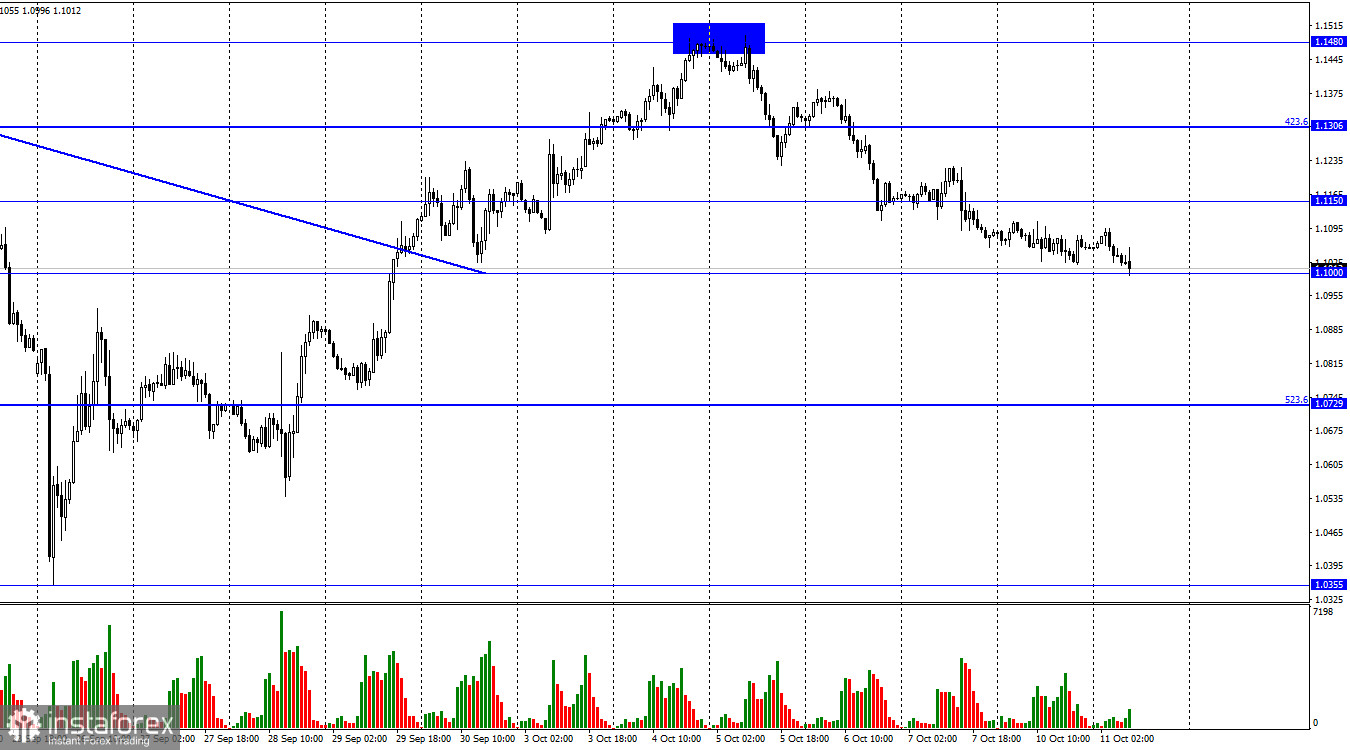

GBP/USD dropped to the psychological level of 1.1000 on the H1 chart. A close below this mark will validate a further decline towards the retracement level of 523.6% at 1.0729. The pair may recover slightly after a rebound.

Meanwhile, the Bank of England announced emergency purchases of long-dated government bonds starting from September 28. The purpose of this measure is to reduce the size of the UK's public debt which has exceeded 4% for the first time in many years. Auctions will take place until October 14, and the volume of assets offered for purchase will be doubled. Initially, the central bank was planning to hold daily auctions to buy up to £5 billion of government bonds. To date, the Bank of England has carried out 8 daily auctions, offering to buy up to £40 billion in bonds. But in fact, only £5 billion of bond purchases were made. Therefore, we can say that the initiative has failed. In the remaining time, the regulator plans to catch up with its plan and increase the maximum size of bond purchases.

