Rally in continued on Tuesday, thanks to the new wave of optimism brought by the decision of the Reserve Bank of Australia on rates and the published data on the number of markets open vacancies in the US.

The RBA was the first among the world's central banks to raise rates by only 0.25%, explaining that it had already somewhat run ahead in this process. This caused a wave of hope among investors that the Fed could make the same decision and, perhaps, at the October meeting, would not be so aggressive in raising rates.

Additional stimulus was the published data on the number of open vacancies in the US for the month of August. The indicator has shown a markedly stronger decline since May of this year, signaling that the increase in rates slowed down the hiring in the labor market. Many saw this news as positive because it could also mean that the economy is in a recession, which would force the Fed to ease if not stop the cycle of raising rates.

In this regard, the US employment data scheduled to be released this week will play an important role, in which if they turn out to be lower than expected, the rally in markets will continue. This will have a negative impact on dollars.

Forecasts for today:

EUR/USD

The pair is trading below 1.0000. If the rally in stock markets resume, expect a breakout and continuation of the local increase to 1.0090. The pair may also be supported by weak statistics on the growth in the number of new jobs from ADP.

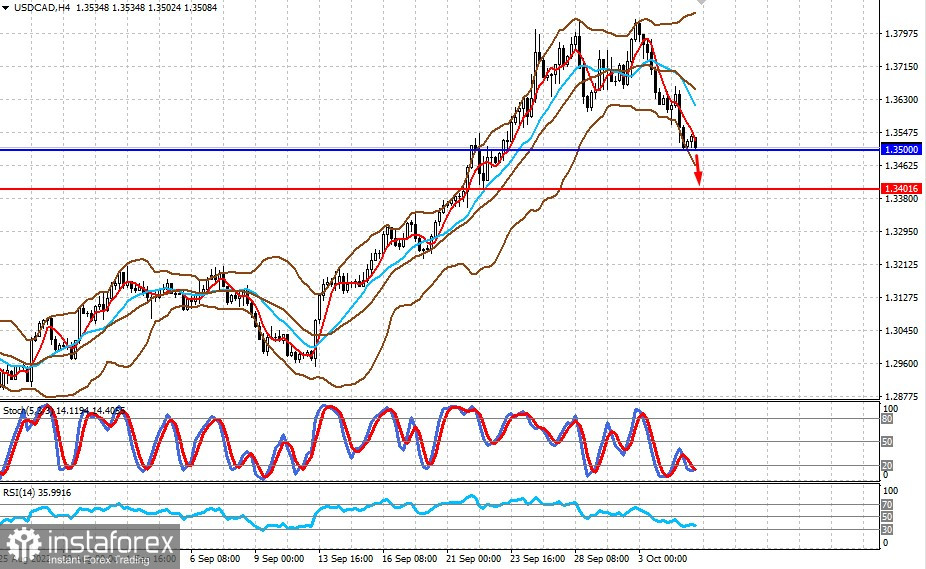

USD/CAD

The pair hangs over the level of 1.3500. An increase in oil prices may lead to a decrease below this level and a fall to 1.3400.