The GBP/USD currency pair continued its upward movement on Tuesday. On the 24-hour TF, the price overcame the Kijun-sen line, which, from our point of view, is a very important moment for the prospects of the British pound. Recall that we have repeatedly talked about the end of a long-term trend: a quick and sharp departure from the minimum of this trend, a strong countertrend movement. That's what we're seeing right now. The pound managed to grow by more than 1,000 points in seven days. In addition, reaching the absolute lows of the British currency throughout history was a point. From a technical point of view, we would say that the downward trend is over.

Unfortunately, now not everything depends on "technology." If the escalation of the conflict between the West and the Russian Federation intensifies, the demand for the dollar may also begin to grow again. Someone may ask where to escalate even more. However, there are always options. Who could have predicted the diversion of the "Northern Streams"? That's the thing - we are all ordinary people. The world's first people hardly inform us about everything they are going to do or have the opportunity to do. Thus, you can expect anything; nothing is funny or fantastic about it. There may be no nuclear strikes. But what if they do? In this case, the pound against the euro may fly back down. Thus, we need to be careful with purchases, even if we are now seeing the beginning of a new long-term trend.

There is also an open question about the prospects of this trend. Yes, the pound has grown by 1,000 points; it may grow by another 500 points, but what's next? After all, to grow over a long distance, the support of the "foundation" or geopolitics is necessary. To expect support from geopolitics now is the same as hoping that the Titanic will not sink, although it has already sunk. The foundation has the opportunity to start supporting the pound, but only at the beginning of next year when the Fed is expected to complete the cycle of tightening monetary policy.

The Nord Stream is out of order, but it can be repaired.

The topic of sabotage on the "Northern Streams" may not be as important for the UK as it is for the European Union. Still, we recall that Moscow regularly accuses the Anglo-Saxons (the States and Britain) of all mortal sins. These countries regularly use "anti-Russian" rhetoric in the opposite direction. Therefore, this diversion also concerns London. Moreover, it is still unclear who is behind it. The versions are called different, but we prefer to wait for the completion of the official investigation rather than guessing on the coffee grounds.

Meanwhile, Russian Deputy Prime Minister Alexander Novak said that it is difficult, but not impossible, to restore the "Northern Streams" efficiency. Appropriate tools can be found, although it will take a lot of time and effort to solve this problem. Novak also noted that today the priority task is to find out who is behind the undermining of gas pipelines. The Deputy Prime Minister of the Russian Federation will recall that the United States, Ukraine, and Poland have repeatedly discussed this infrastructure as attractive to disable it. "Therefore, this issue needs to be seriously investigated," Novak stressed.

It is also noted that for the possibility of repairing the Nord Stream, Western equipment and equipment may be required, as well as spare parts that Russia cannot receive due to the sanctions imposed on it. Naturally, sanctions can be lifted or suspended, or an exception can be made due to the force majeure of the situation. Recall that stopping gas pumping in the EU means a shortage of "blue fuel" in the EU and a possible increase in prices worldwide. For the UK, where the cost of living has already increased so much that the government even intends to reduce the number of taxes and set a marginal price for electricity supply to consumers, a new increase in the cost of gas may be a verdict for the economy. So far, gas is not growing in price, but winter, when the need for it will increase many times, is not far off.