The start of the bond purchasing program indicates that the market has lost faith in UK government bonds. The rising yield means that the demand for this type of asset is extremely low now. Besides, high yield means more pressure on debt servicing in the future. The UK's budget deficit will increase in the coming years due to tax cuts and limited selling prices for energy companies. So, an additional burden won't do it any good. Earlier, the Bank of England approved the plan to sell £80 billion of government bonds. So, the regulator is buying up the bonds which it is planning to sell later. The fact that the central bank is purchasing bonds now may accelerate inflation as this is a stimulating, rather than limiting, measure for the economy.

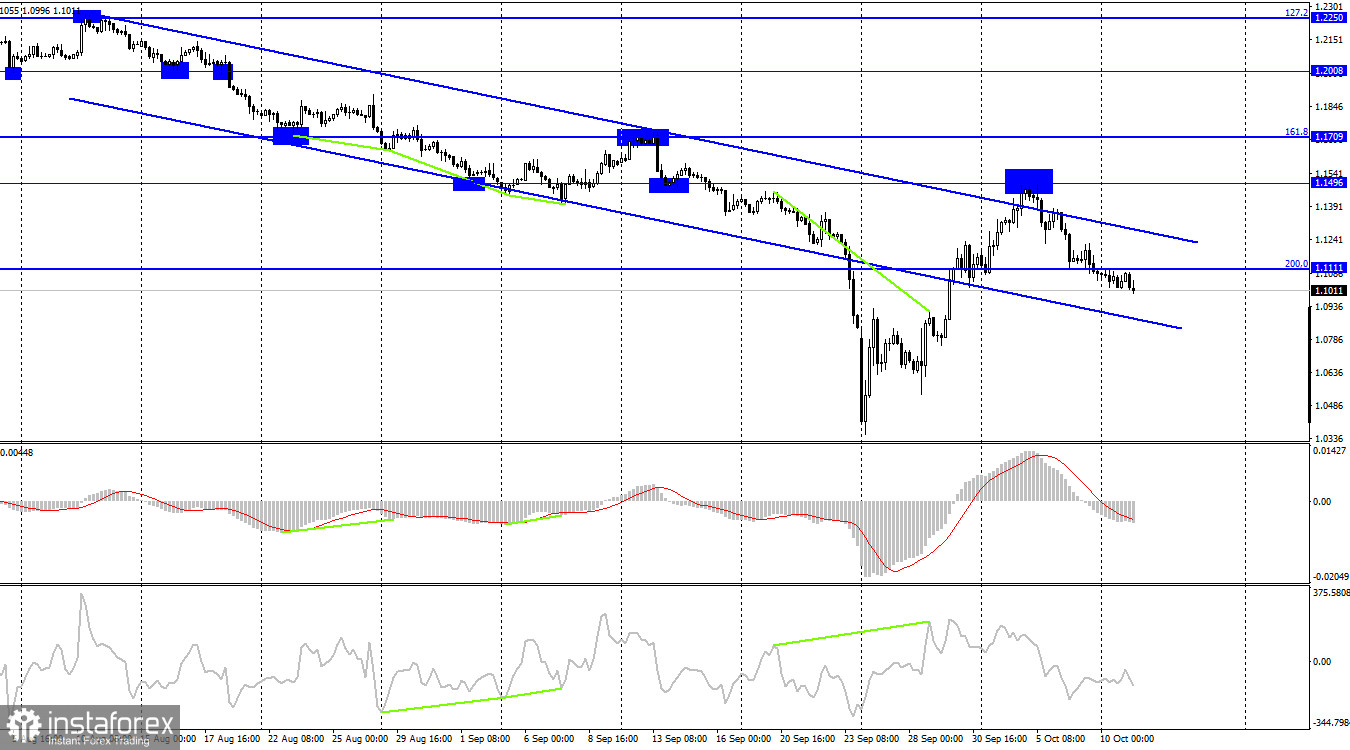

The pair reversed in favor of the US dollar on the 4-hour chart and settled below the Fibonacci retracement level of 200.0% at 1.1111. So, the price may continue to decline toward the low of 2022. Even though the pair has closed above the descending channel, the market sentiment is still bearish. A rebound from the level of 1.1496 allowed sellers to return to the market.

