Although the employment report from ADP showed that the number of new jobs in the US is increasing, indicating the strength of the economy, stock markets declined as this could mean that the Fed may not ease the pace of interest rate hikes in the coming months.

Earlier, many have considered the idea that the state of the labor market could change the stance of the central bank regarding monetary policy. They believe that if the number of new jobs fall steadily, the Fed will see that the economy has slowed down enough for them to start turning down the pace of interest rate increases. But yesterday's data showed non-farm payrolls climbing to 208,000 in September, up from an estimate of 200,000 and August figure of 185,000.

Of course, the values from ADP are not official and the market will really act after the release of data from the US Department of Labor tomorrow. But the growth in the number of new jobs will be perceived by the market as a signal that the Fed may reduce the pace of rate growth.

In terms of today's market dynamics, there may be a consolidation until the employment data tomorrow show whether the US labor market is still strong or has already begun to experience problems amid high interest rates .

Forecasts for today:

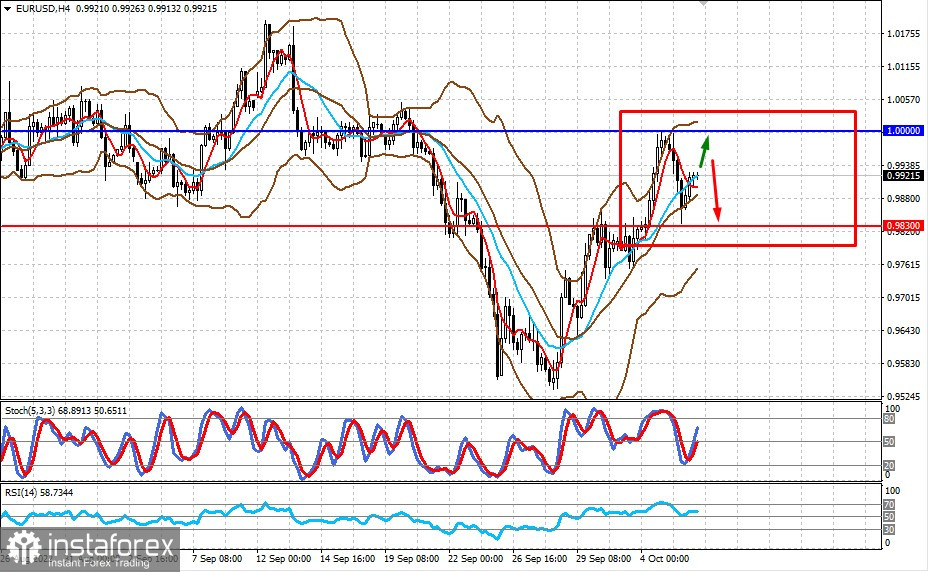

EUR/USD

The pair has not yet overcome the 1.0000 mark. It is likely that before the release of employment data in the US, there will be a consolidation around 0.9830-1.0000.

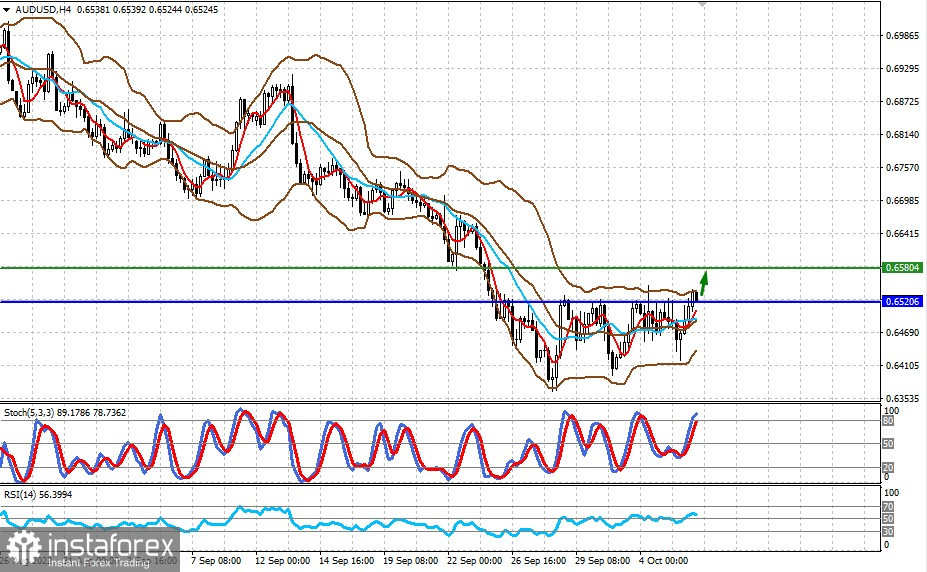

AUD/USD

The pair is trading above 0.6520. It may rise to 0.6580 if positive sentiment prevails on markets today.