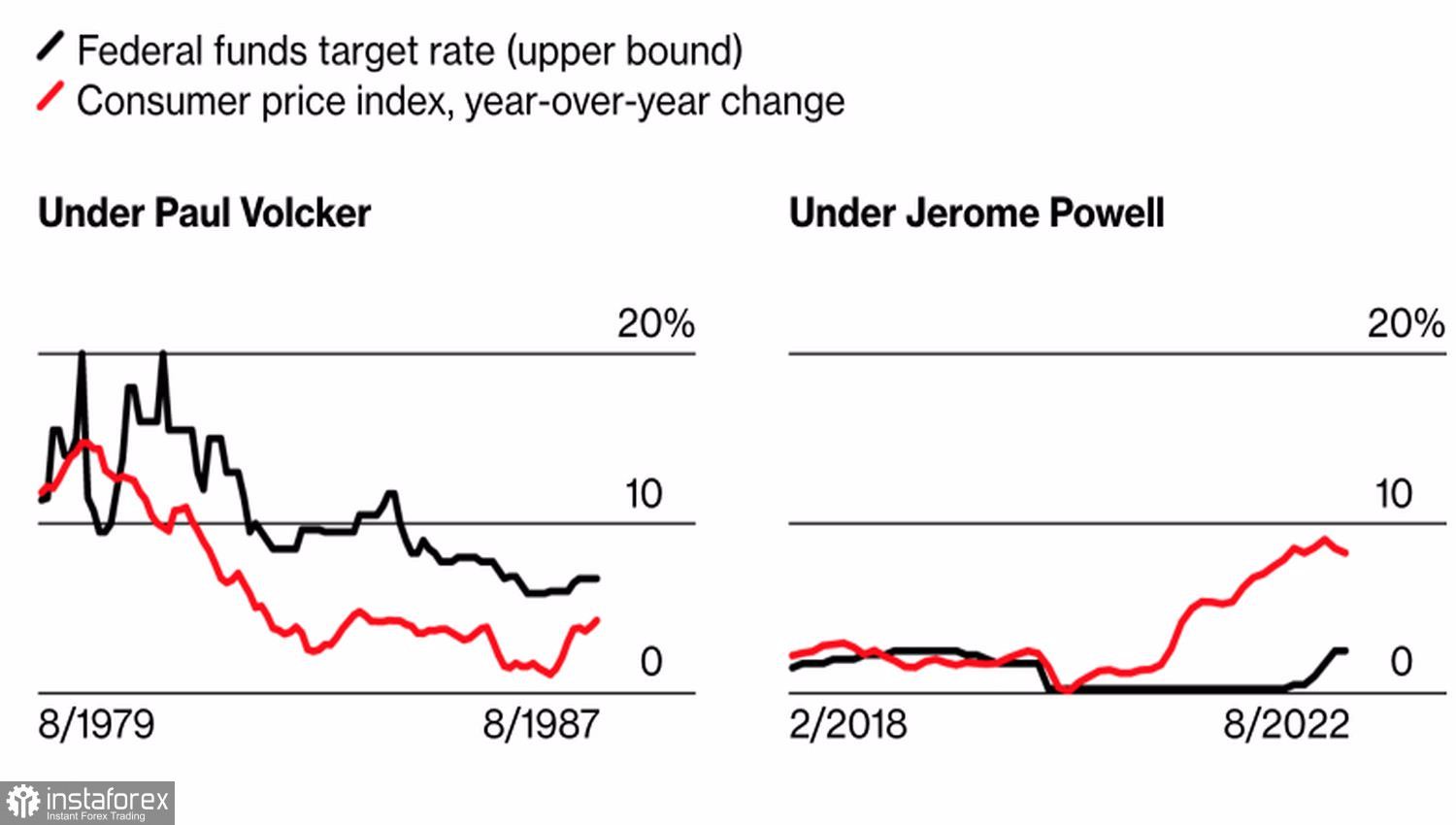

Will Jerome Powell's crusade become as ugly as Paul Volcker's? In the 1980s, the Fed had to push the economy through two recessions at once to beat inflation. Judging by the speeches of FOMC officials, they do not intend to repeat the mistakes of their predecessors—to stop as soon as they find signs of malaise in the US economy. Easier said than done. Observing the central bank, which is aggressively raising rates while watching the decline in GDP—its nerves must be made of steel.

Most likely, the ECB will be the first to pass the test of strength. According to JP Morgan, a recession in the eurozone is about to happen—if it hasn't already happened. States will face a recession in 6–9 months. By that time, the federal funds rate will already have reached the FOMC projected ceiling of 4.5% and will remain at this level for a long time.

Inflation Dynamics and Fed Rates

The European Central Bank is in a clearly worse position. The futures market is set to raise the deposit rate by 75 bps in November and then will weigh between 50 bps and 75 bps in December. The head of the Bank of the Netherlands, Klaas Knot, is confident that we need to act decisively and add 150 bps to borrowing costs at the next two meetings of the Governing Council. As for the quantitative tightening program in the form of sales of bonds accumulated during QE, one of the main ECB hawks does not expect it to begin before 2023. To start QT, it is necessary to bring the deposit rate to a neutral level.

