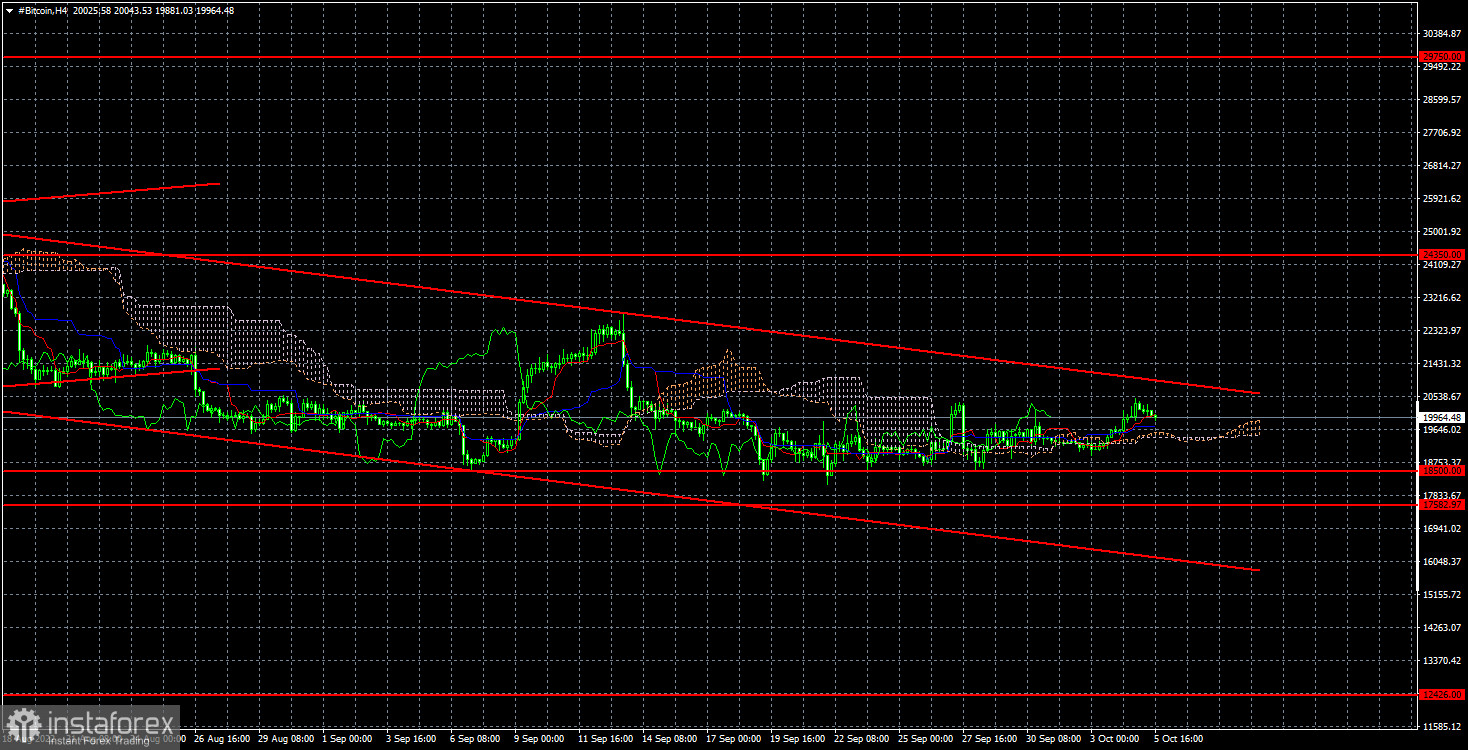

On the 4-hour TF, it is even better to see that recently, bitcoin has been moving exclusively sideways, with minimal volatility and exactly along the $18,500 level. At the moment, microscopic growth towards the upper boundary of the descending channel has begun, but it may end soon. If the pair have already encountered two important resistances on the 24-hour TF, it may encounter a third on the 4-hour chart. The same conclusions are: overcoming this resistance will allow the "bitcoin" to grow by another $2,000–3,000. Otherwise, a fall.

We are still waiting for a new bitcoin drop. One main idea supporting this scenario is that the current levels are extremely low for bitcoin. However, for some reason, none of the investors are in a hurry to invest in the most famous cryptocurrency. There may be some investment cases, but they are not of a mass nature. The logic is simple: if supply and demand are approximately equal, the asset is traded sideways. This is what we have been seeing in the last three months. This means that even if there is a demand for bitcoin, it is opposed by the same volume of supply. The supply fully satisfies the demand, which is why bitcoin is not growing.

Consequently, all the calls by experts and coin owners to buy cryptocurrency at "very attractive prices" may also be some form of "pump." Recall that a person or a legal entity with bitcoin on its balance sheet is interested in its growth. And for this, the demand must exceed the supply.

We admit that bitcoin may show growth in the near future, but we urge you to monitor technical signals. If there are none, do not rush to buy. If Bitcoin starts a new "bullish" trend, everyone will have time to join it.

In the 4-hour timeframe, the quotes for "bitcoin" continue to move sideways. We believe the decline will continue in the medium term, but we need to wait for the price to consolidate below the area of $17,582-$18,500. If this happens, the first target for the fall will be a level of $ 12,426. The rebound from the level of $18,500 (or $17,582) can be used for small purchases, but be careful – we still have a downward trend.