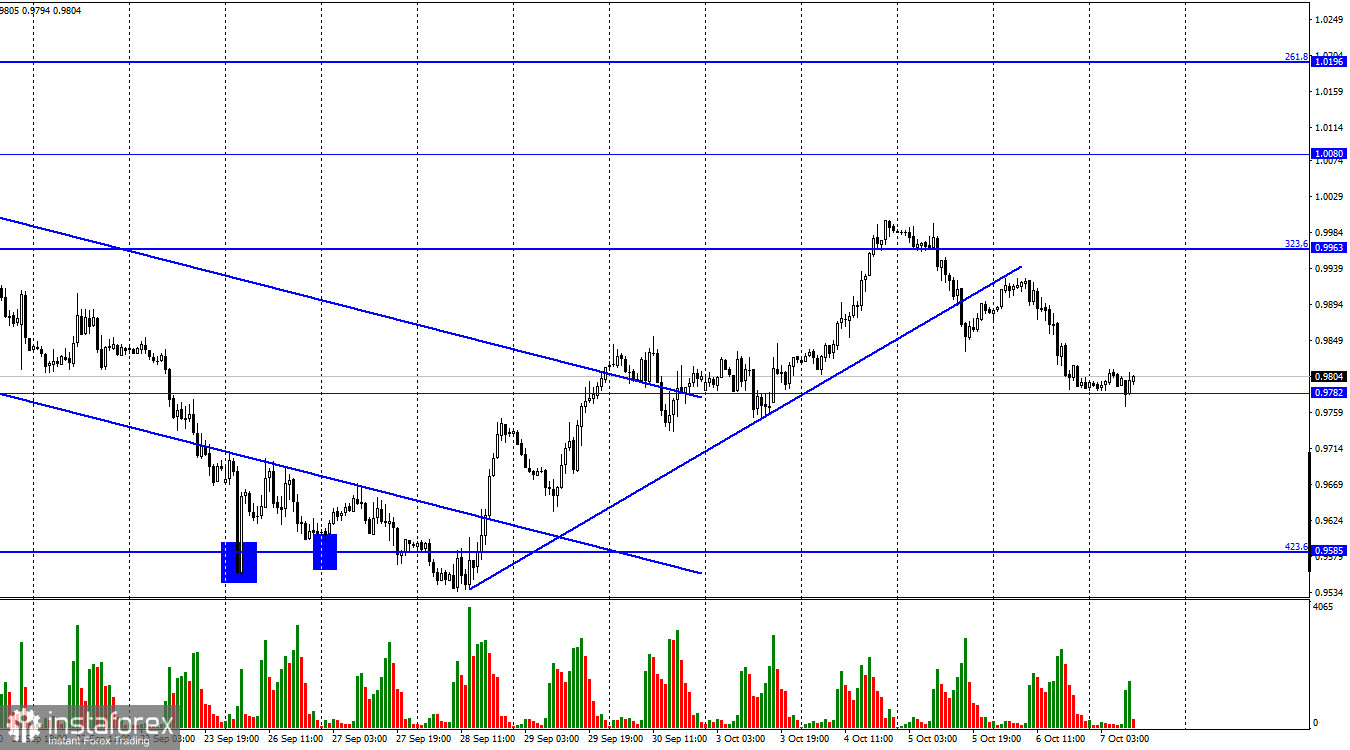

Hello, dear traders! Yesterday, EUR/USD reversed to the downside and fell to 0.9782. Although the quote failed to consolidate at the level, no bounce occurred. Right now, traders prefer to wait until important macro data in the US comes, which is due in the second half of the day. The euro was bearish in the past two days. After consolidation below the trendline, it is important that the price resumes growth on Friday. In such a case, the two-day fall could be seen as a bearish correction, while maintaining bullish sentiment. However, should the quote close below 0.9782 today and the euro go down again, the price would soon reach 0.9585, which stands slightly above the 20-year low. In my view, a close below 0.9782 would mean that the bears regained control over the market.

Speaking of NonFarm Payrolls, the reading is forecast to increase by 250-290K. Almost similar results came in the two previous months. In case the figures rise above 300K, buying pressure on the greenback will increase. Any reading below the mark would trigger a sell-off in the dollar. This is what the euro actually needs right now.

As for unemployment, the rate grew to 3.7% from 3.5% last month. If unemployment shows an increase for the second straight month, it could signal a slowdown in the labor market. Notably, the US Federal Reserve adjusts monetary policy based on the state of the labor market and unemployment data.

