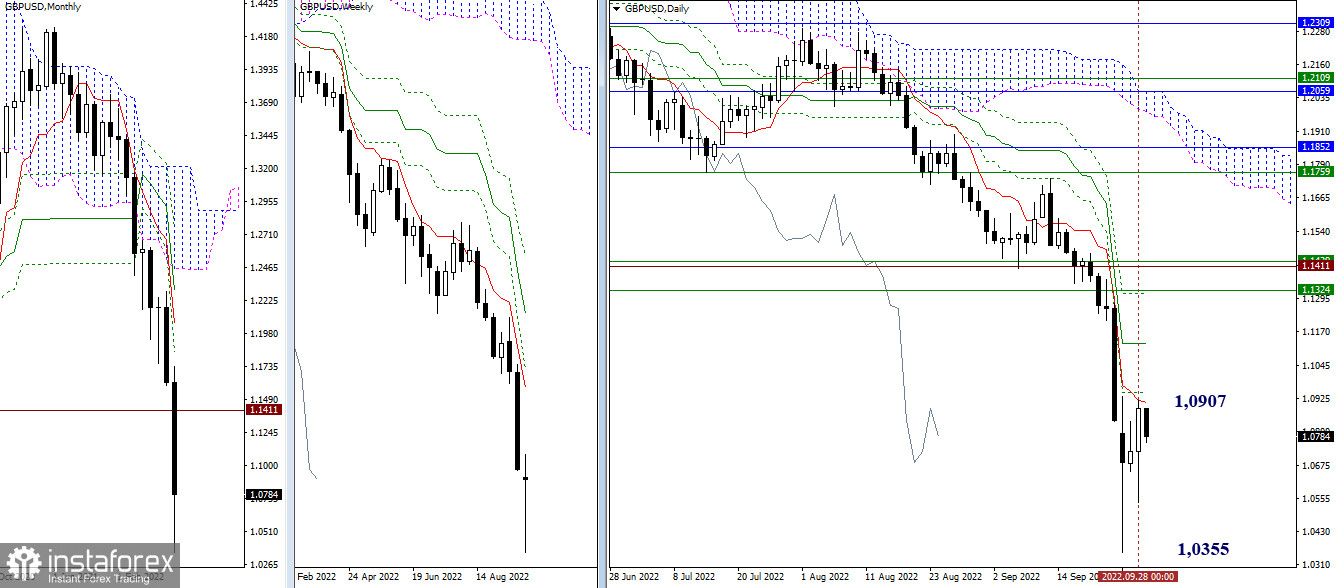

Yesterday, bulls tested the first correction target; on higher timeframes it is usually the daily short-term trend (1.0907). Overcoming the level will allow the continuation of the ascent. In this case, the next reference points for the upward move will be the resistance of the daily Ichimoku cross (1.1128 - 1.1310), reinforced by the accumulation of weekly levels 1.1324 - 1.1429. For bears, the main task is still to update Monday's low (1.0355) and restore the downward trend.

H4 – H1

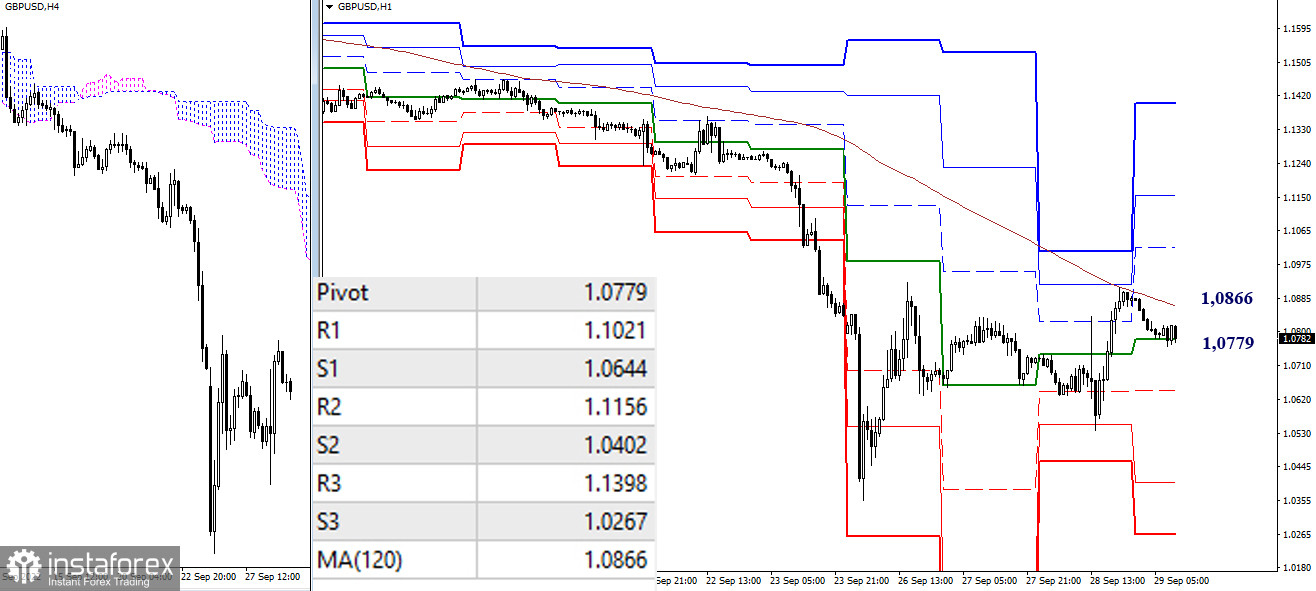

As of writing, work is underway on the lower timeframes with key levels 1.0779 (central pivot point) and 1.0866 (weekly long-term trend). Overcoming the resistance of the weekly long-term trend (1.0866), reversal of the moving average, and consolidation above the daily short-term trend (1.0907) will strengthen bullish positions and the emergence of new prospects. Within the day, they will be the resistance of the classic pivot points 1.1021 – 1.1156 – 1.1398. A return to the decline will restore the relevance of the support of the classic pivot points (1.0644 – 1.0402 – 1.0267). A breakdown of the supports will provide an exit from the correction zone and the restoration of the downward trend.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)