The Bank of England said it managed to avert a financial crisis with £65bn of temporary QE. Based on its calculations, pension funds would need to sell bonds worth £50 billion to obtain the liquidity necessary to maintain positions, which would look very problematic at the current trading volumes of £12 billion per day. Investors and the pound have calmed down for a while, but who knows if GBPUSD is waiting for new shocks?

The main problem of Britain is the colossal negative balance of the current account. Because of the energy crisis, it has become even more inflated. It is necessary to patch up the holes by attracting capital from foreign investors, reducing domestic savings, or a fall in the sterling exchange rate. The fiscal stimulus package from Liz Truss suggests that in 2023–2024 Britain will have to sell bonds worth £226 billion on a net basis. If we add to this figure the scale of the BoE's QT, we get £390 billion, which is three times more than the previous record of £130 billion in 2010–2011.

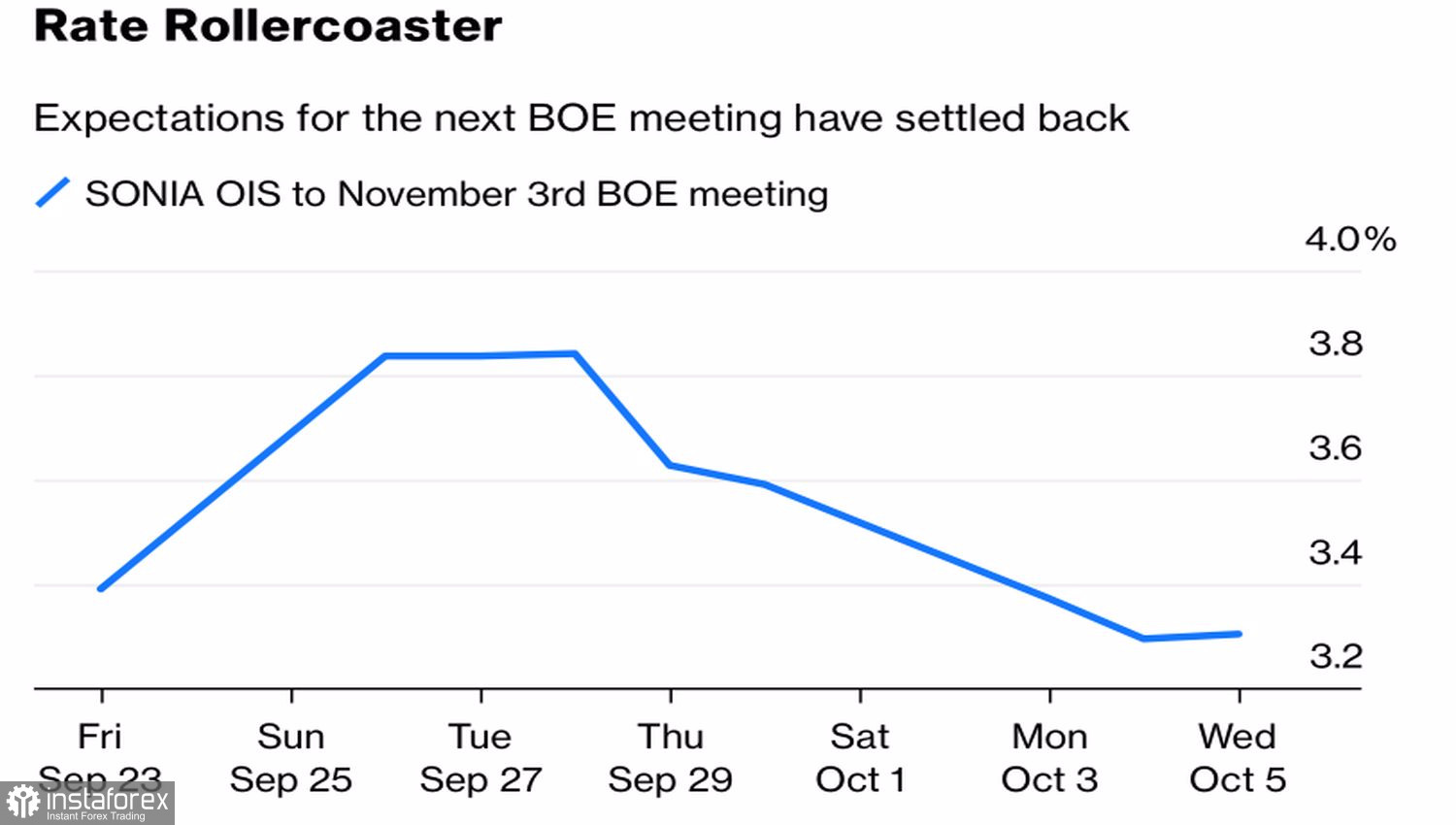

The question is, who will take all this? How to attract foreign investors? High yield? To do this, the Bank of England should significantly accelerate the process of tightening monetary policy. The futures market expects it to raise the repo rate by as much as 100 bps from 2.25% to 3.25% in November. And this is not the biggest figure. Amid the financial markets' shock, after the announcement of the terms of the tax cut program, there were significantly more.

