The EUR/USD currency pair was adjusted upwards during the second half of Wednesday and part of Thursday. We want to note that even an upward movement of "as much as" 200-250 points is not a sufficient reason to consider the downtrend completed. However, there is technical analysis, and we should pay attention to it, as it most clearly visualizes the picture of what is happening in the foreign exchange market. So, the price may soon gain a foothold above the moving average. We mean fixing not for a couple of hours, but a confident overcoming of the moving average line. However, the first "but" is in favor of the fact that growth will not continue. How many such fixations have we already seen in 2022?

Further, both linear regression channels are still directed downward. It is clear that sooner or later, they will start to turn up, but for this, the price needs to refrain from a new fall for a long time, which is quite problematic with the current fundamental and geopolitical background. The third "but": the current growth of the pair is not so strong that it can be considered the "beginning of a new trend." The fourth "but": all indicators on the 24-hour TF signal the continuation of the downward trend.

Once again: any trend starts small, but we are interested in the probability of a new trend starting at this time, and it should be recognized that it is small. After all, the situation regarding the rates of the ECB and the Fed has not changed recently. The geopolitical situation has worsened. Macroeconomic statistics, in general, do not provide serious support for the euro currency, so the market also ignores it with pleasure. Christine Lagarde said that her department would continue to raise the rate this week, but Jerome Powell and some of his colleagues also said that the Fed would raise the rate. So, at the expense of what, can the downward trend end now? Of course, it may end for no apparent reason, but in this case, we can only rely on technical analysis, which so far does not give us strong buy signals.

The situation with the Nord Stream and Putin's speech.

A speech by Russian President Vladimir Putin is due to take place today. Experts expect that its topic will be the annexation of the occupied territories based on the will of the people of Russia. The West, the EU countries, and almost all countries of the world have already stated that they do not recognize the Ukrainian territories as part of Russia. It is because even if referendums took place, international observers were not allowed to attend them to verify the legitimacy and honesty of the process. Nevertheless, Moscow may annex parts of four regions of Ukraine. And this news can create a new resonance in the foreign exchange market. The fact is that Kyiv is not going to follow Moscow's lead and continues de-occupation of territories, moving forward in the Kharkiv and Mykolaiv regions. Moscow's position is simple: any strike on the territory of Russia will cause a response in the form of the possible use of nuclear weapons. However, we have already seen the attacks of the Armed Forces of Ukraine, at least, on the Crimea, although there is very little official information about this. Then there was no response, but who knows what will happen this time?

The topic of the explosions of Nord Stream-1 and Nord Stream-2 in the North Sea adds fuel to the fire. It is still unclear to whom and why it was necessary. It is unlikely that the European Union did this since it needs gas coming through the pipeline. It is doubtful that the States did it since they have no benefit from it at all. But why should Gazprom itself blow up its pipes if gas supplies can simply be stopped, citing equipment malfunction, for example, and the inability to repair it due to the imposed sanctions? In general, it is entirely unclear who needs it and why, but the fact that it will add fuel to the blazing geopolitical conflict can no longer be interpreted as Russia-Ukraine. The whole world will receive new consequences. The European Union will no longer be able to receive gas through the pipeline. Moreover, gas prices may rise even more due to speculation on hubs and the "blue fuel" shortage in Europe, and Gazprom will not receive billions of dollars for gas sold. Not to mention the relations between the EU and the Russian Federation that have been spoiled for decades. In such a situation, the euro currency may continue to fall.

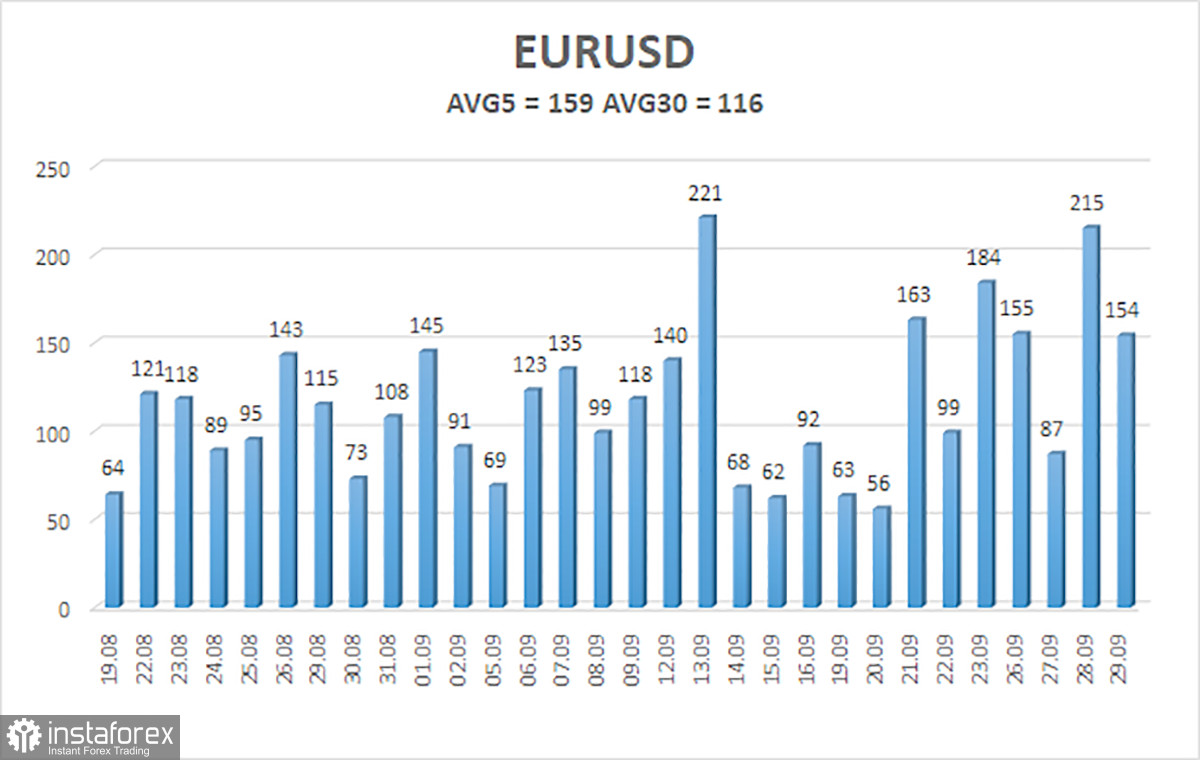

The average volatility of the euro/dollar currency pair over the last five trading days as of September 30 is 159 points and is characterized as "high." Thus, on Friday, we expect the pair to move between 0.9626 and 0.9944 levels. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement.

Nearest support levels:

S1 – 0.9644

S2 – 0.9521

Nearest resistance levels:

R1 – 0.9766

R2 – 0.9888

R3 – 1.0010

Trading Recommendations:

The EUR/USD pair maintains a downward trend. Thus, new short positions with targets of 0.9626 and 0.9521 should now be considered in case of a price rebound from the moving average. Purchases will become relevant no earlier than fixing the price above the moving average with a target of 0.9888.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction to trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.