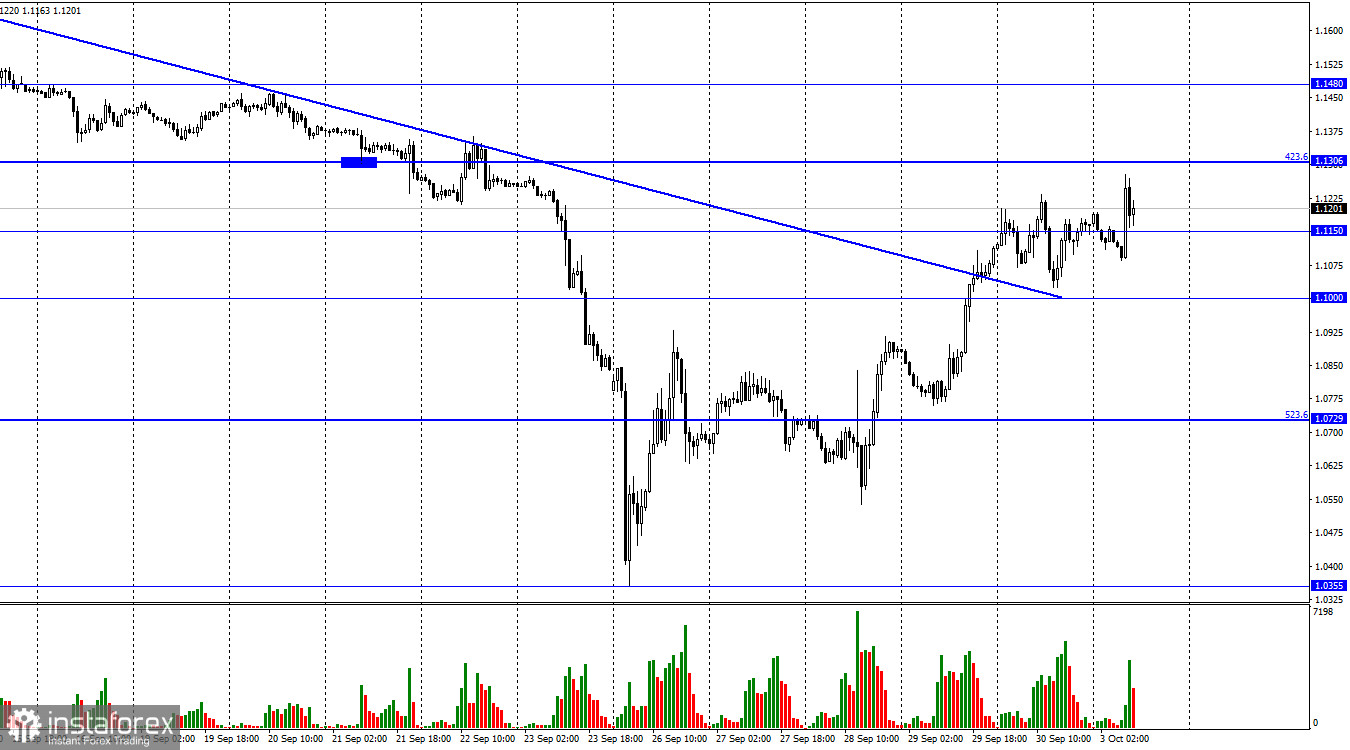

Hi, dear traders! According to the H1 chart, GBP/USD closed above the descending trend line, making an upside movement towards 1.1308 and 1.1480 more likely. The pound sterling has quickly recovered from its latest shakeup. However, more news and data releases will be out soon, which could push the US dollar up. At the end of the week, US non-farm payrolls will be released, which always trigger a reaction from traders. This report is particularly important for the Federal Reserve's fight against inflation. Several FOMC board members have stated recently that the US economy is in a "technical recession". The economy is slowing down, but this downturn isn't bringing down living standards or causing mass layoffs, bankruptcies, and unemployment. So far, NFP data has proven them right, as unemployment in the US remains at its lowest level in 50 years.

However, if non-farm payrolls begin to decline, it could undermine confidence in the US economy. Though it might not make the UK economy significantly more attractive, it could still give a short-term boost to the pound sterling. Thanks to efforts of bulls, GBP/USD has broken through the trend line, but any further upside movement of GBP is debatable. At this moment, it is certainly possible, but not very likely. The pound sterling's strong decline has been going on for more than a year, and one week would not be enough to undermine investor confidence in the US dollar. The numerous problems currently plaguing the UK economy could scare away investors from going long on GBP. However, a 200 pips upward movement this week is definitely possible.

According to the H4 chart, the pair continued to rise towards the upper boundary of the descending trend line, cancelling the bearish divergence and surpassing its peak. If GBP/USD closes above the Fibo level of 200.0% (1.1111), it would make further upside movement more likely. Bearish traders have not yet fully exited the market, but they are currently in the process of doing so.