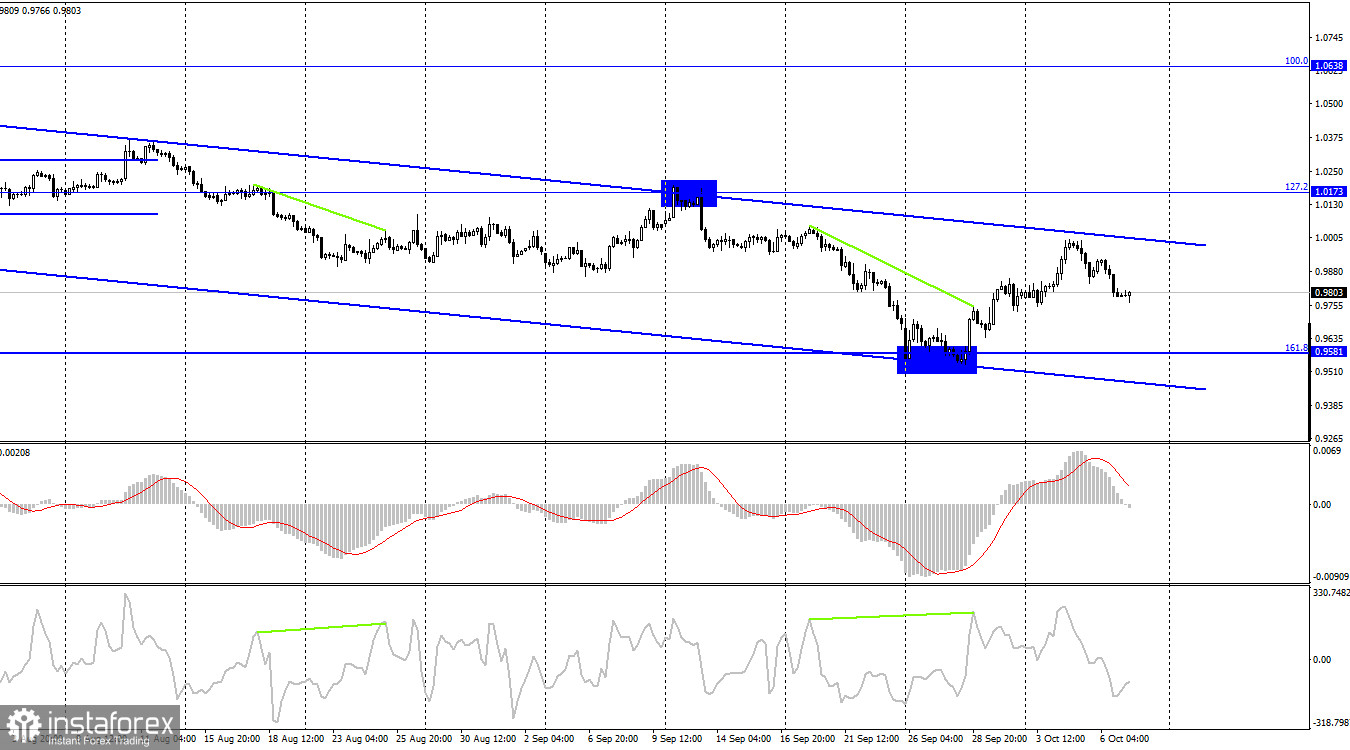

In the H4 chart, the pair reversed to the downside. It is now moving down to the 161.8% Fibonacci retracement of 0.9581 within a descending trend corridor. The chart illustrates bearish pressure. Consolidation above the descending corridor could lead to a rise in the euro.