Dynamics of expected changes in the REPO rate

One of the MPC's top hawks, BoE deputy governor Dave Ramsden, who voted in a previous meeting for a bigger rate hike than actually happened, argues that the government's mini-budget has a huge impact on the economy. But the Bank of England must stay on course to fight inflation. At the next meeting, a lot will depend on how strong the "hawks" turn out to be.

In my opinion, if in late September and early October BoE became the one who extinguished the panic in the country's financial markets, then in November it may become its initiator. Borrowing costs should not rise too high, but they should not be too low, so as not to excite investors.

Despite the stabilization of the pound, you need to understand how strong its opponent is in the face of the US dollar. Positive statistics on employment outside the agricultural sector and the fall in unemployment to 3.5% hint that the work of the Fed is far from done. The federal funds rate is likely to rise to 4.5–4.75% in 2023. In addition, aggressive monetary restrictions, a slowdown in the economy and the worst forecast for corporate profits for the quarter since 2020 contribute to lower stock indices and increase demand for safe-haven assets.

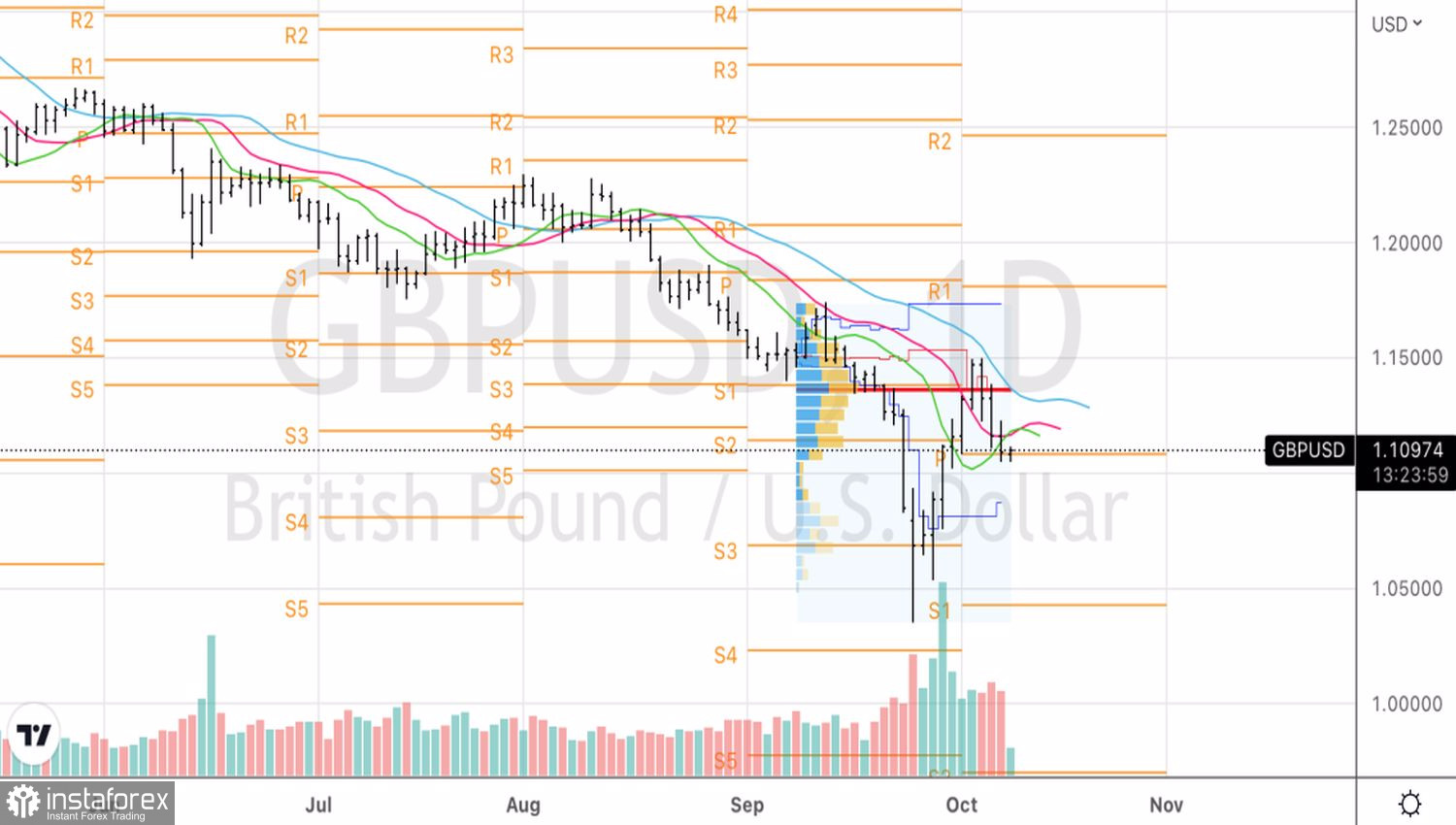

Technically, on the GBPUSD daily chart, the fall of the pair below the moving averages increases the risks of a downward trend recovery. As long as the pound is trading below the 1.1085 pivot point, the recommendation is to sell.