The key event of the day is the OPEC + meeting in Vienna. According to the reports on Tuesday evening, the grouping was considering an output cut of 1.5-2 million bpd instead of the planned decrease of 1 million barrels. This measure is supposed to keep oil at a comfortable level of 90 US dollars per barrel. At the same time, this may be a sign that the cartel is bracing for a deeper decline in crude demand amid a global economic downturn.

This decision may trigger a sell-off wave in financial markets and spur the demand for safe-haven assets. The threat of a global recession forces some central banks to soften monetary tightening. So, a drop in crude prices would be a supporting factor in the fight against inflation. However, higher output cuts by OPEC + may become a serious obstacle as this decision will have both economic and political impact.

Yesterday's decision by the RBA to raise the rate by just 0.25% also added to the overall slowdown.

Meanwhile, the US dollar was going through a sell-off on Tuesday which is hardly surprising considering its recent jump to a 20-year high. The gap between US Treasury yields and government bonds of other countries is slowly narrowing. The global government bond market has been trading in the red over the past 24 hours which may reflect fears that central banks may stop their aggressive policy in the face of a recession.

Markets can be rather volatile today as some key reports are due to be published. After a disappointing report on the ISM Manufacturing PMI, markets will be focused on the ADP employment data in the US. The second important event is the publication of the ISM Services PMI. The indicator is expected to decline below 50 which may deteriorate the market sentiment and boost the demand for safe-haven assets.

