GBP/USD analysis on October 7, 2022. BoE to raise rate even higher in November

Bears may push the pound down to 1.1150 and 1.1000

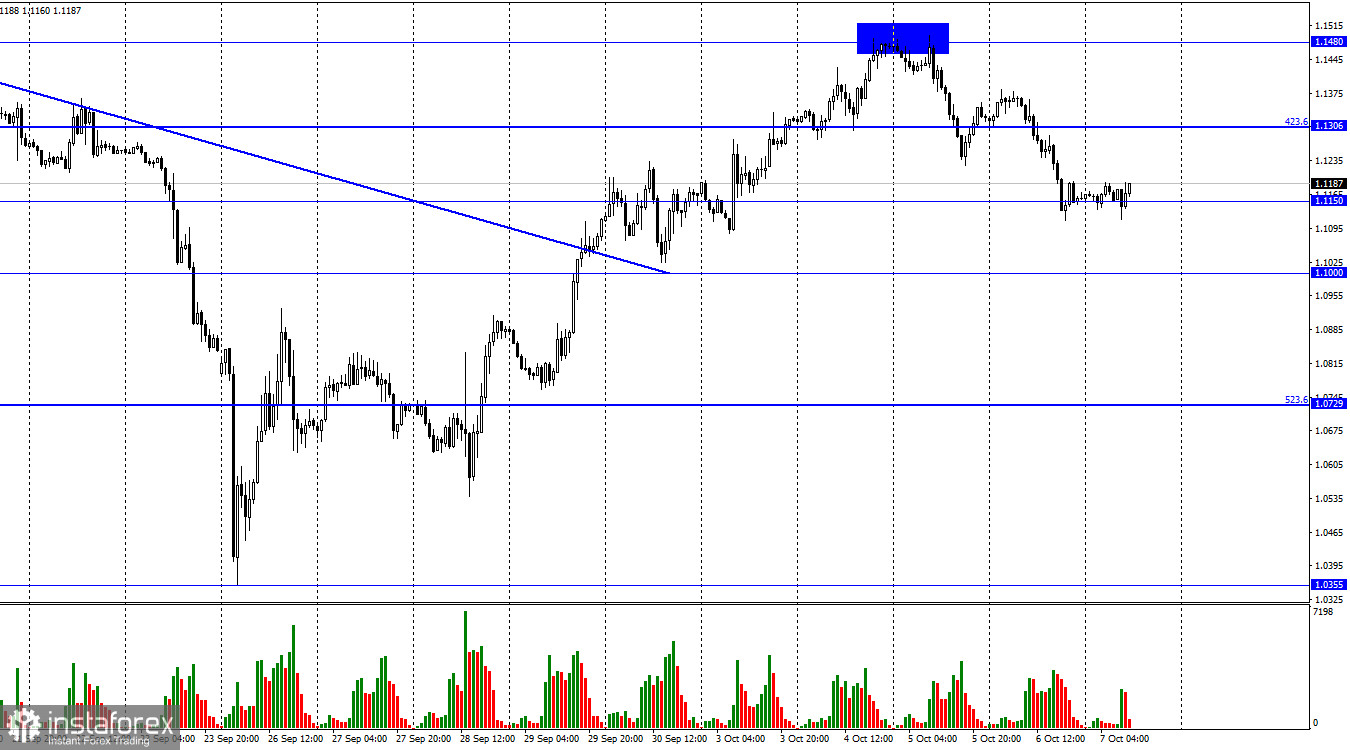

On the 1-hour chart, GBP/USD dropped to the level of 1.1150 that I mentioned yesterday as the first target. A rebound from this level will support the pound and help it develop growth towards the retracement level of 423.6% at 1.1306. A firm hold below 1.1150 may open the way to the lower target of 1.1000. However, both of these scenarios may fail today. With the start of the New York session, markets will focus on fresh data on US unemployment and the labor market. These reports are considered crucial for the US economy and its currency. So, the pair may fluctuate rapidly in the second half of the day which may result in a sharp reversal. So traders should be especially cautious on Friday. I have already outlined my expectation for the US macroeconomic data in the EUR/USD analysis.

Meanwhile, next month will be even more decisive for the pound. The market has been already shaken by the news about tax cuts in the UK and purchases of long-dated government bonds by the Bank of England. The further dynamic of the market will mostly depend on the next meeting of the regulator which is due in November. Last time, several members of the Committee voted to raise the rate by more than 0.50%. Therefore, we can suggest that the central bank may introduce a higher rate hike in November. Economists note that the regulator may have to lift the rate by 0.75% or even 1.00% to balance the effect of future tax cuts and bond purchases. The UK's budget deficit may hit £220 billion next year due to lower taxes and the cap on energy prices to support consumers. Some countermeasures are needed.

The pair reversed in favor of the US dollar on the 4-hour chart and dropped to the retracement level of 200.0% at 1.1111. A rebound from this level may initiate a rise towards 1.1496. Consolidation below 1.1111 will make a new fall to September lows more likely. Even though the price settled above the descending channel, I still see the market sentiment as bearish.

