Whatever doesn't kill makes bitcoin stronger. The token rather calmly accepted the information about the theft of another $100-110 million from Binance coin, and about 7 million of them have already been frozen. Despite the fact that since the beginning of 2022, cryptocurrency hacks have cost their holders $2 billion, interest in the industry is not declining. Moreover, the latest dynamics of BTCUSD hints that the pair has found a bottom.

The current year has really become a very sad one for the crypto industry. Thefts and the loss of 70% of the value from the levels of November highs are only half the trouble. About $2 billion of the sector's capitalization was erased, and 12,000 tokens either completely disappeared or turned into zombies - assets that are more dead than alive. Yet bitcoin fans look to the future with optimism. Life is like a zebra: black stripes are replaced by white ones and vice versa. In addition, the seasonal factor speaks in favor of a potential rally in BTCUSD in October. This month is one of the strongest of the year for the leader of the crypto-currency sector. According to its results, bitcoin grew in 85% of cases, adding an average of 25% to its value.

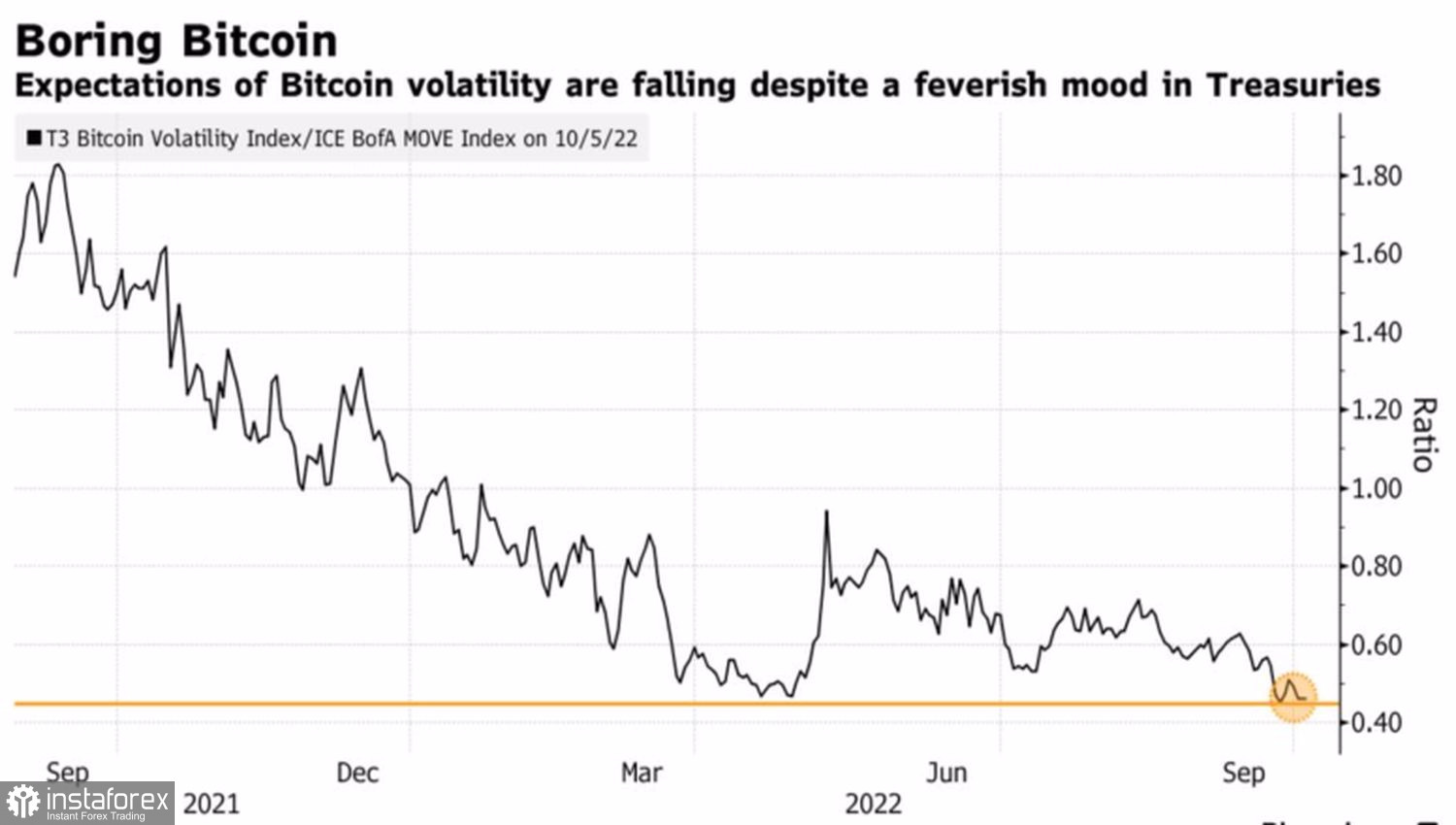

The reluctance of investors to get rid of the token translates into a prolonged consolidation in the immediate vicinity of the psychologically important mark of 20000. While it is difficult to find a day in 2022 when BTCUSD quotes have not moved in the same direction as US stocks, bitcoin's movements have been more muted lately. Usually its volatility is 3-4 times higher than that of the S&P 500, but now everything has been turned on its head. The same goes for the volatility of the crypto-currency sector leader and US Treasuries. Their ratio has reached at least an annual low.

Bitcoin vs US Bond Volatility Ratio

I have repeatedly suggested that in an environment where investors have nowhere to hide from external shocks, and the US dollar looks overbought at 20-year highs, the attention of market participants is switching to BTCUSD. The explosive growth of US stocks leads to similar movements of the token, and their runaway fall does not provoke large-scale sales of bitcoin.

US stock indexes have shown the greatest sensitivity to macroeconomic statistics since 1990, which is clearly seen in their reaction to business activity and other US indicators. The S&P 500 started the week on October 7 with the most impressive two-day rally since April 2020, but then slowed down. The leader of the crypto-currency sector responded in kind. Both assets eagerly awaited US labor market data for September. An increase in employment outside the agricultural sector of 250,000 or more expected by Bloomberg analysts will come back to haunt another wave of BTCUSD sales. On the contrary, weak statistics will allow the pair to grow.

Technically, the Expanding Wedge pattern continues to form on the BTCUSD daily chart. As long as quotes are above fair value by 19,000, buying on pullbacks are preferred.