The pound has been declining for two consecutive days, and if the day before yesterday it was due to US statistics, then yesterday the development of events was already determined by European statistics. Market participants were clearly disappointed by the data on retail sales in the euro area, the rate of decline of which accelerated from -1.2% to -2.0%. What is much more important is that sales have been declining for the third consecutive month. But we are talking about consumer activity, which is the locomotive of the entire economy. So the single currency continued to lose its positions, pulling the pound along with it. Simply because of the scale of the single currency itself.

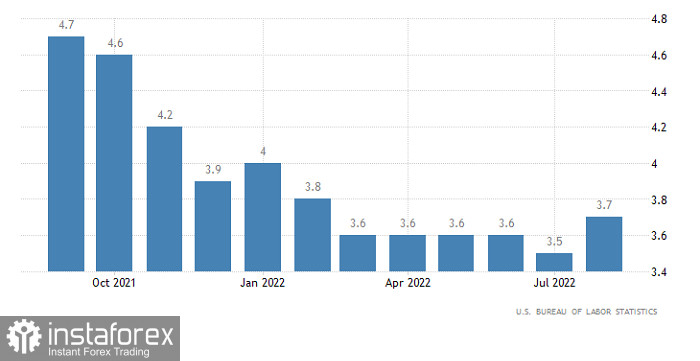

Today, markets will focus on US statistics. More precisely, to the content of the report of the Ministry of Labor. If the forecasts come true, and the unemployment rate is expected to remain unchanged, then the market is likely to consolidate around the values reached yesterday. However, there is every reason to believe that the data will be slightly better than forecasts, and the unemployment rate will fall to 3.6%. This is particularly indicated by the employment data, the growth of which not only exceeded expectations, but also the previous data were revised up. And if this is the case, the dollar will continue to strengthen.

Unemployment rate (United States):

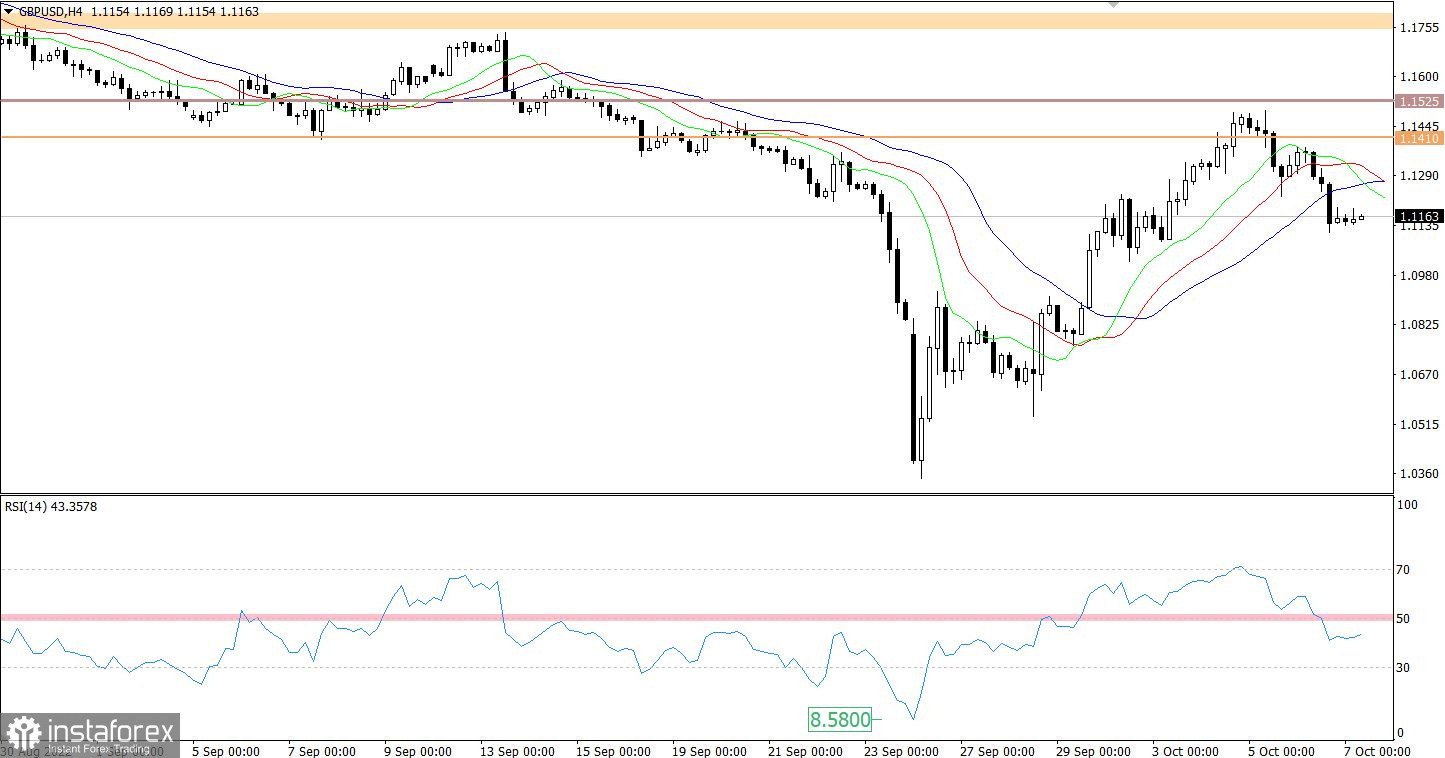

The pound against the US dollar has partially lost what it gained during the recovery period. Literally in two trading days, there has been an active decline, as a result of which the quote fell by more than 300 points. The resistance is the area of 1.1410/1.1525 values relative to which the reverse has occurred.

The RSI H4 technical instrument crossed the average 50 line from top to bottom during an active decline from the resistance area. This signal indicates a high desire of bears to keep the specified cycle.

The moving MA lines on the Alligator H4 indicator have a signal of slowing down the upward course, due to the fact that their interweaving has arisen. Alligator D1 also has an interweaving between the MA lines, but in this case this signal refers to a slowdown in the downward trend.

Expectations and prospects

In this situation, the subsequent increase in the volume of dollar positions may occur when the price is kept below 1.1080, which will lead to a gradual decrease towards the values of 1.1020 and 1.0900.

The upward scenario is considered from the point of view of local overheating of short positions over the past two days. In this case, it is possible to torture a reverse course towards the resistance area.

Complex indicator analysis in the short-term and intraday periods has a sell signal due to the intense downward move from the resistance area.