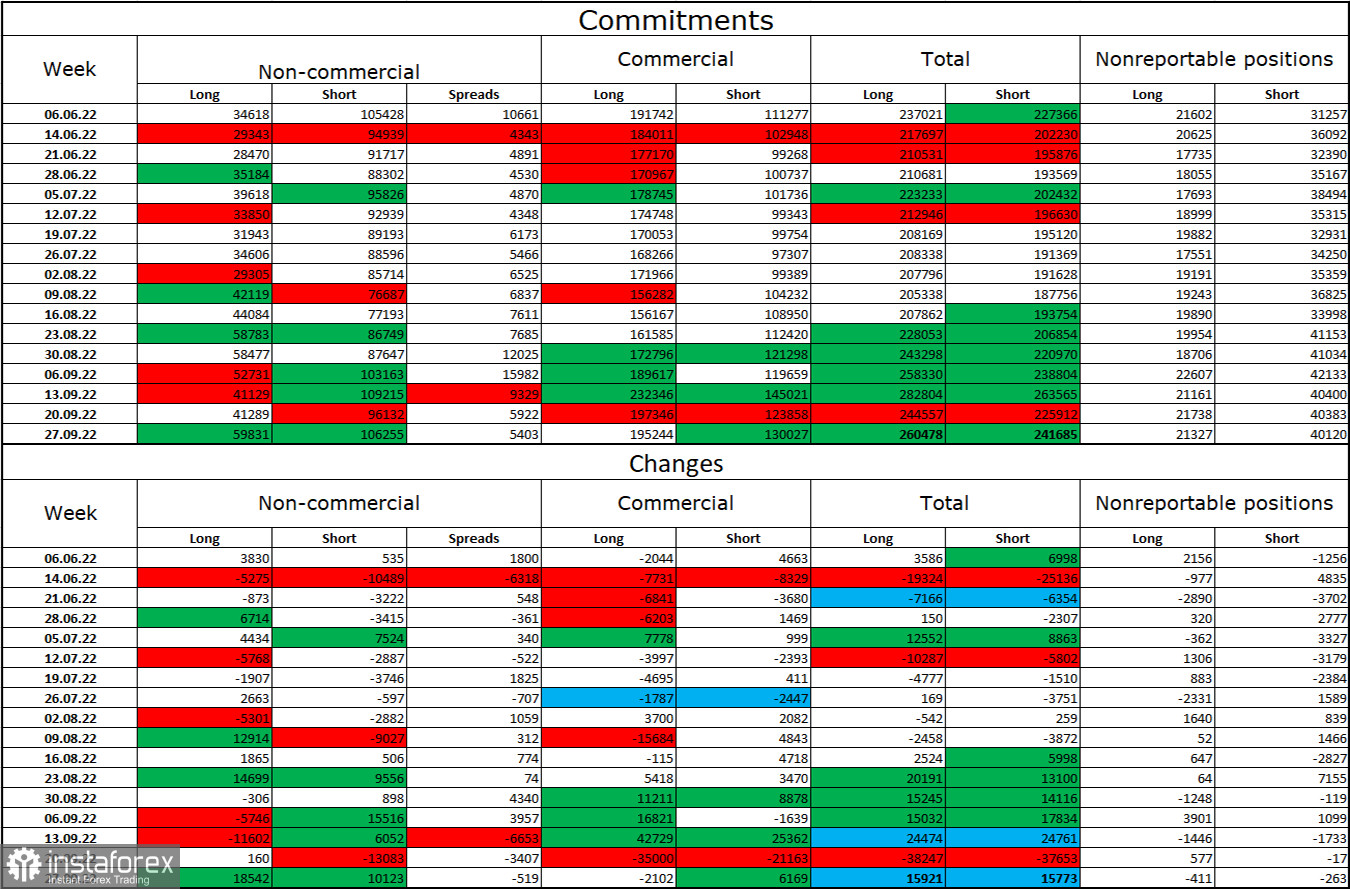

Commitments of Traders (COT) report:

Over the past week, the non-commercial group of traders became less bearish on the pair than a week earlier. Traders added 18,542 long contracts and 10,123 short contracts. However, the overall sentiment of large market players remains bearish as short positions still outweigh the long ones. Therefore, institutional traders still prefer to sell the pound even though their sentiment has been slowly changing towards bullish in recent months. However, this is a slow and lengthy process. The pound may continue its uptrend only if supported by strong fundamental data which has not been so favorable lately. The total amount of long contracts is a bit higher than that of the short ones which indicates a bullish market. At the same time, any negative news may quickly reverse the trend to the opposite.

Economic calendar for US and UK:

US - Average Hourly Earnings (12-30 UTC).

US - Nonfarm Payrolls (12-30 UTC).

US - Unemployment rate (12-30 UTC).

There is nothing to monitor in the UK's economic calendar on Friday. Meanwhile, the US will release several important reports. The impact of the information background on the market may be quite strong today, especially in the afternoon.

GBP/USD forecast and trading tips:

I would recommend selling the pair with the target at 1.1111 when the price rebounds from 1.1496 on the 4-hour chart. Buying the pound will be possible when the price rebounds from 1.1111 to the target of 1.1496.