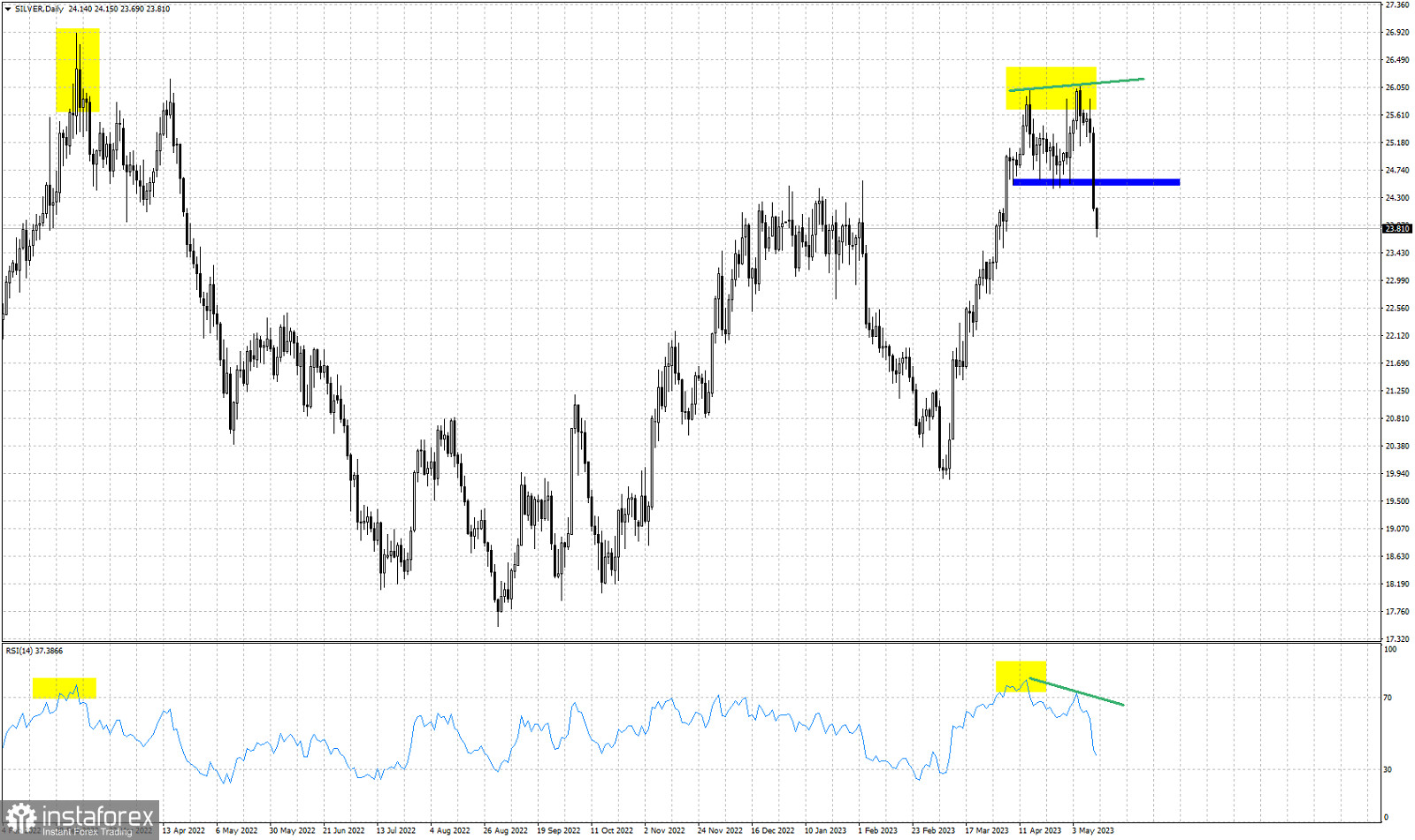

Yellow rectangles- overbought tops

Blue rectangle- key support

Green lines- bearish divergence in the RSI

Our analysis on Silver on May 5th explained the scenario of an important top and the chances of a bearish reversal in trend. Price was then trading around $25.60-$26 and is now falling below $24. The similarities to the previous top on February of 2022 have led us to expect a decline. We see now that history repeats as the similar technical conditions in Silver have the same result. The RSI reached similar overbought levels with February of 2022. The RSI provided a bearish divergence warning. Price is now under pressure as expected and is making lower lows and lower highs. We are in a corrective phase with Silver price approaching the 38% Fibonacci retracement of the entire rise from $19.85. Next key support is at $22.92 where we find the 50% Fibonacci retracement. The RSI is far from oversold levels so we continue to expect price to move even lower.