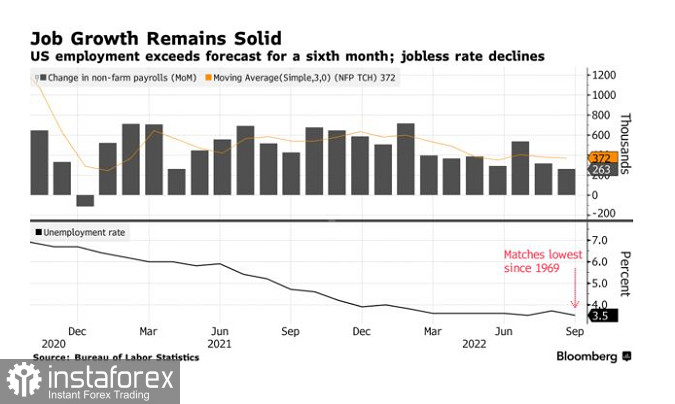

The U.S. labor market remained strong in September as the unemployment rate unexpectedly returned to an all-time low, allowing the Federal Reserve to continue its course for another aggressive rate hike.

The number of non-farm payrolls increased by 263,000 in September after rising by 315,000 in August, a Labor Department report showed on Friday. The unemployment rate fell to 3.5%, which is a fifty-year low. The average hourly wage has risen steadily.

Excluding government employment, employment rose by 288,000 in September, slightly more than the previous month. The overall wage figure would be higher were it not for the decline in education employment, reflecting how the government is adjusting to hiring high school graduates. On an unadjusted basis, the number of local education workers grew by over 700,000.

The numbers are the latest illustration of the decades-long strength of the US labor market. While there have been some signs of a slowdown in demand for labor - most notably the recent decline in vacancy rates and rising layoffs in some sectors - employers, many of which are still understaffed, continue to hire at a steady pace. This force not only supports consumer spending, but also drives up wages as businesses compete for a limited pool of workers.

The dollar index continued to rise after the release of data on unemployment in the US:

In the meantime, the Fed is hoping to see significant easing in labor market conditions to slow wage growth and ultimately inflation. Although employment growth was the smallest since April 2021, politicians are watching to see if their rate hikes will push up the unemployment rate.

This is the last jobs report Fed officials will get their hands on ahead of their November policy meeting as they consider a fourth straight 75 basis point rate hike. Fresh data on inflation, which will be released next week, will also play a fundamental role in decision-making. The report is forecast to reveal the depth and scope of the Fed's inflation problem, with a key consumer price indicator likely to worsen.

The report is welcome news for President Joe Biden, who has highlighted the strength of the labor market ahead of next month's midterm elections. High inflation hurt his approval rating and the Democrats' chances of maintaining a narrow majority in Congress.