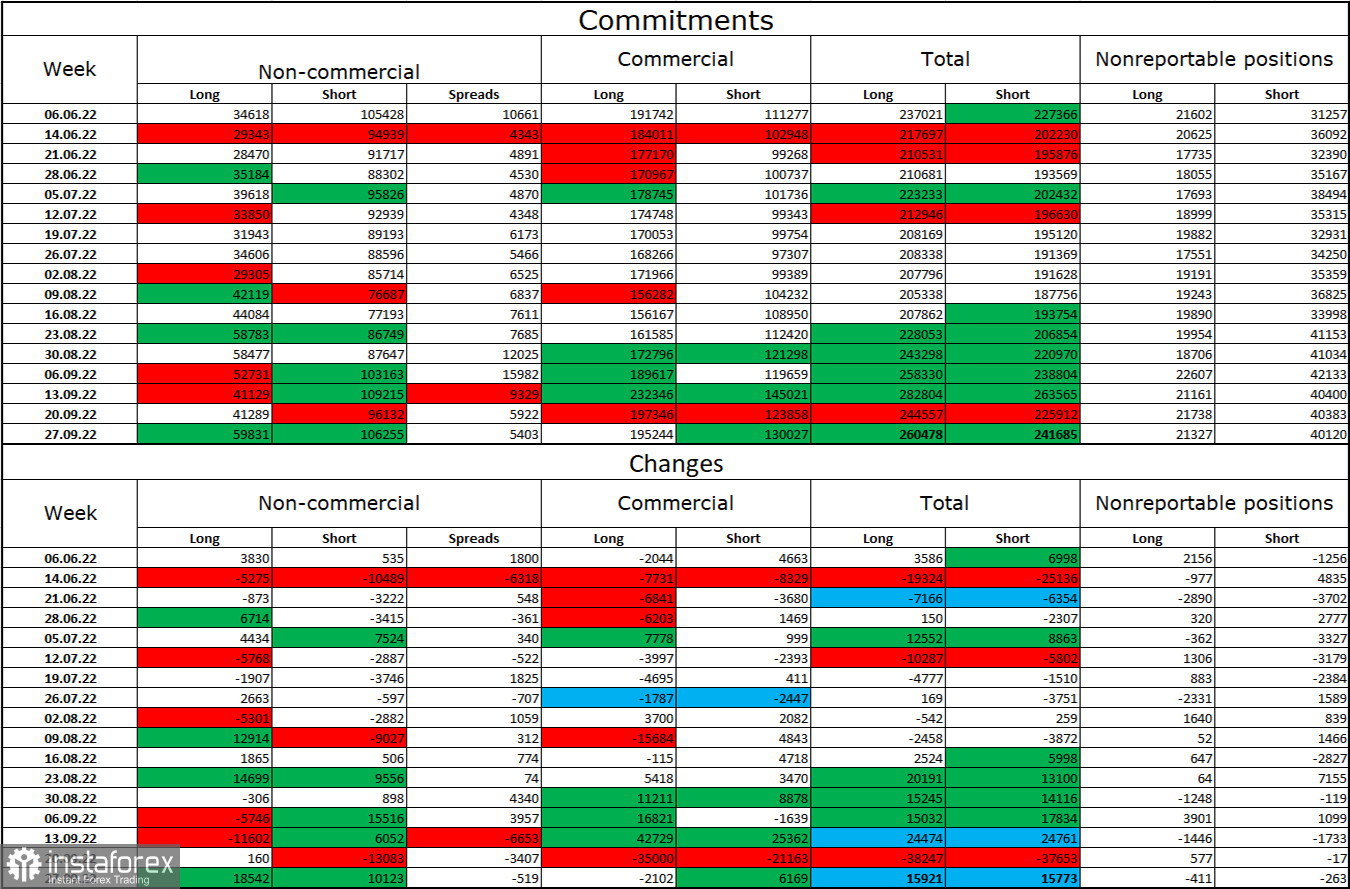

Commitments of Traders (COT) report:

Non-commercial traders became less bearish on GBP/USD in the past week. They opened 18,452 Long and 10,123 Short positions. However, major players remain predominantly bearish, and Short positions continue to outnumber Long ones greatly. Major players have largely remained bearish on GBP, and have slowly become more bullish over the past several months. However, it has been a very slow and lengthy process. Only support from positive news and data, which has been lacking over the past months, could allow the pound sterling to continue its upside movement. The market sentiment is currently bullish, as traders are net long on GBP/USD. However, any negative news could easily reverse this situation.

US and UK economic calendar:

UK - Manufacturing PMI (08-30 UTC)

US - Manufacturing PMI (13-45 UTC)

US - ISM manufacturing PMI

Monday's only events on the economic calendar are manufacturing PMI data in both the UK and the US. They could have a limited impact on traders.

Outlook for GBP/USD:

Traders are recommended to open new short positions if the pair bounces off the upper boundary of the descending trend channel on the H4 chart, with 1.1111 being the targets. Long positions can be opened right now targeting 1.1306 and 1.1480 – earlier, GBP/USD closed above the trend line on the H1 chart.