As I have already said, the European and British wave markings now suggest different directions of movement. From my point of view, this should not be the case, although theoretically, it is possible. For both wave markings to develop, we need very bad news from the European Union and very good news from Britain. However, I do not see how this condition can be fulfilled. Both central banks are now actively raising interest rates. Problems are observed in both economies, although they are quite different. I think one of the wave patterns will have to be corrected sooner or later.

The ECB will raise the key rate by 75 basis points at the next meeting, which will be the third consecutive increase and the second consecutive increase by 75 points. Practically no one doubts this anymore. Goldman Sachs experts announced the same forecast yesterday, but how will the market react to this event? The ECB meeting will not take place soon, and if we look at the downward section of the trend as a whole, the probability of a new decline in demand for the euro remains very high. At the same time, the Fed is also preparing to raise the rate by 75 points, so the balance will not be disturbed. The bank also noted that initially, they predicted a 50-point rate increase, but the latest inflation report forced them to change their forecast. Let me remind you that inflation has already risen to 10% and exceeds the American and British.

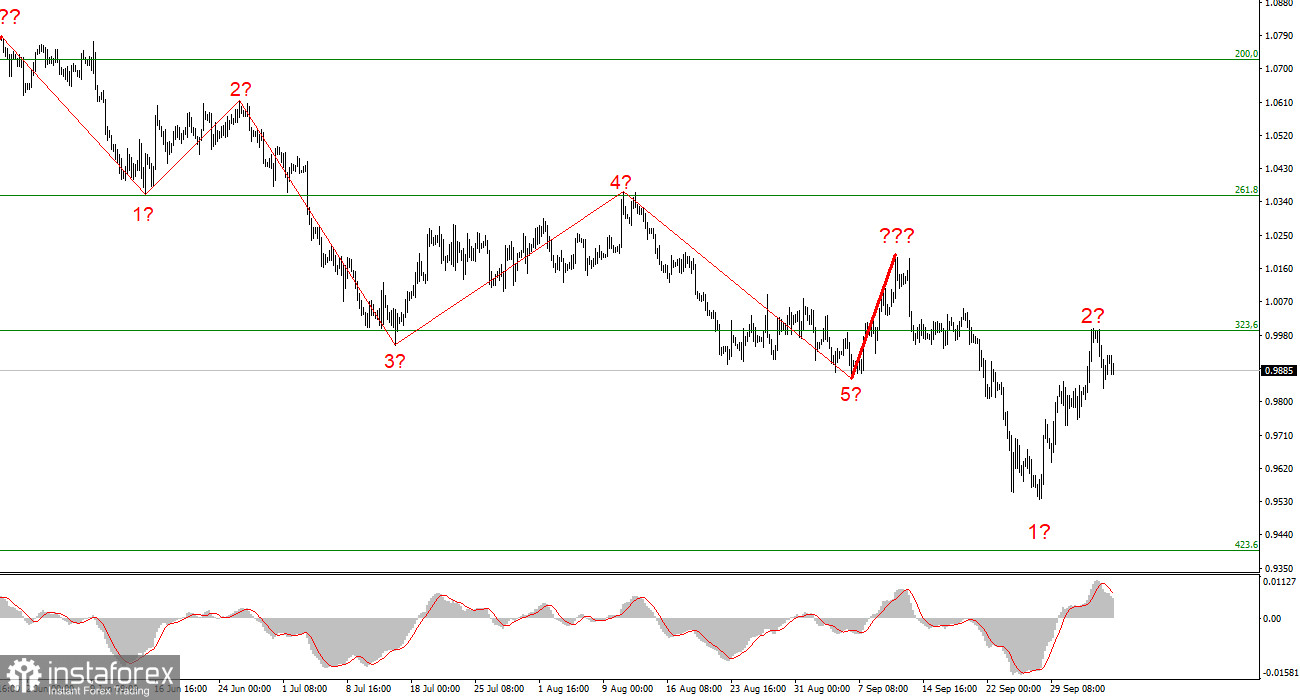

No matter how ambiguous the wave marking looks, I prefer to start from it. An unsuccessful attempt to break through the 0.9990 mark, which corresponds to 323.6% Fibonacci, can be considered a key event for the instrument. From this mark, the construction of the third downward wave can begin as part of a new downward trend segment. If the wave marking is incorrect (although it has long lost its "classic" look), a successful breakout attempt of 323.6% will indicate that the market is ready to build an upward trend channel.

I will also note that the market mood may change tomorrow. Reports on payrolls and unemployment (if they turn out to be strong) may increase demand for the US currency. But even in this case, the wave markings of the British pound and European currencies will not suffer changes since a downward wave is expected to be built in both cases. It's just that for the European currency, it should be an impulse wave, and for the British pound, it should be a corrective wave. Since there are no grounds for making adjustments to the markup, I suggest leaving everything as it is. The market itself will indicate in which direction it intends to move. But I am afraid that it will choose the South again since nothing optimistic is visible on the horizon for the European and British economies. Yesterday, the European Union approved the eighth package of sanctions against Russia, which implies the introduction of a ceiling on oil prices. By the end of the year, Brussels plans to abandon most of the volume of oil purchases in the Russian Federation, and gas is now supplied to Europe through the only pipeline that passes through Ukraine. Not the most stable way, considering that a much safer pipeline in the North Sea was blown up.

Based on the analysis, I conclude that the construction of the downward trend section continues but can end at any moment. At this time, the tool can build a corrective wave, so I advise selling with targets near the estimated 0.9397 mark, which is equal to 423.6% by Fibonacci, and by MACD reversals "down." I urge caution, as it is unclear how much longer the decline of the euro currency will continue.