The short-term rally in gold could have run its course. Sentiment on Wall Street turned bearish on the back of US labor market data, which reinforced market expectations that the Federal Reserve will continue to aggressively raise interest rates through the end of the year and into 2023.

While Wall Street has moved to the bearish side, the weekly gold survey shows that retail investors remain optimistic about the precious metal, and sentiment has improved compared to the week before last.

As long as retail demand for gold remains robust, many analysts say the precious metal continues to face headwinds from the US dollar, which ended last week near a 20-year high.

There is an 81% chance that the Federal Reserve will raise interest rates by 75 basis points next month. Expectations for a rate hike bolstered after the US Bureau of Labor Statistics reported that 263,000 jobs were created in September. Economists had expected to see an increase in jobs by about 250,000.

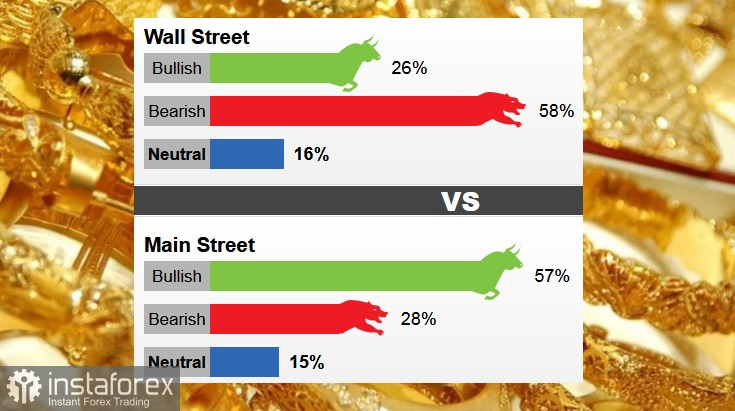

A total of 19 market professionals took part in a Wall Street survey last week. Eleven analysts, or 58%, said they are bearish on gold this week. Five analysts, or 26%, said they were optimistic, while three analysts, or 16%, said they were neutral on the precious metal in the near term.

As for retail, 790 respondents took part in online surveys. A total of 451 votes, or 57%, called for gold to rise. Another 222, or 28%, predicted a fall in gold prices. The remaining 117 voters, or 15%, were in favor of a side market.

Although there is significant bearish sentiment in the market, some analysts see further potential for gold in the near term.

Some analysts say that the direction of gold's movement will depend on the consumer price index. If the report shows a significant decline in inflation, then this could prompt markets to reduce their expectations for another extremely hawkish Fed rate hike next month, which will positively affect gold