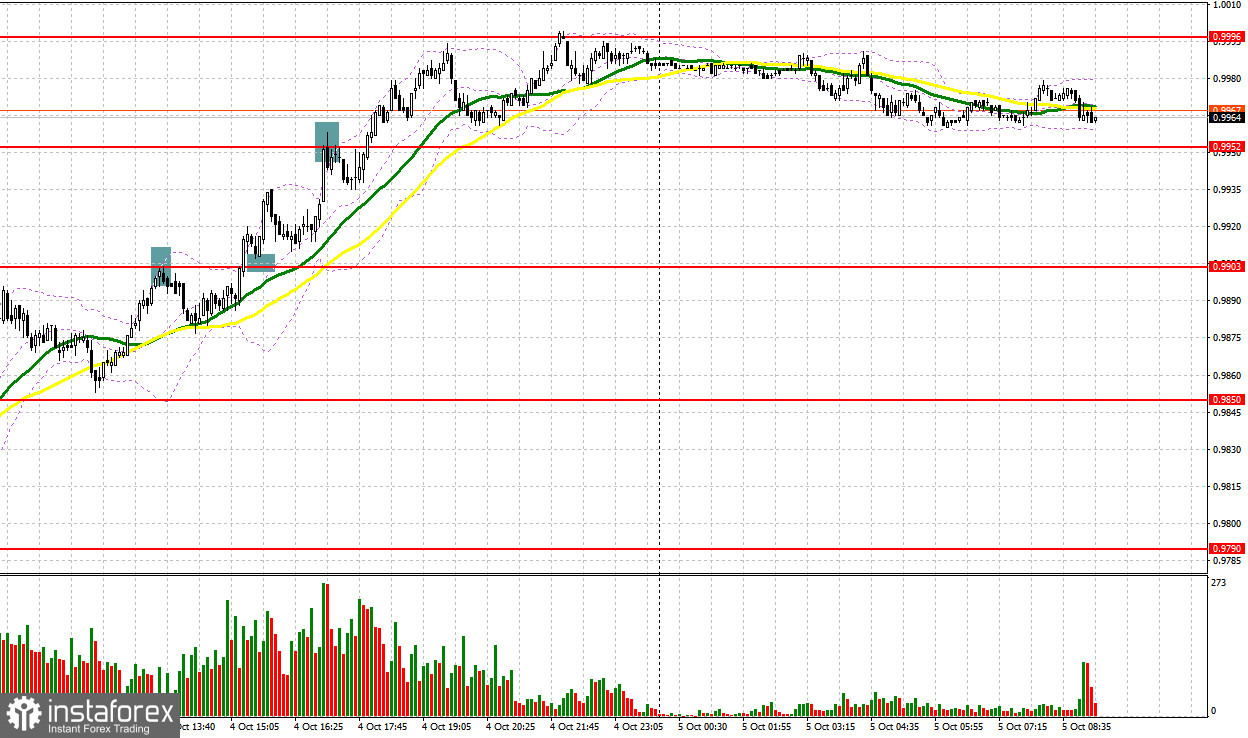

Several market entry signals were formed yesterday. Let's take a look at the 5-minute chart and see what happened. I paid attention to the 0.9903 level in my morning forecast and advised making decisions on entering the market there. A breakthrough of 0.9850 passed without a reverse test from top to bottom, so I failed to get an entry point into long positions there. As a result of the pair's growth in the first half of the day, the level of 0.9903 was updated, where a false breakout gave a sell signal. The downward movement amounted to about 25 points, after which the demand for the euro returned. In the afternoon, a breakthrough of 0.9903 also occurred without a reverse test, so it did not work out to buy EUR/USD here either. All I could see was a false breakout and a small selloff from 0.9952 with an 18 point downward move.

When to go long on EUR/USD:

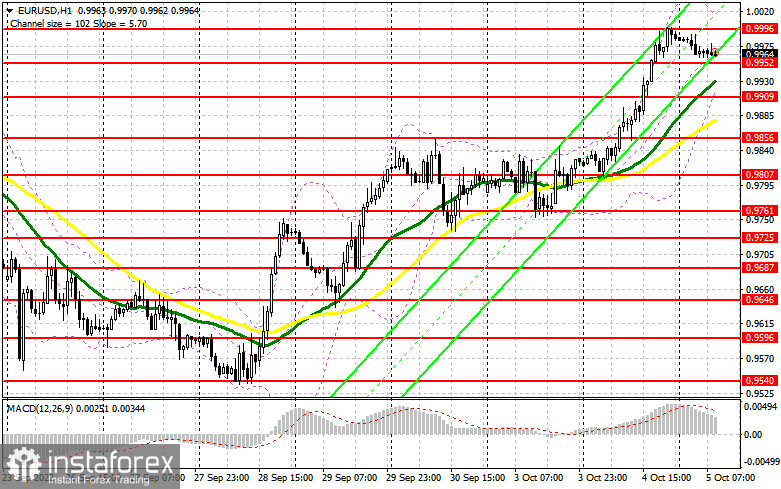

Risk appetite has risen significantly as traders began to bet on the completion of a series of interest rate hikes by the Federal Reserve before the end of this year. Given the attractive levels for buying the euro, the bulls quickly returned the pair back to parity, for which the main struggle will unfold. We expect a large set of statistics on activity in the eurozone countries today, which may cool the ardor of bulls, which will lead to a slight correction in the market - especially in conditions when the contraction in the services sector and in the composite PMI index for the eurozone for September of this year is forecast. If the pair goes down, I advise you to act from the level of 0.9952. Forming a false breakout there will be the starting point for building up long positions with the prospect of recovery back to the weekly high of 0.9996. A breakthrough and test from top to bottom of this range, together with strong statistics on the eurozone, on the contrary, will hit the stop orders of speculative bears, forming an additional signal to open long positions with the possibility of a surge up to the 1.0040 area. Consolidating above this level will be a serious victory for the bulls, as the bear market will gradually slow down in the medium term. A more distant target will be resistance at 1.0084, where I recommend taking profits.

