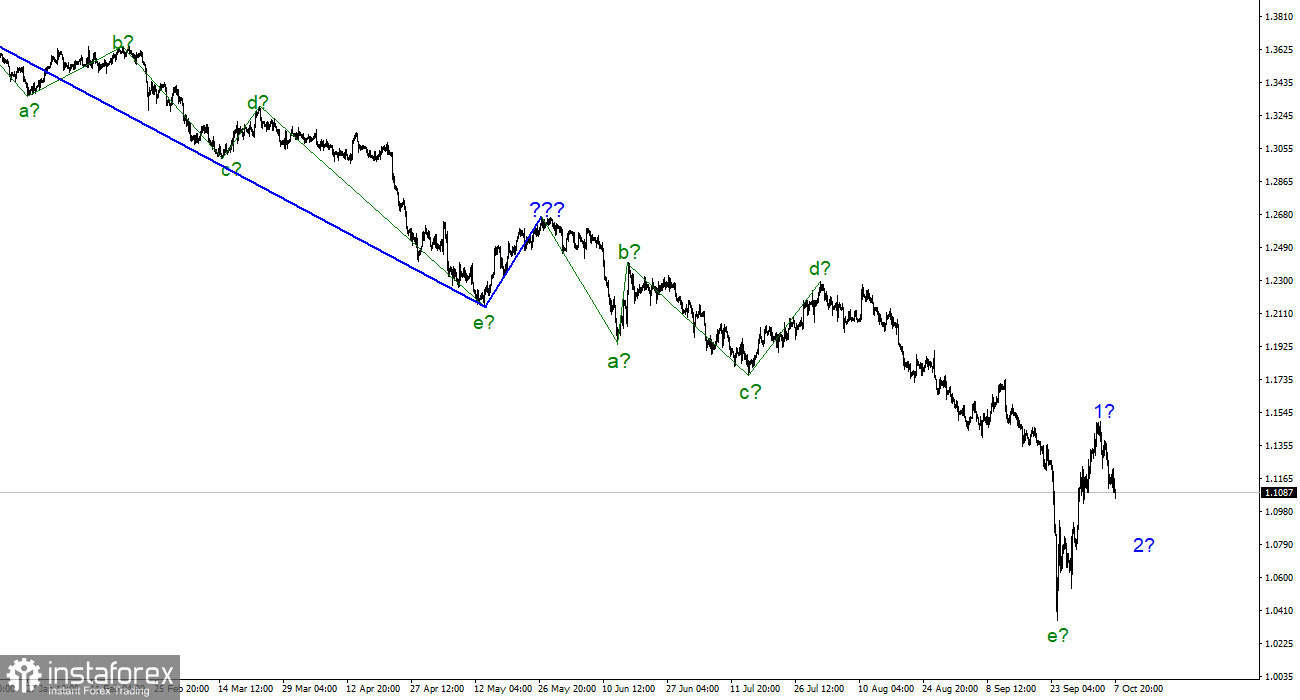

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but still does not require any clarification. We have a supposedly completed downward trend segment consisting of five waves a-b-c-d-e. If this is indeed the case, then the construction of a new upward trend section has begun. The first wave is supposedly completed, and the construction of wave 2 has begun. Unfortunately, there is no confidence in this particular scenario since the instrument must go beyond the peak of the last wave to show us its readiness to build an upward section of the trend and not complicate the downward one once again. The peak of the nearest wave is located at about 23 figures. Thus, even after the pound has increased by 1000 points, you need to go up another 1000 points to reach this peak. This is a very significant distance. I also want to note that the wave markings of the euro and the pound are now radically different. I understand that many people have seen strong British growth in a short time, so they are "itching" to make purchases. However, let me remind you that even if the upward section has started building now, we should see another downward correction wave (after completing 1). If the quotes do not fall below the low wave e (which is very difficult, but not impossible), then you can also expect to build a new upward wave 3 and buy.

US statistics helped the dollar.