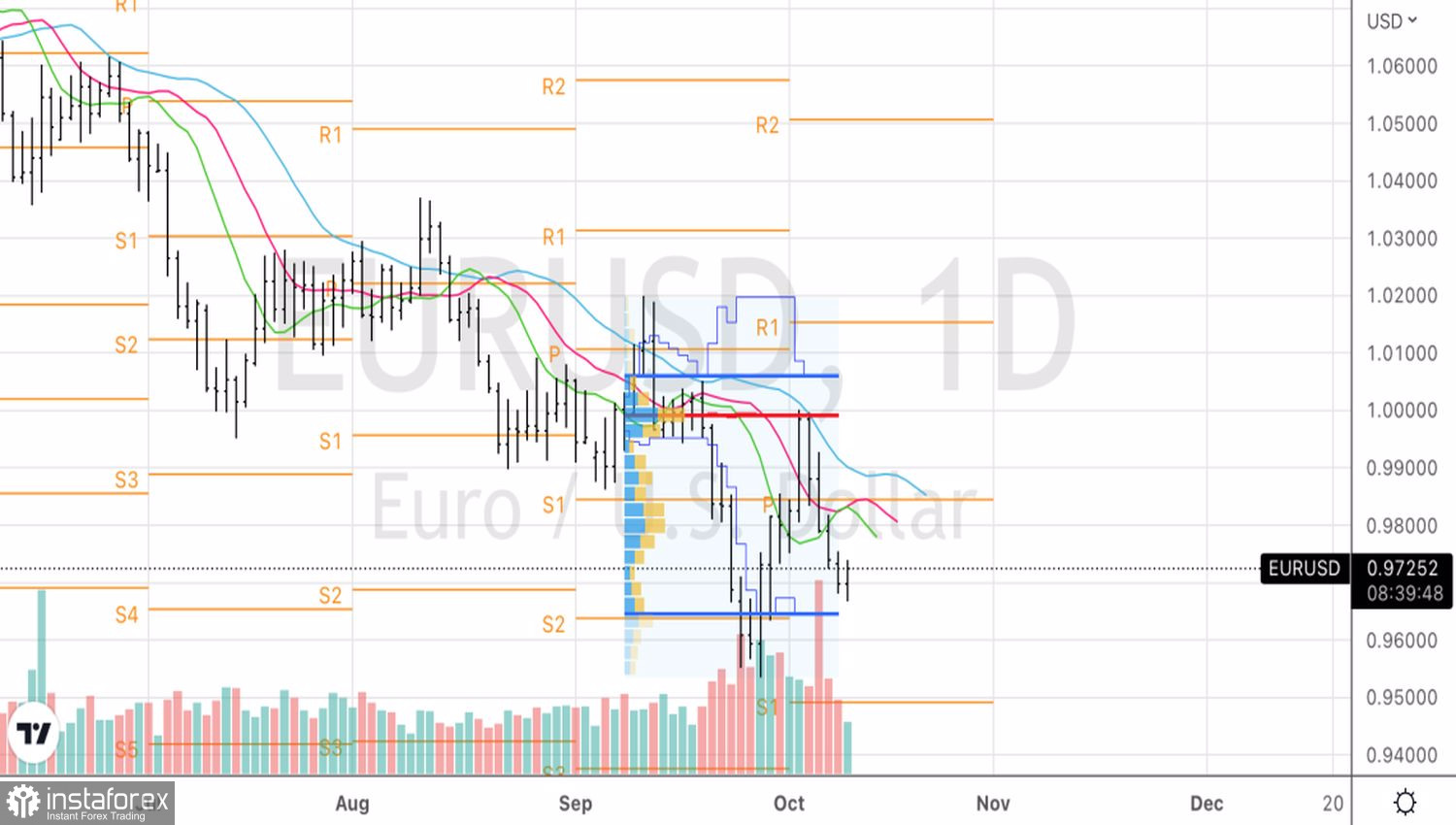

Knot's rhetoric was one of the factors that allowed EURUSD to cling to the 0.97 mark. The desire of the Bank of England to re-enter the market with a proposal to buy British bonds in order to stabilize yields also played into the hands of the euro. Last time, this led to a rapid rally in the pound, pulling other European currencies with it. Today their reaction was more than muted.

Most likely, expectations of the release of US inflation data for September are to blame for this. Too much depends on this indicator! If it starts to slow down, the chances of a dovish reversal will increase, which will lend a helping hand to risky assets and EURUSD. On the contrary, the acceleration of the underlying indicator will convince the financial markets that the Fed's work is far from over, and will become the basis for another wave of US dollar purchases.

In my opinion, the fact that the federal funds rate is still lower than consumer prices and inflation expectations indicates extremely low real yields on Treasury bonds. Under Paul Volcker, this was not the case. He managed to beat high inflation, and Jerome Powell has yet to do it.

Technically, on the EURUSD daily chart, the inability of the bears to keep the quotes of the pair below the pivot point at 0.969 indicates their temporary weakness and creates prerequisites for a pullback. We sell the pair on growth to 0.978 and 0.9845. The reason for the formation of shorts will be the return to the support at 0.969.