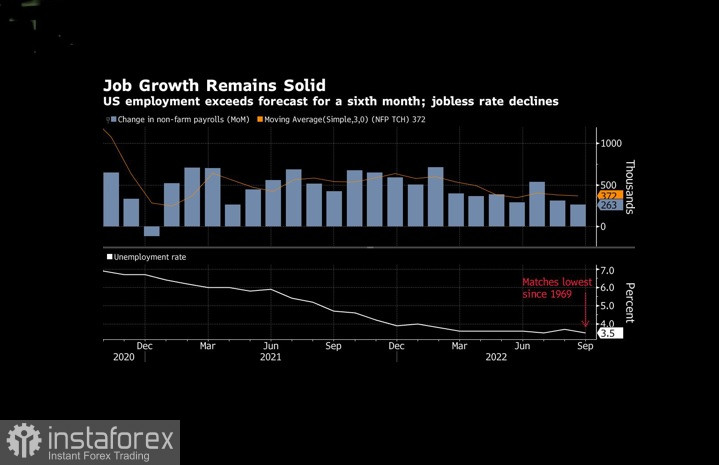

Friday's September jobs report showed a decline in monthly growth, with 263,000 new jobs added last month, down from the previous month's 315,000.

The profound impact it had on nearly every asset class in the financial markets was not due to low numbers, but rather to the Federal Reserve's hope that those numbers would be even lower. The Fed was hoping Friday's report would show slower growth because that would be the reason for the Fed's progress in bringing inflation down.

Inflation is still holding at 40-year highs, even after the Federal Reserve has raised interest rates at every FOMC meeting since March. The Fed raised rates by 25 basis points in March, by 50 basis points in May, and by 75 basis points in June, July, and September. It also raised the benchmark fund rate from 0–25 basis points in February to 300–325 basis points in September.

While Friday's report points to a slowdown in job growth, it is believed that this reduction is not enough for the Federal Reserve to slow the current pace of interest rate hikes.

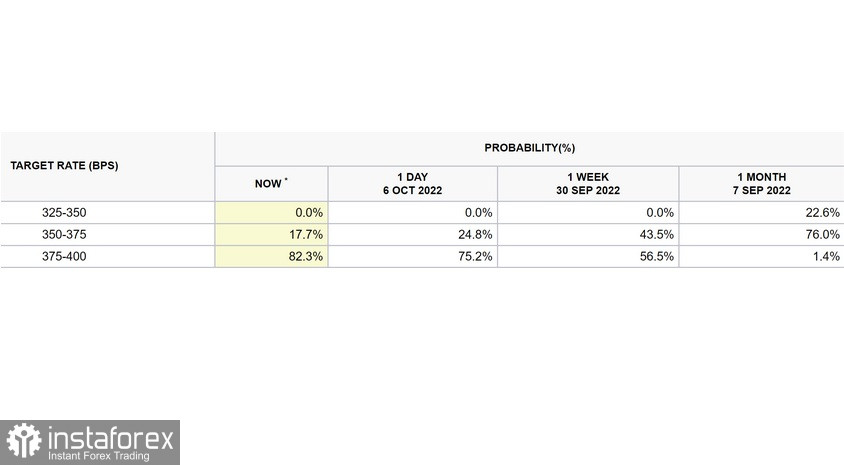

According to the CME FedWatch tool, the week before last there was a 56.5% chance of an interest rate hike, on Thursday there was a 75.2% chance, which increased to an 82.3% chance on Friday that the Federal Reserve would raise rates by 75 basis points in for the fourth time in a row in November. This probability indicator predicts the likelihood of a FOMC rate change using 30-day Fed Funds futures price data.

Friday's report had a profound effect on US equities. The Dow fell 2.22%:

The NASDAQ is down about 415 points:

And the S&P was down 106.16 points, or 2.90%:

Friday's report also had a strong impact on gold prices:

So what does this mean for the future of gold pricing?

While this report is extremely important in the dataset that the Federal Reserve will use at its November 2 FOMC meeting, the CPI inflation report for September this week will be far more important. But in terms of the Fed's long-term impact on gold prices, it's highly likely that if the Fed continues to raise rates and inflation remains robust, at some point market participants will have to focus on high inflation rather than focusing on growth. rates. If this assumption is correct, the price of gold could rise significantly. But it is also likely that there will be more pain ahead.