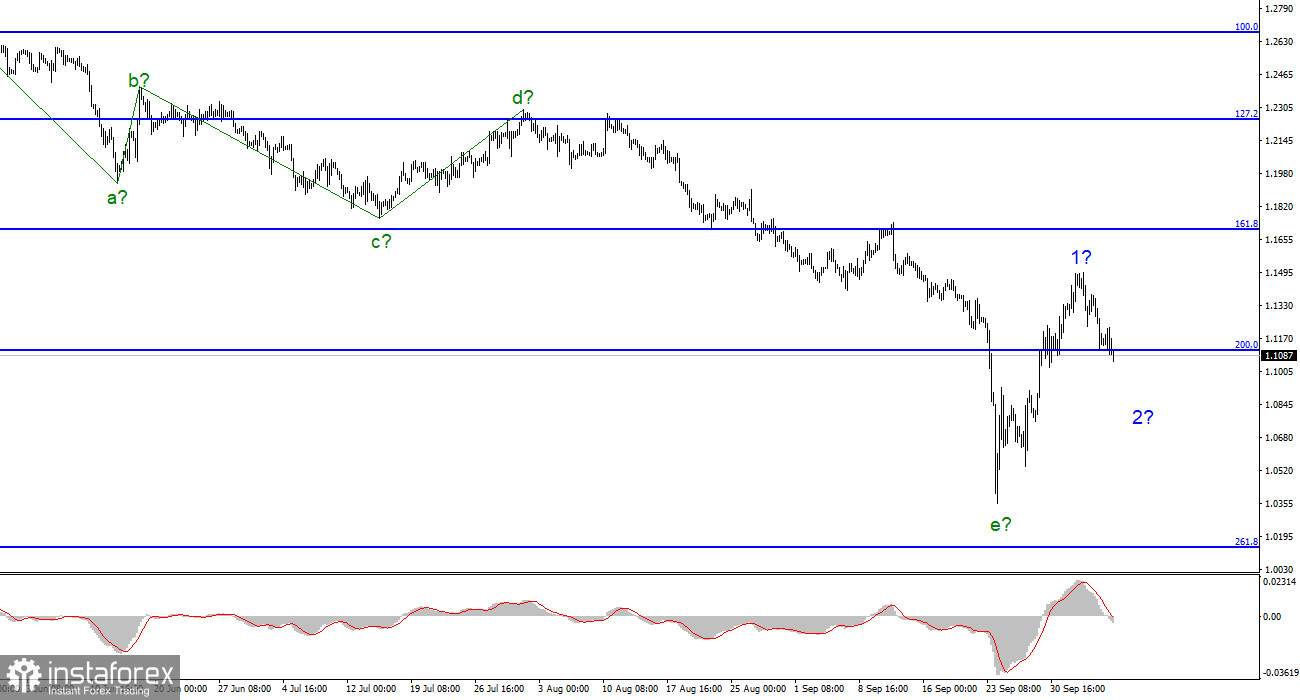

The exchange rate of the pound/dollar instrument decreased by 80 basis points on October 7. The instrument's amplitude decreased on Friday, although the news background was strong. As I have already said, I can call the data on the labor market and unemployment in the United States positive for the dollar, so the growth in demand for it on Friday is logical. In the coming weeks, the most important things will be new inflation reports in the European Union, the UK, and the USA. Then it will be time for new meetings of central banks, which can significantly raise their interest rates.

The greatest expectations are now associated with the Bank of England. Let me remind you that it was decided to reduce the number of tax rates in the UK, which will create serious budget problems. The Bank of England also decided to buy bonds by October 14, although it had previously stated that it would sell bonds from its balance sheet for 80 billion pounds. Many analysts have already stated that, in light of such events, they expect tougher measures from the British regulator in November than at the previous seven meetings. The probability of a rate increase by 75-100 basis points is higher than ever. However, the Fed will also raise the rate by 75 basis points for the fourth time. It is very good for the British now if the Bank of England continues to tighten monetary policy and increases the pace. This increases the likelihood of its further growth. But let me remind you that the wave markings for the euro currency are different; most likely, one of them will have to be adjusted.

General conclusions.

The wave pattern of the pound/dollar instrument suggests a new decline in demand for the pound. I advise now selling the instrument, as before, on the MACD reversals "down." It is necessary to sell more cautiously since the construction of a downward trend section could be completed. In any case, there should be a decrease since a corrective wave 2 is needed. This wave can also be impulsive, and the entire descending wave structure is transformed in this case.

The picture is very similar to the euro/dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same five waves down after it. The downward section of the trend can turn out to be almost any length, but it may already be completed.