Good afternoon, dear traders! The EUR/USD pair grew on Thursday and consolidated above the 0.9782 level. Today, it has closed above the downward corridor, which significantly increases the chances of a further rise to 0.9963 - the correction level of 323.6%. The euro has been trying to regain bullish momentum for a long time. As a reminder, the euro and many other currencies have been constantly falling through 2022. The main reasons were the Ukraine-Russia conflict, sanctions against Russia, high inflation, the risks of a recession in many economies, and aggressive rate hikes by the Fed. However, the bearish trend always ends. The bulls have asserted strength this week. They are ready to regain the upper hand.

I believe that this is unwise to associate a rebound in the euro with a certain event or any news. There were no important economic reports this week. Christine Lagarde, Jerome Powell, and several Fed policymakers delivered speeches. However, they made similar remarks. They voiced a strong commitment to monetary tightening as inflation remains high. Even if it slows down, it is happening at a slower pace. So, it may undermine economic growth. The hawkish rhetoric of Fed and ECB officials has remained unchanged for a couple of months. Thus, traders are unlikely to consider Lagarde's statements optimistic or see clues about a shift to a dovish stance by the Fed. The watchdog has pledged to raise the key rates aggressively. Otherwise, traders will hardly pay attention to the speeches if everyone interprets them as they want. Besides, technical indicators provide clear signals. At this time, they are indicating a trend reversal. Of course, the euro may face some challenges before it cements the upward movement. However, the likelihood of a further rise is extremely high.

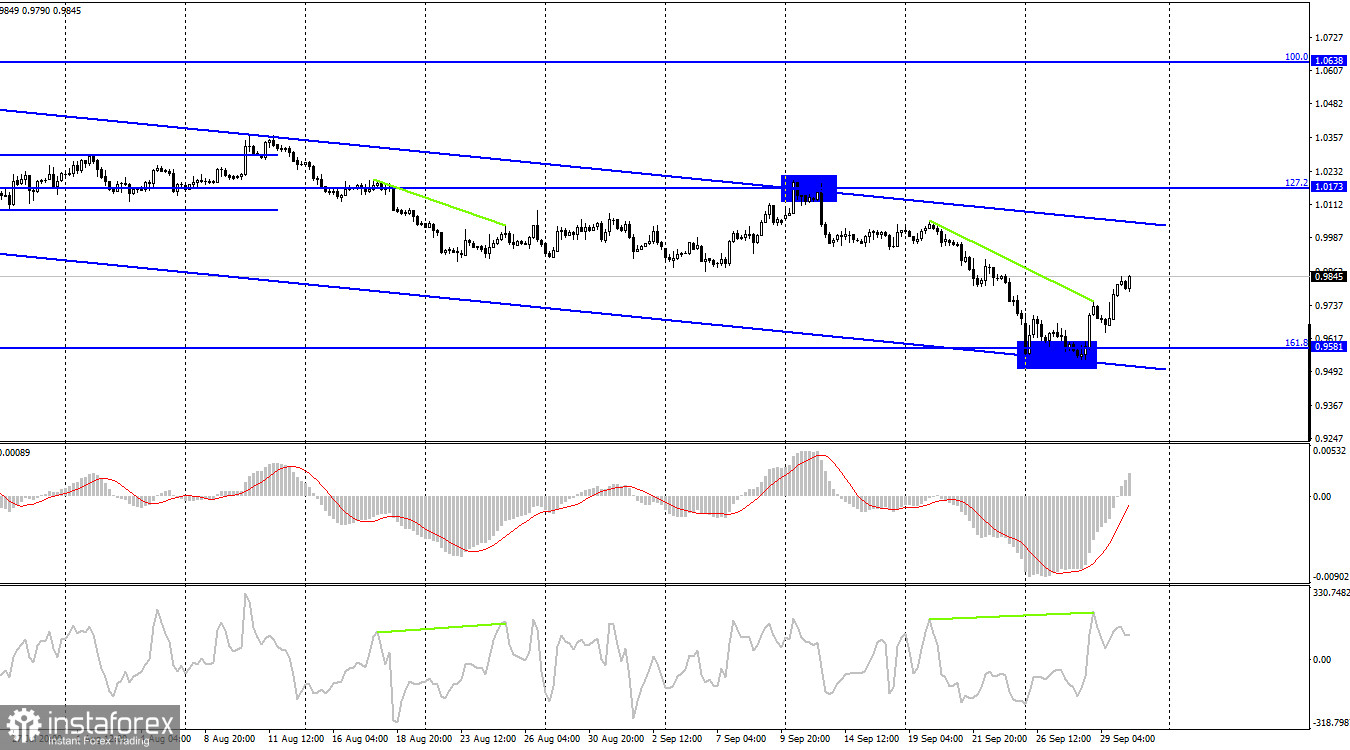

On the 4H, the EUR/USD pair resumed an upward movement after the formation of a bearish divergence in the CCI indicator. However, the drop was insignificant. The pair is now growing to the upper border of the downward corridor. On the 4H chart, the sentiment is still bearish. Bulls are sure the regain momentum if the pair consolidates above the downward corridor.