If the EUR/USD declines and there are no bulls at 0.9952, there is no need to panic. Although the pressure on the pair will increase, it will only lead to a fall to the 0.9909 area, where the moving averages are passing, playing on the bulls' side. In this case, the best solution to open long positions there would be a false breakout. I advise you to buy EUR/USD immediately on a rebound only from 0.9856, or even lower - in the area of 0.9807, counting on an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

The bears have once again missed the market, and the observed upward correction has already turned into a good short-term bull market. The bears' initial task for today is to protect the new high of 0.9996, since releasing the pair above this level can further lose the initiative, which will jeopardize the existence of the trend. Forming a false breakout at this level, together with a weak eurozone services PMI for August, will provide an excellent entry point for short positions, allowing for a sharper movement of the pair down to the 0.9952 area. Surely a breakdown and consolidation below this level with a reverse test from the bottom up creates another sell signal with the removal of bulls' stop orders and a larger fall to the 0.9909 area, where the moving averages are passing, which are clearly capable of limiting the pair's downward potential. A more distant target will be the area of 0.9856, where I recommend taking profits.

In case EUR/USD jumps during the European session, as well as the absence of bears at 0.9996, the demand for the euro will only increase, which will lead to a more powerful upward correction. In this case, I advise you not to rush into short positions. I recommend opening shorts only if a false breakout is formed at 1.0040. You can sell EUR/USD immediately on a rebound from the high of 1.0084, or even higher - from 1.0118, counting on a downward correction of 30-35 points.

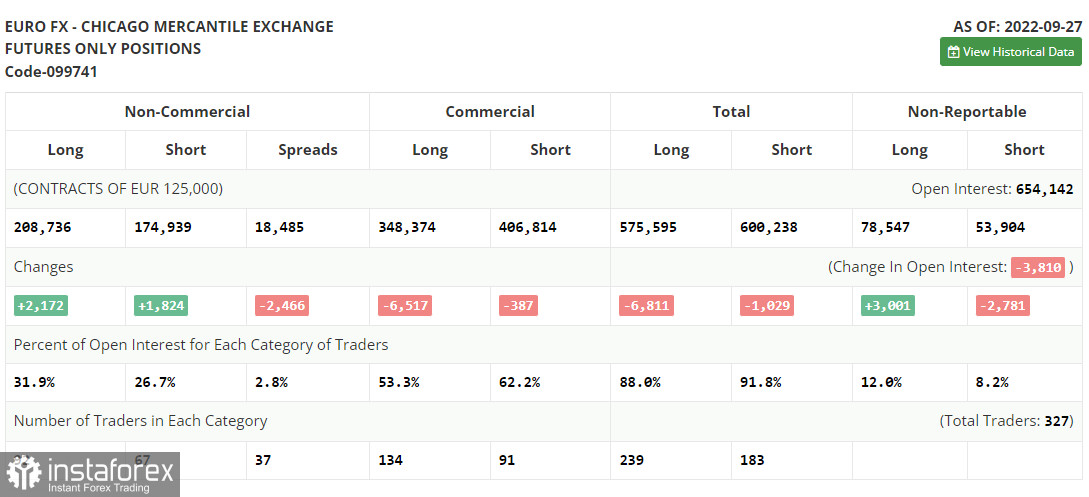

COT report:

The Commitment of Traders (COT) report for September 27 logged an increase in both short and long positions. The meetings of the central banks have passed, and given that the euro withstood the pressure formed last week by the statements of European and American politicians, one can count on a gradual recovery of the pair in the short term. However, you shouldn't get too carried away. As is already known, inflation in the EU countries has already exceeded 10.0% and in the autumn-winter period the situation with this indicator will only worsen. For this reason, I would not bet on a strong euro growth. The deterioration of the geopolitical situation in the world, which to a greater extent concerns the eurozone, will greatly slow down the European economy in the near future and will surely lead it to recession in the spring of next year. In the near future, a number of important data on activity in the euro area is expected, the decline of which may significantly limit the further upward potential of the pair. The COT report indicated that long non-commercial positions rose by 2,172 to 208,736, while short non-commercial positions jumped by 1,824 to 174,939. At the end of the week, the total non-commercial net position remained positive and amounted to 33,797 against 33,449 This indicates that investors are taking advantage of the moment and continue to buy cheap euros below parity, as well as accumulate long positions, counting on the end of the crisis and the recovery of the pair in the long term. The weekly closing price collapsed and amounted to 0.9657 against 1.0035.

Indicator signals:

Moving averages

Trading is above the 30 and 50-day moving averages, which indicates the euro's succeeding growth.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper border of the indicator in the area of 1.0015 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.