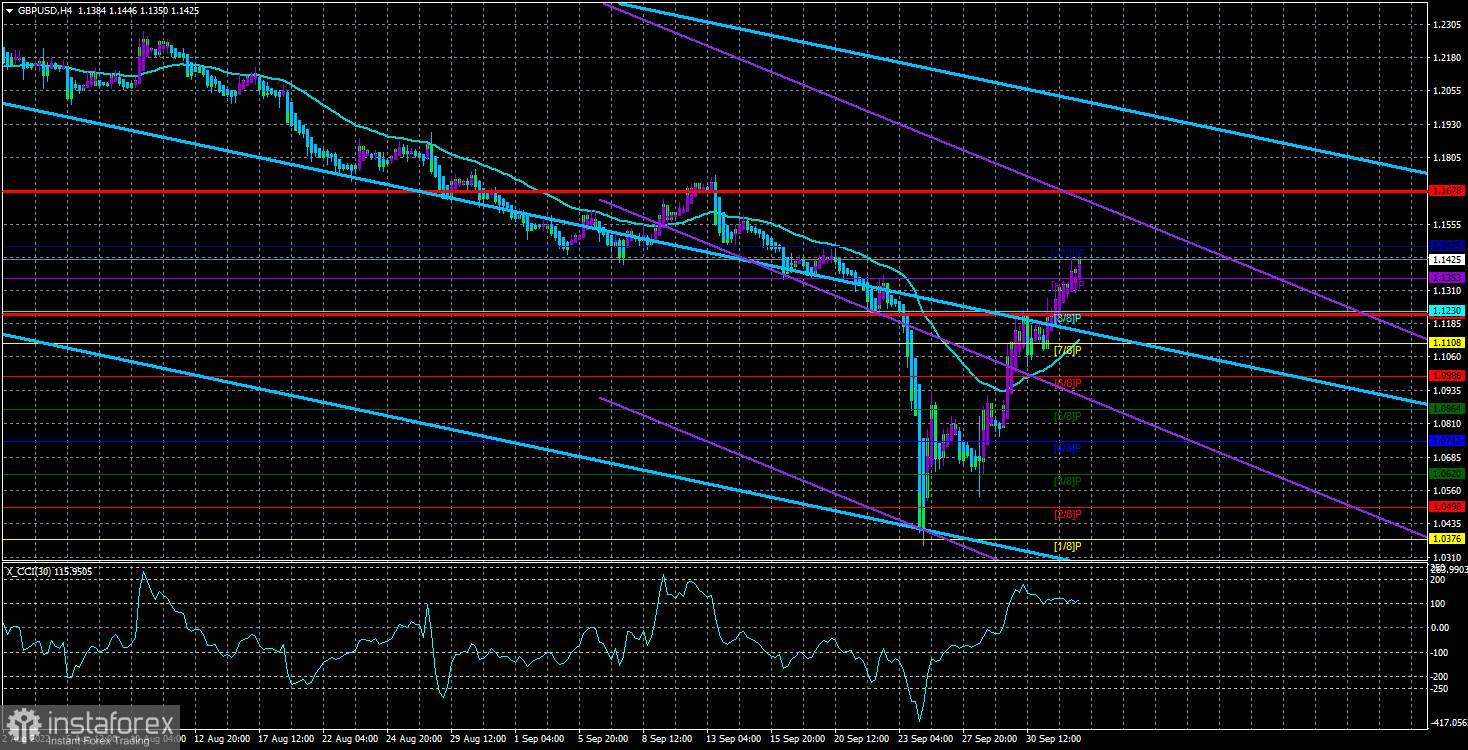

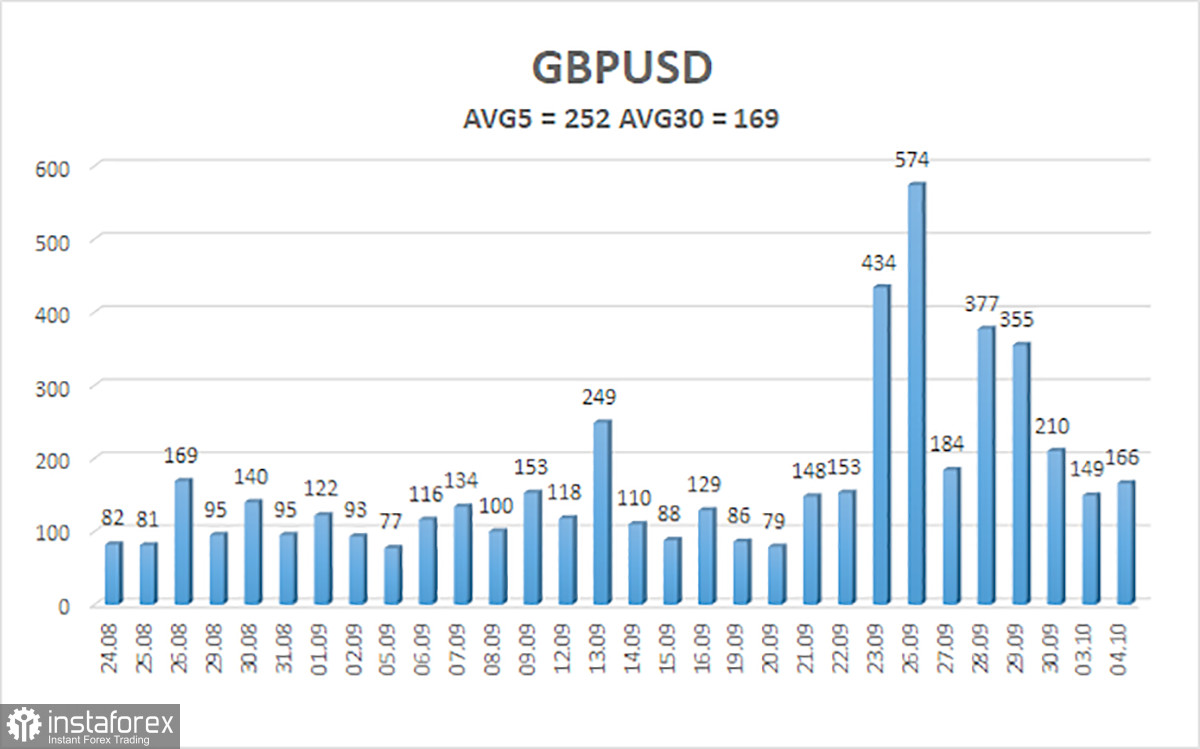

The average volatility of the GBP/USD pair over the last five trading days is 252 points. For the pound/dollar pair, this value is "very high." On Wednesday, October 5, thus, we expect movement inside the channel, limited by the levels of 1.1219 and 1.1678. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.1353

S2 – 1.1230

S3 – 1.1108

Nearest resistance levels:

R1 – 1.1475

Trading Recommendations:

The GBP/USD pair on the 4-hour timeframe may continue to increase. Therefore, at the moment, you should stay in buy orders with targets of 1.1551 and 1.1678 until the Heiken Ashi indicator turns down. Open sell orders should be fixed below the moving average with targets of 1.0986 and 1.0864.

Explanations of the illustrations:

Linear regression channels help to determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which to trade now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.