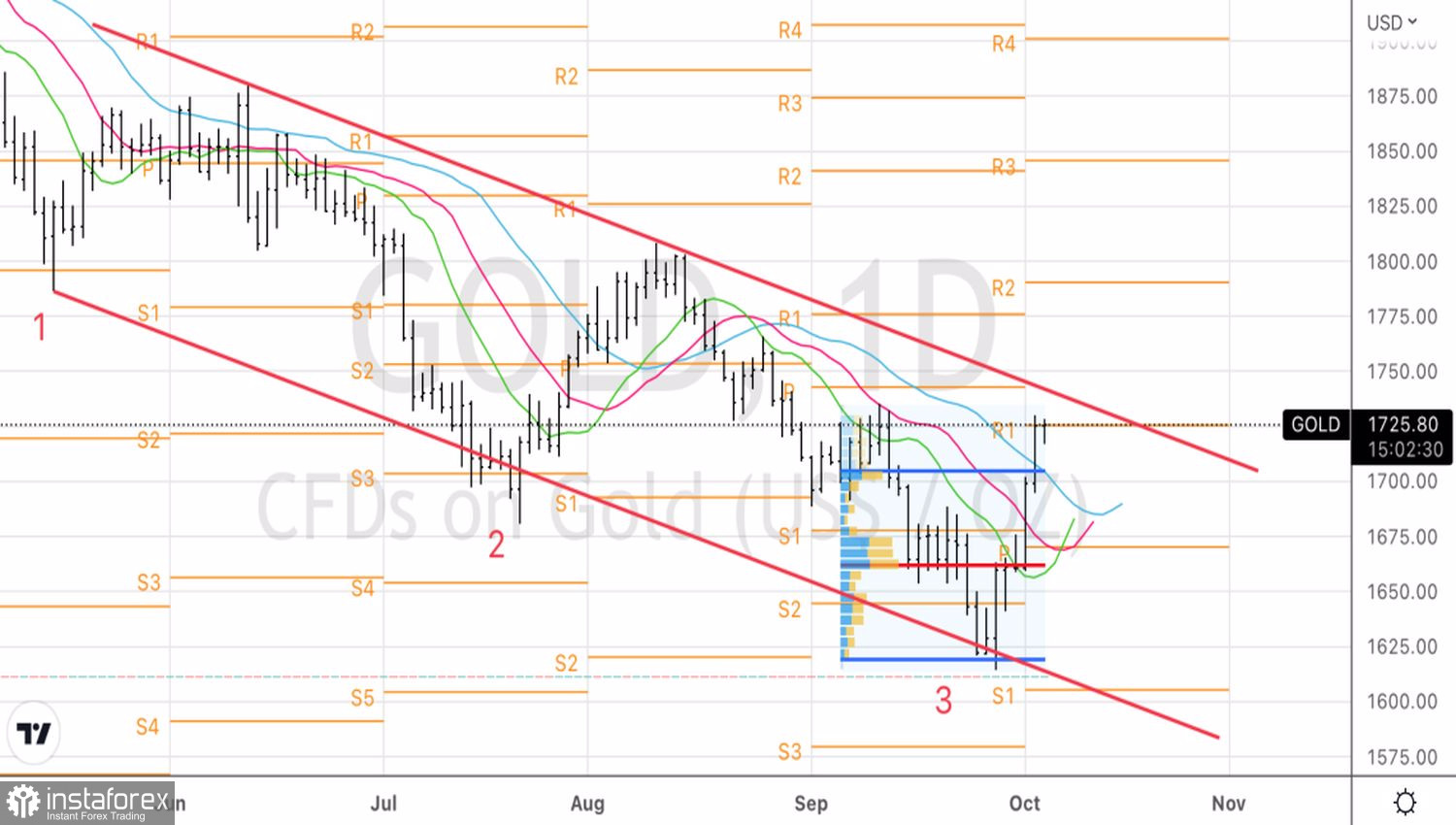

Within a few days, gold has retraced a quarter of its downward trend from its March peak of $2,070 to its September low of $1,610 an ounce. Improved global risk appetite, fears of a global recession, and expectations of a dovish turn by the Fed allowed XAUUSD quotes to return to 4-week highs.

The 5.7% rally in the S&P 500, rising oil prices and other commodity market assets suggest an improvement in investor sentiment. They are looking for signs of a change in the Fed's mindset. If other central banks can be "dove," why shouldn't the Fed do the same? Indeed, the resuscitation of the British QE by the Bank of England and the increase in rates by the Reserve Bank of Australia by a modest 25 bps instead of 50 bps, predicted by Bloomberg experts, could set a precedent for other regulators as well.

Also, FOMC members don't sound as hawkish as they used to. San Francisco Fed President Mary Daly said that the Fed knows how to fight inflation, but will strive to do it gently. New York Fed President John Williams said tighter monetary policy is cooling demand and slowing inflation, but the Fed's job is not done yet.

Naturally, there is no talk of any dovish reversal yet, but the very fact of slowing down the process of raising rates increases global risk appetite, weakens the demand for the US dollar as a safe-haven asset, and underlies the XAUUSD rally.