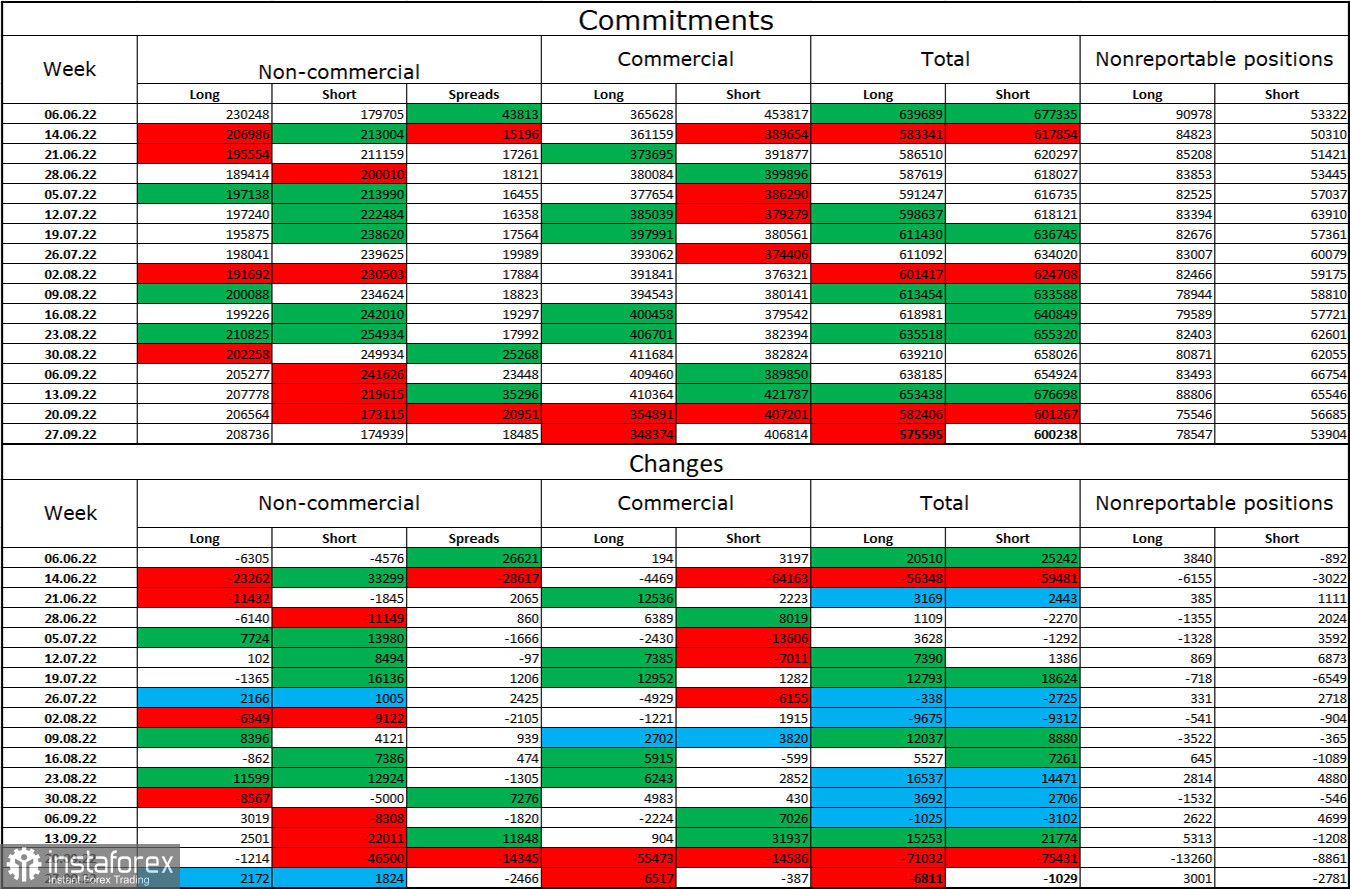

Commitments of Traders:

Last week, speculators opened 2,172 long positions and 1,824 short ones. Trader sentiment did not change in the reporting week. The total number of long positions is 208K, and that of short positions amounts to 174K. Thus, the sentiment of major players remains bullish. However, the euro is still struggling to show growth amid high demand for the greenback in the past few days. Therefore, I would focus on important descending corridors on the H4 and H1 charts. In addition, the geopolitical situation will continue weighing on trader sentiment.

Macro events in the US and the eurozone:

United States: Average Hourly Earnings (12-30 UTC); NonFarm Payrolls (12-30 UTC); Unemployment Rate (12-30 UTC)

On September 7th, the eurozone's macroeconomic calendar contains now interesting releases. Traders will have to wait for the second half of the day when labor data is published in the US. The fundamental background could have a strong influence on trader sentiment today.

Outlook for EUR/USD:

Consider selling the pair when the price bounces off the upper limit of the corridor at the H4 chart with the target at 0.9581 or after consolidation below the trendline on the H1 chart. New sell trades could be opened when the quote closes below 0.9782 with the target at 0.9585. The euro could be sold when the price settles above the upper limit of the corridor on the H4 chart with the target at 1.0638.