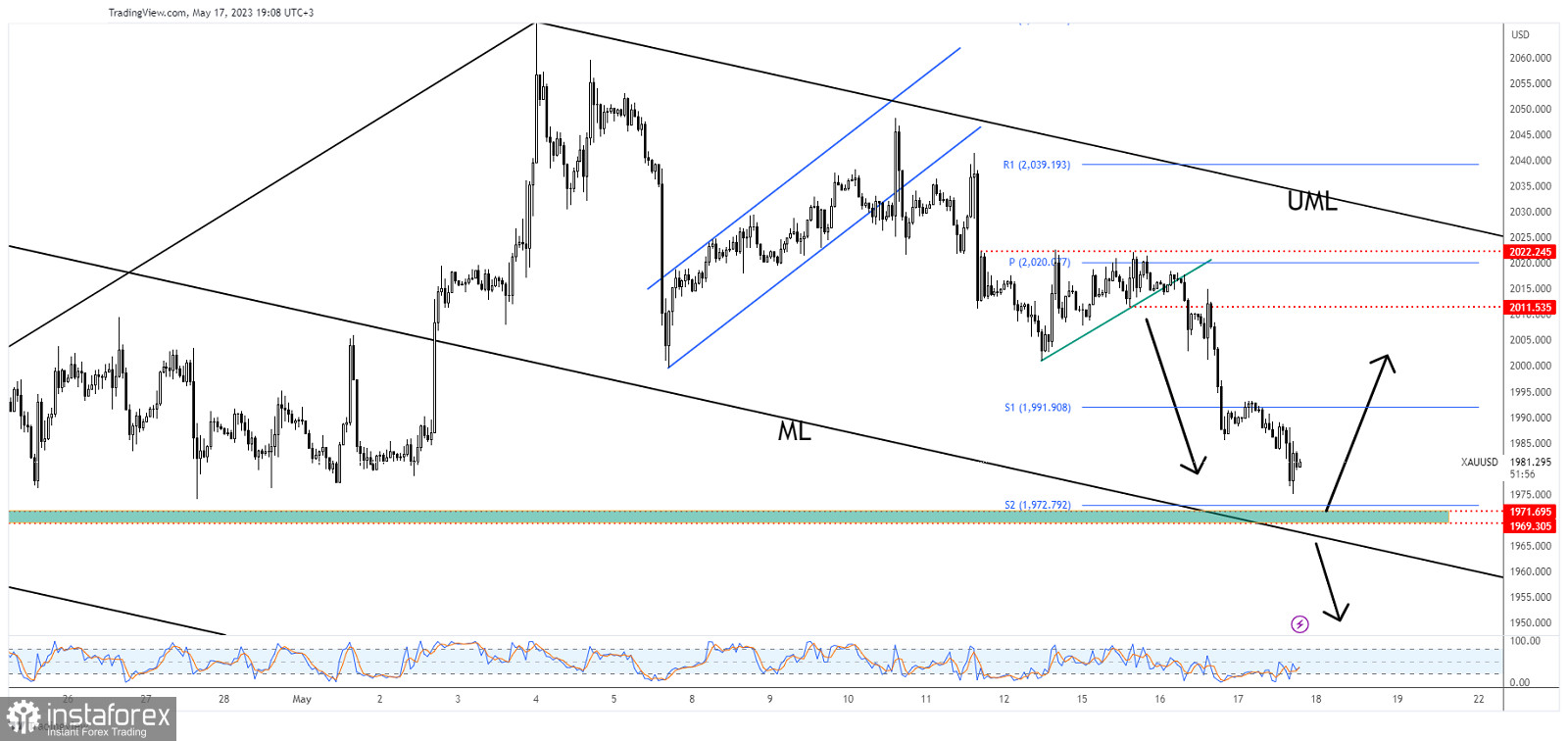

The price of Gold crashed in the short term but now is almost to hit a major support zone. It remains to see how it reacts after such an impressive drop. It's trading at 1,980 and remains very heavy in the short term as the USD is strongly bullish.

Fundamentally, XAU/USD extended its sell-off after the Canadian CPI reported higher inflation and after the US retail sales figures came in better compared to the previous reporting period. Today, the US Building Permits and Housing Starts came in worse than expected, that's why the yellow metal could try to rebound.

XAU/USD Strong Support!

As you can see on the H1 chart, XAU/USD extended its downward movement after validating the breakdown below 2,011. It has ignored the weekly S1 of 1,991 and now it was almost to the weekly S2 (1,972).

Technically, 1,969 and 1,971 represent downside obstacles as well. Personally, I would like the rate to test and retest the support levels before trying to turn to the upside.

XAU/USD Outlook!

The downside pressure remains high, so temporary rebounds could bring new selling opportunities. Testing and retesting 1,971 and 1,969, registering only false breakdowns may announce a new leg higher. This is seen as a new bullish signal.

On the other hand, a valid breakdown below the median line (ML) activates more declines and brings a new selling opportunity.