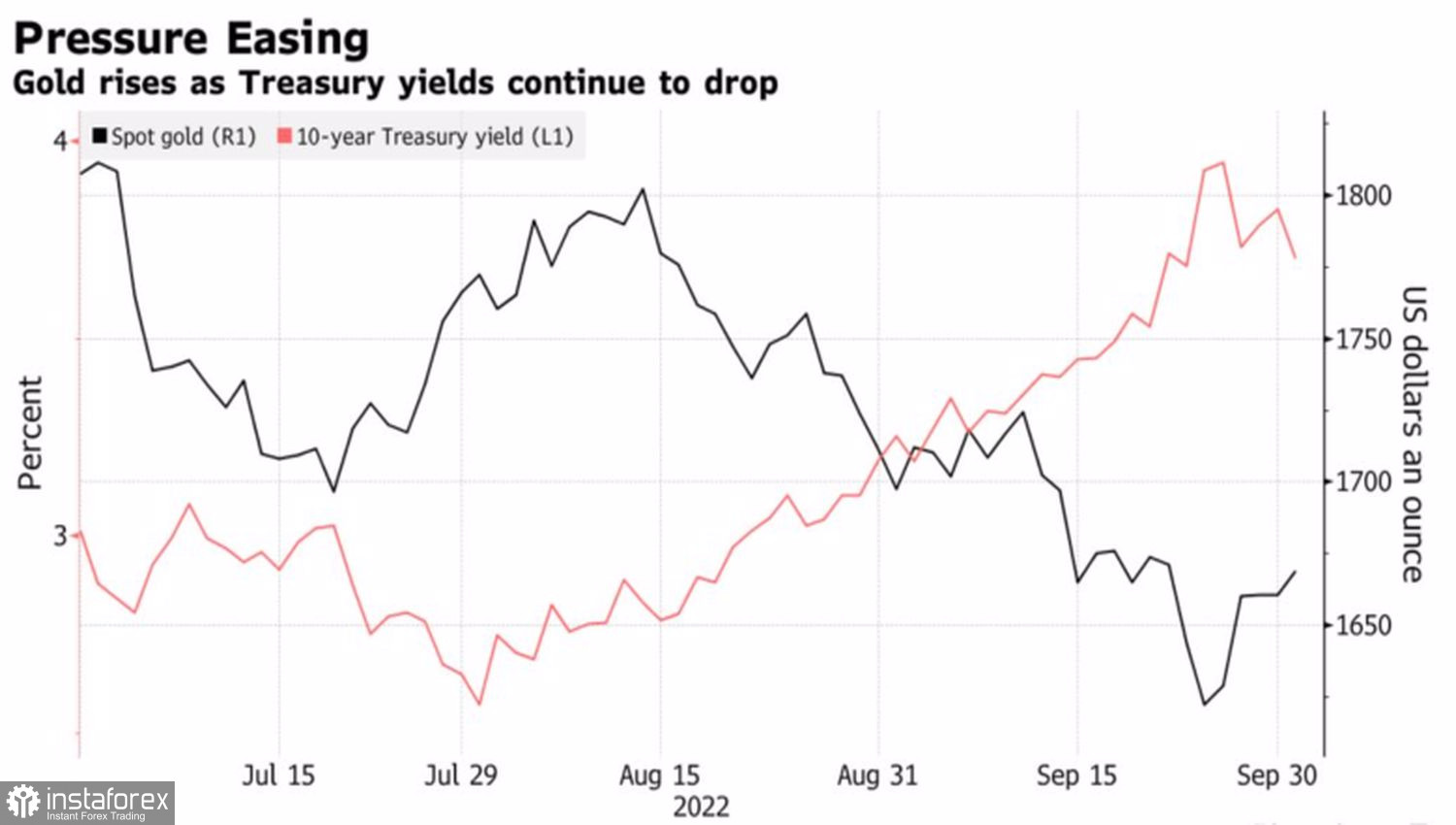

At the same time, lowering the expected ceiling on the federal funds rate from 4.7% to 4.5% contributes to the fall in US Treasury yields. Under these conditions, non-interest bearing gold feels like a fish out of water.

Dynamics of gold and US Treasury yields

The decrease in US debt market rates is also taking place against the backdrop of a gradual deterioration in macroeconomic statistics. The fall in the US manufacturing PMI from ISM to a two-year low and the fastest decline in the number of vacancies since March 2020 amplify recession risks and demand for bonds.

The XAUUSD rally would not have been so fast if it weren't for the bearish sentiment in the precious metal market over the past few months. ETF outflows have been going on for 16 weeks, while hedge funds have been shorting for seven weeks. Their closing, known as a speculative squeeze, allowed gold to soar to $100 an ounce very quickly.

Its further dynamics will depend on statistics on the labor market and inflation in the US. The consensus forecast of Bloomberg experts assumes an increase in non-agricultural employment of 263,000. According to Jefferies, in order for the Fed to start adjusting its plans, it takes no more than 100,000 jobs.

Technically, on the daily chart of gold, thanks to the Three Indians pattern, there is a rally towards the upper limit of the descending trading channel. A rebound from it near $1,740 is a reason for selling. On the contrary, an unsuccessful assault on support at $1,700 is a reason to buy.