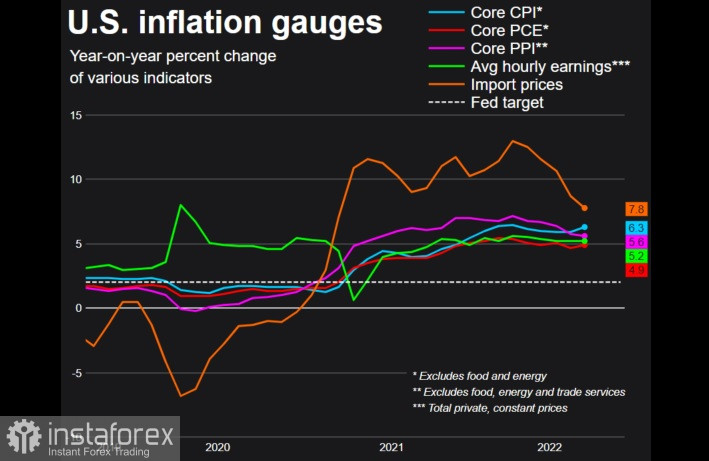

Key reports published in both US and Europe show that inflation continues to spiral and is at staggering levels. This prompted Credit Suisse to issue a gloomy outlook for the global economy, saying the worst is yet to come.

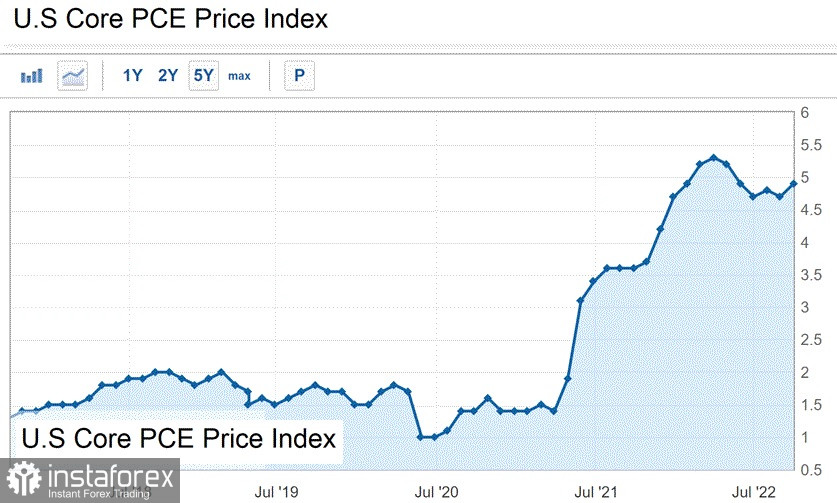

The Department of Commerce released the latest inflation data, indicating that core PCE jumped 0.6% in August. This suggests that inflation is still intense and increasing, and may even be higher in the next months. Core labor costs, which excludes food and energy costs, also rose 4.9%, up 4.7% from forecasts.

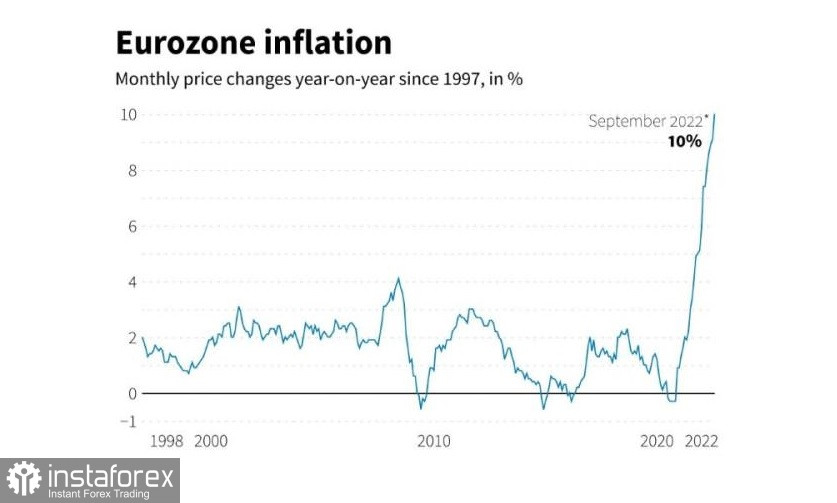

In Europe, inflation hit a new record high of 10% in September.

In Europe, inflation hit a new record high of 10% in September.

CPI for the Eurozone differs from that of the US as year-on-year energy prices in the region were up 40.8%. In the US, there is a slight decline from 8.5% to 8.3%.

To address inflation, the Fed has implemented five consecutive interest rate hikes, but from last week's report, it is obvious that the aggressive measure is yet to bring inflation down. Vice Chairman Lael Brainard said the risk of additional inflationary shocks cannot be ruled out, so the central bank is trying to avoid a premature retreat. "Monetary policy should be tight for some time to be sure that inflation returns to its target level," she stated.