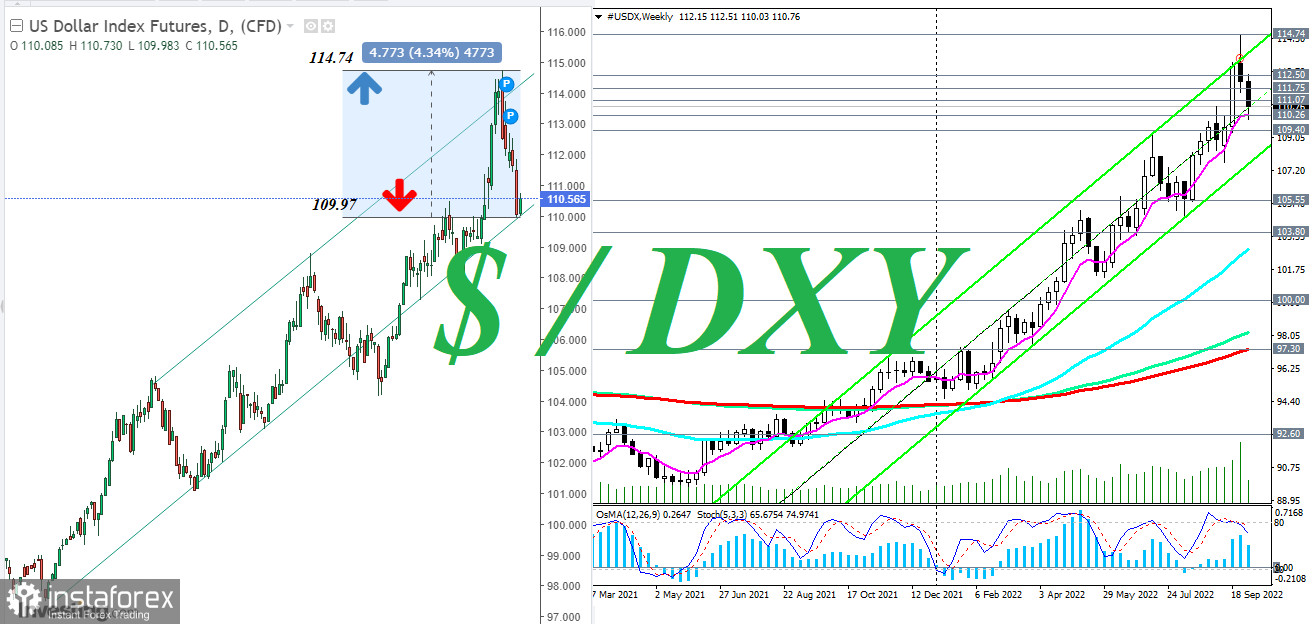

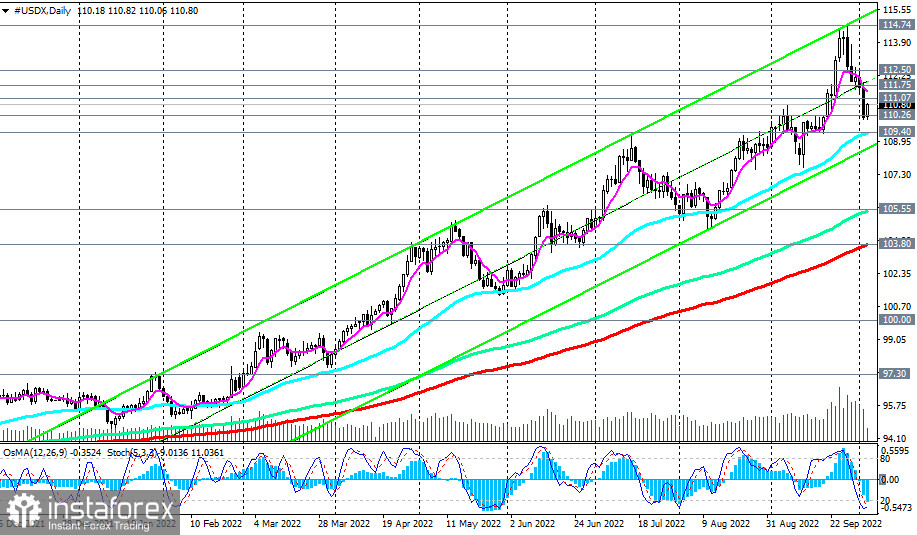

Has the dollar correction ended? If you look at the daily chart of the dollar index (DXY), you can see that it is trying to develop an upward trend today, starting from yesterday's and 2-week low of 109.97. In total, the DXY fluctuation range over the past less than 2 weeks was 4.34%. This is a fairly strong downward correction of the dollar.

Has it ended? Perhaps we will find out about it this week: today, at the beginning of the American trading session, a whole block of important macro statistics for the United States will be released, including reports for September by ADP on the level of employment in the private sector and the Institute of Supply Management (ISM) on business activity in the services sector of the American economy, and on Friday—the Department of Labor's report on US labor market for September.

The ADP report usually has a strong impact on the market and dollar quotes, although, as a rule, there is no direct correlation with Non-Farm Payrolls (to be published on Friday at 12:30 GMT). The indicator is expected to grow up to 200,000 from 132,000 in August. The rising rate and strong data should have a positive impact on the dollar.

As for the PMI in the services sector, a slight relative decline is expected to 56.0 from 56.9 in August. Despite the relative decline, this is a high figure. A result above 50 indicates an increase in activity and is considered a positive factor for the USD. However, if the decline in PMI is stronger than the forecast, and especially if it comes out with a value below 50, then expectations of today's dollar growth should be said goodbye for now, at least until the release of the US Department of Labor's monthly report with data for September on Friday.

In any case, during the publication of these reports, you should be prepared for a significant increase in volatility in the market and, above all, in dollar quotes.

As of writing, DXY (reflected as CFD #USDX in the MT4 trading terminal) is near 110.57, 60 points above yesterday's low.

Despite a rather strong correction, the dollar's upward momentum continues, pushing the DXY towards more than 20-year highs near 120.00, 121.00.

The breakdown of short-term resistance levels 111.07, 111.75 will be the first signal that the dollar and the DXY index will return to growth.