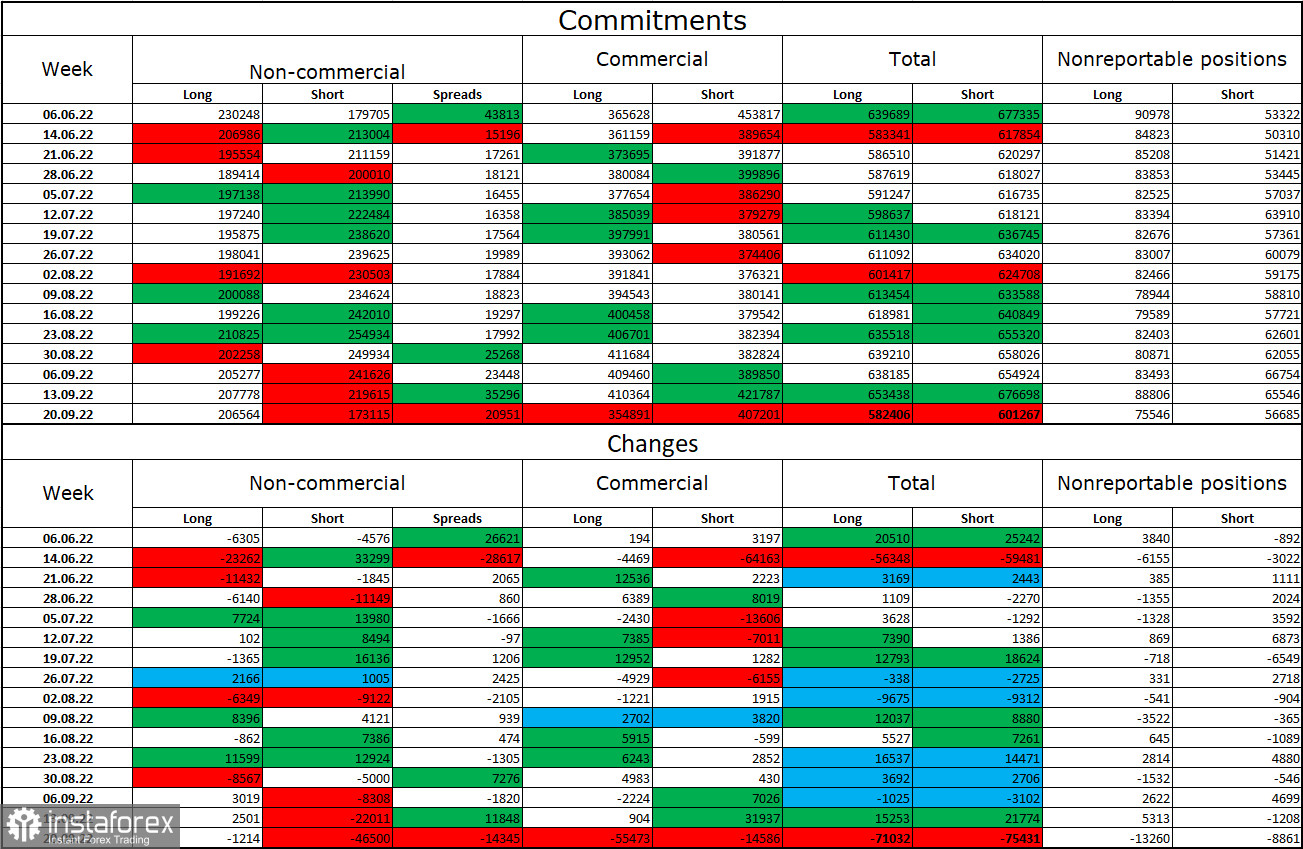

Commitments of Traders (COT):

Last week, speculators closed 1,214 Long positions and 46,500 Short positions. It means that the bearish sentiment of the major players has weakened significantly. The total number of Long positions now amounts to 206,000 and the number of Short positions totals 173,000. Now, the mood of large traders is bullish. However, the euro has not advanced yet. In the last few weeks, the likelihood of a rise in the euro has been gradually increasing. Nevertheless, speculators are more willing to buy the US dollar instead of the euro. The euro has not been able to climb in the last few months. Therefore, it is important now to pay attention to the downward corridor on the 1H and 4H charts. The euro is sure to regain ground if it consolidates above the downward corridor.

Economic calendar for US and EU:

EU – CPI Index (09:00 UTC).

US - PCE Index (12:30 UTC).

US – University of Michigan's Consumer Sentiment Index (12:30 UTC).

On September 30, the economic calendar for the European Union and the United States includes several interesting reports. The EU CPI Index is the most crucial one. The impact of the fundamental background on market sentiment may be moderate today.

Outlook for EUR/USD and trading recommendations:

It is recommended to sell the pair if it declines from the upper border of the downward corridor on the 4H chart with the target level of 0.9581. It is better to buy the euro if it rises above the upper border of the downward corridor on the 4H chart with the target level of 1.0638.