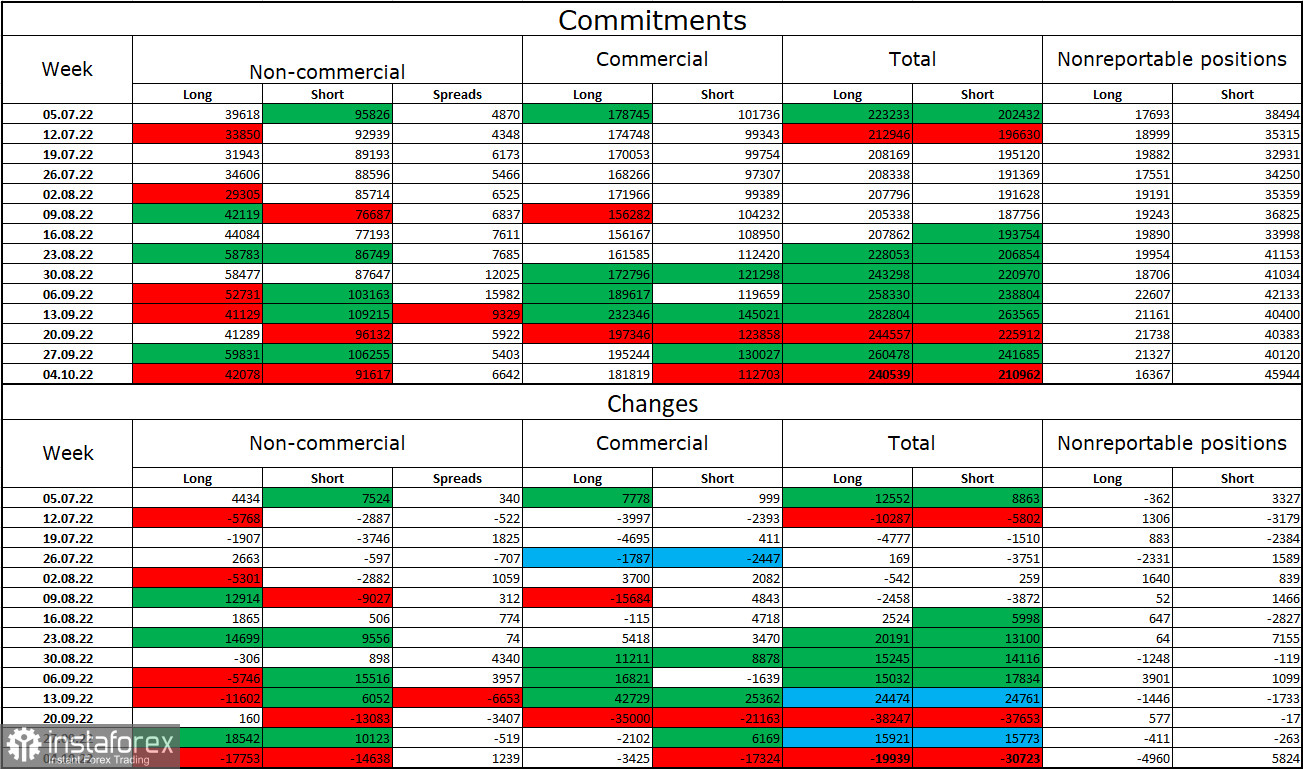

Commitments of Traders (COT) report:

Over the past week, the non-commercial group of traders became more bearish on the pair than the week earlier. Traders closed 17,753 long contracts and 14,638 short contracts. However, the overall sentiment of large market players remains bearish as short positions still outweigh the long ones. Therefore, institutional traders still prefer to sell the pound even though their sentiment has been slowly changing towards bullish in recent months. However, this is a slow and lengthy process. The pound may continue its uptrend only if supported by strong fundamental data which has not been so favorable lately. I would like to point out that although the sentiment of the euro trades has become bullish, the euro is still depreciating against the dollar. As for the pound, even COT reports do not favor buying the pair.

Economic calendar for US and UK:

UK – Unemployment rate (06-00 UTC).

UK – Average Earnings Change (06-00 UTC).

On Tuesday, all important reports in the UK have already been published. Yet, they haven't affected the market in any way. Meanwhile, the US economic calendar is empty today. Therefore, the information background will have no impact on the market sentiment today.

GBP/USD forecast and trading tips:

I would recommend selling the pair with the targets at 1.1111 and 1.1000 that have already been tested. New short positions can be opened when the price closes below 1.1000 with the target at 1.0729. Buying the pair will be possible when the quote settles above the descending channel on the 4-hour chart.