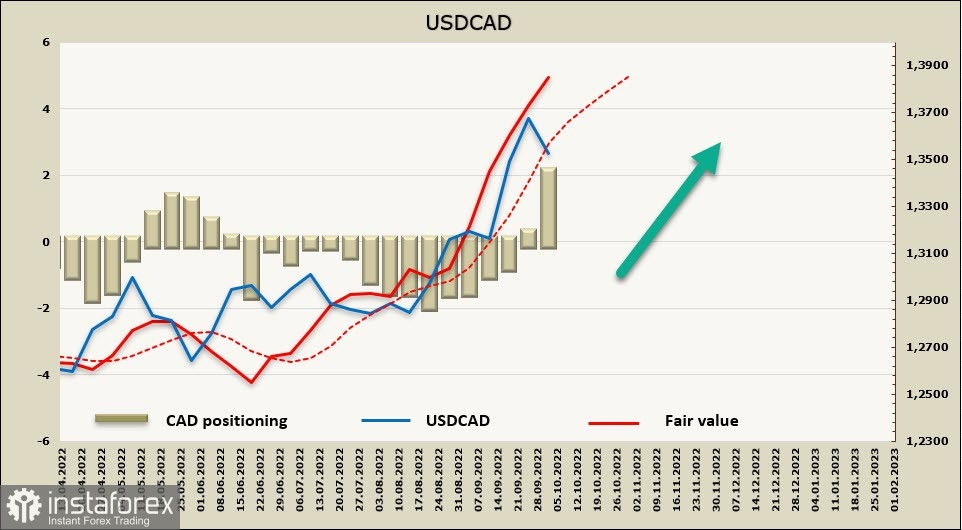

USD/CAD

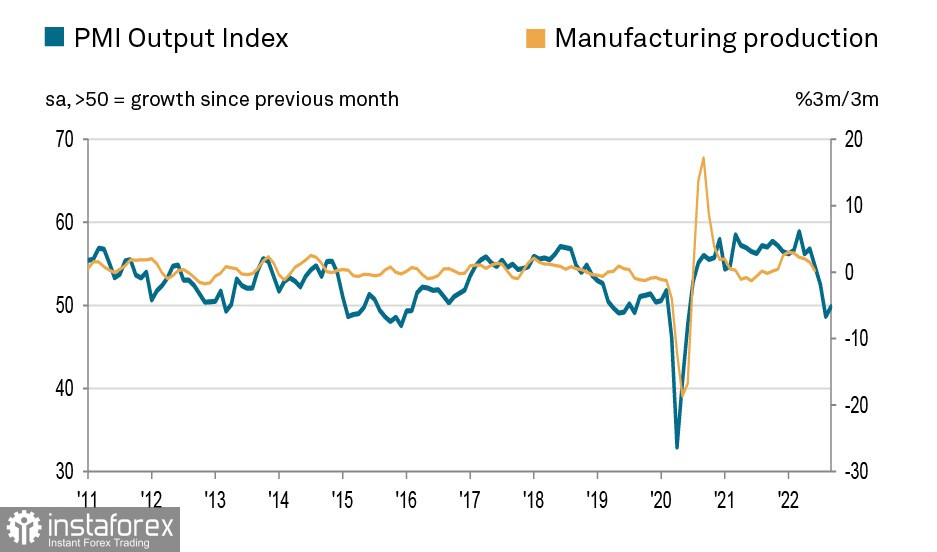

From the fundamental point of view, no important reports have been released in Canada this week. The loonie is following the global market trajectory. The Manufacturing PMI is still in negative territory, having recovered to 49.8 from 48.7. The industrial output index is also likely to decline given its strong correlation with the PMI.

On Thursday, Tiff Macklem, the Governor of the Bank of Canada, will give a speech. He may give a hint to the markets on what rate change to expect. On Friday, Canada will publish the employment report for September which has a positive forecast so far.

The Canadian dollar is highly dependent on the dynamic of oil prices. That is why the OPEC + meeting in Vienna may send the quote in any direction.

Speaking about the futures market, the balance has sharply changed from bullish to bearish after the expiration date last week. The closing price of the pair surged which means traders are betting on the weakening of the loonie in the long term.

Today's fall in the USD/CAD pair can be considered a correction. The level of 1.3400 serves as the nearest support. A decline to this level will encourage the bulls to open new long positions. In the long term, the pair may head for the high of 1.4667 last seen during the pandemic.

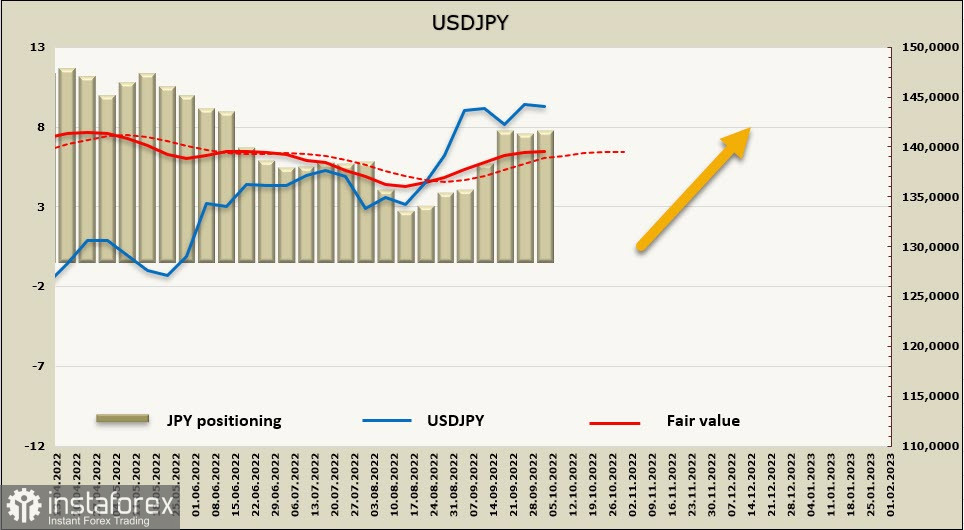

USD/JPY

The Tankan index of business conditions in Japan, which is of the same importance to Japanese investors as the ISM PMIs in the US, stayed almost unchanged in September and declined by just one point to +8. This is the fourth quarterly decline of the index although it still holds above zero, signaling relative stability of the Japanese economy.

The consumer price index in Tokyo has unexpectedly dropped to 2.8% from 2.9% in September while the forecast was 3.0%. However, this does not mean that inflation has slowed down. Most likely, this reading reflects weak consumer demand that the BOJ has been unsuccessfully stimulating for years. In the meantime, the core CPI exceeded the forecast and rose to 1.7% from 1.4%. Obviously, global inflation is penetrating Japan, and this process is inevitable.

A week earlier, the USD/JPY pair had a great opportunity to develop growth towards the resistance of 147.71. Yet, the upside momentum faded away, and there are currently no bullish factors to support it. The closing price is above the long-term average, meaning that the bullish momentum has not been fully completed.

The current trend is rather stable. A pullback to the support of 139.96 (previous monthly high) looks very unlikely but is still possible. Nothing has influenced the policy of the Bank of Japan so far. After a short break, the pair may resume its rise towards the upper target of 147.71 which is still relevant.