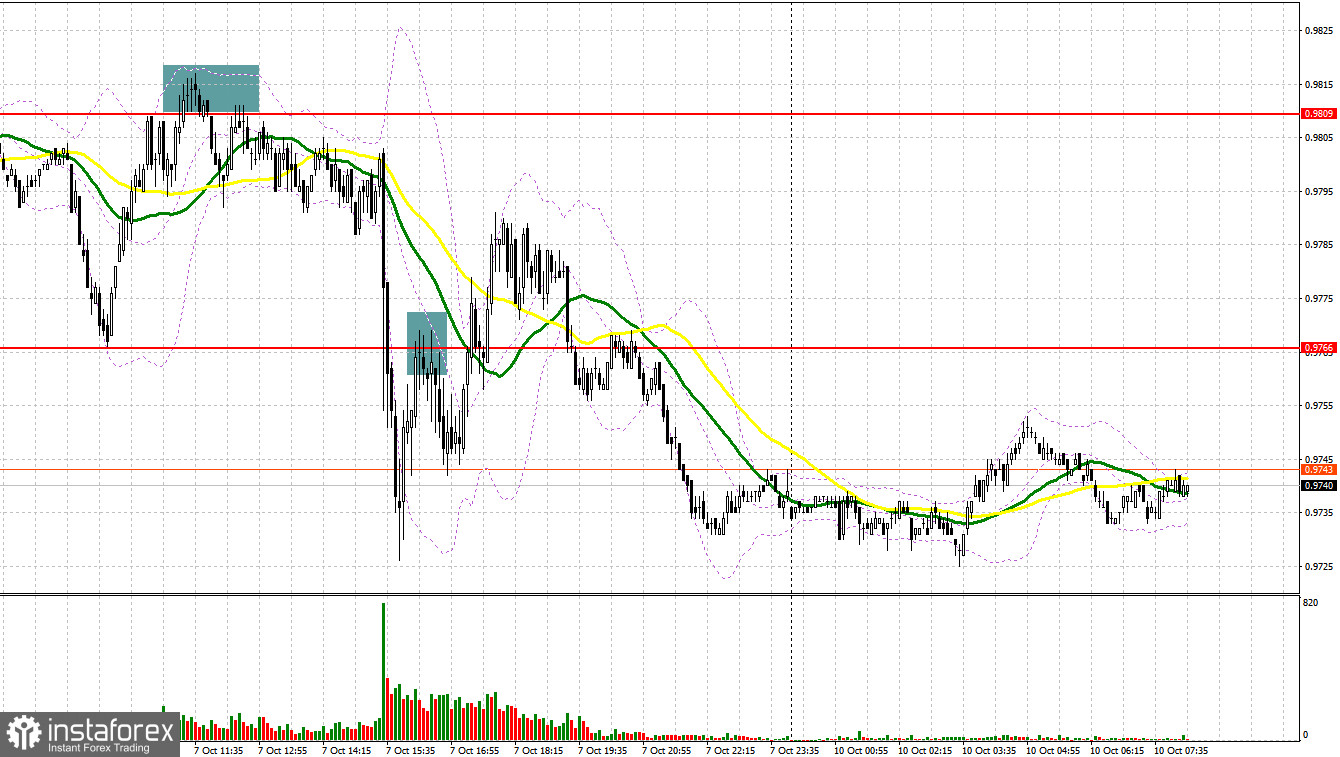

On Friday, traders received several signals to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. Earlier, I asked you to focus on the level of 0.9809 to decide when to enter the market. The pair dropped to 0.9761 and failed to upwardly test it. That is why traders fail to go long from this level. When the pair tried to go above 0.9809, traders received a short signal. As a result, the price dropped by 40 pips. Strong data on the US labor market led to a breakout and an upward test of 0.9766. As a result, traders received a sell signal, which led to a decline of 20 pips. After that pressure on the euro became lower.

Conditions for opening long positions on EUR/USD:

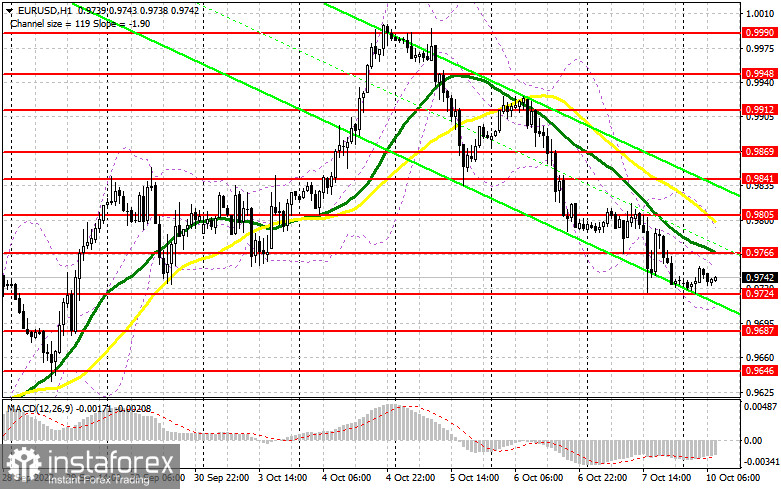

A sharp drop in the US unemployment rate to a new low of 3.5% has surprised most economists, especially amid the rapid rise in the key interest rate. Since the number of new jobs is increasing amid the regulator's attempt to cap inflation, the Federal Reserve may raise the benchmark rate by another 75 basis points. This fact should support the US dollar as traders priced in such a rise even before the publication of the labor market figures. If the pair continues falling, a false breakout of 0.9724 will give a long signal with the target at 0.9766. Bulls will have a chance to regain control over the market after a breakout of 0.9766 and a downward test of this level. This will affect stop orders of bears' who expect the euro to fall deeper amid Friday's data. This may form a new buy signal with the target at 0.9805. Even if the price consolidates above this level, the market situation will hardly change. If the price settles above 0.9805 and hits the resistance level of 0.9841, the bearish trend will be under threat. The next target is located at the resistance level of 0.9869, where it is recommended to lock in profits. If the euro/dollar pair drops and buyers fail to protect 0.9724, pressure on the euro will increase. In this case, the price may drop to 0.9687. It will be better to go long after a false breakout. Traders may also open buy orders just after a rebound from 0.9646 or even lower – from 0.9596, expecting an upward correction of 30-35 pips.

Conditions for opening short positions on EUR/USD:

Bears became very active after Friday's data. Now, only protection of the support level of 0.9724 will give hope for a rise. Meanwhile, bears should prevent the pair from rising above the resistance level of 0.9766. Today, the macroeconomic calendar is empty and only Buba Wuermeling and ECB's Lane will provide speeches. That is why the pair is likely to go on falling. It will be wise to go short after a false breakout of 0.9766. In this case, the pair will decline to 0.9724. Only a false breakout and upward test of this level will give a sell signal with the target at 0.9687. The farthest target will be located at 0.9646, where it is recommended to lock in profits. If the euro/dollar pair increases during the European sessions and bears fail to protect 0.9766, demand for the pair will increase, thus causing a stronger rise. In this case, it will be better to avoid sell orders. Traders may go short after a false breakout of 0.9805. It is also possible to sell the asset just after a rebound from the high of 0.9841 or higher- from 0.9869, expecting a drop of 30-34 pips.

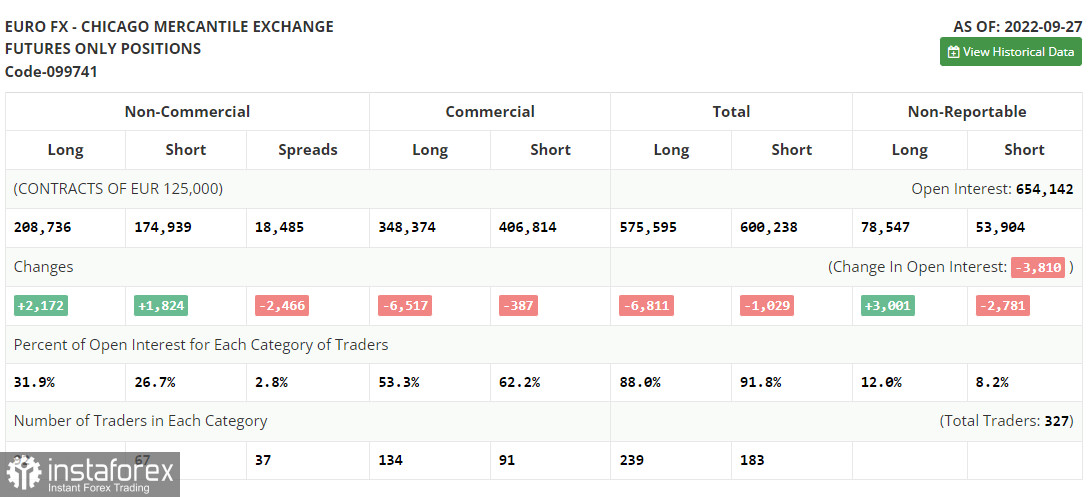

COT report

According to the COT report from September 27, the number of both short and long positions increased. After the central banks' meetings, the euro was under considerable pressure caused by comments provided by European and US politicians. However, the currency managed to cope with it and now it has every chance to recover, though for a short period of time. The fact is that inflation in the EU has already exceeded 10.0%. In autumn and winter, the situation will only aggravate. That is why the euro will hardly show considerable growth. The worsening geopolitical situation in the world, which is mainly affecting the eurozone, may cause a considerable slowdown in the local economy, which is likely to slip into recession as early as next spring. Soon, the eurozone will disclose reports on activity in various sectors. A decline may cap the pair's upward potential. The COT report unveiled that the number of long non-commercial positions increased by 2,172 to 208,736, whereas the number of short non-commercial positions surged by 1,824 to 174,939. At the end of the week, the total non-commercial net position remained positive and amounted to 33,797 against 33,449. This indicates that investors are taking advantage of the moment and continue to buy the cheap euro below parity, as well as accumulate long positions, expecting the end of the crisis and the pair's recovery in the long term. The weekly closing price collapsed to 0.9657 from 1.0035.

Signals of indicators:

Moving Averages

Trading is performed below the 30- and 50-day moving averages, which points to bearish sentiment.

Note: The period and prices of moving averages are considered by the author on the one-hour chart, which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair advances, the upper limit of the indicator located at 0.9805 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.