The attention of markets is now riveted not to the ECB or the Bank of England, but to the Fed. This is because even though the UK was the first to start raising interest rates, much more importance is paid to the Fed than other banks. That is why it is not surprising that the actions of the US central bank continue to guide the market, especially since at this time there is not a single hint that Fed rates will stop increasing in the foreseeable future.

Of course, rates will decrease sooner or later, but it is unlikely to happen before the figure hits 4.5%. Almost all FOMC representatives agree that monetary policy needs to be tightened further in order to curb inflation.

Yesterday, Fed Vice President Lael Brainard delivered a speech, confirming the fact that the bank will continue to do everything to stabilize prices. In particular, Brainard said that inflation is a serious problem and requires a clear, balanced approach. Supply remains fairly low and demand high, creating imbalances that are still pushing inflation higher. The labor market is likely to remain in a weaker state than before the pandemic. The economy may face a new shock associated with rising food and fuel prices due to the military conflict in Ukraine.

Brainard also noted that the risks of a new rise in inflation remain due to OPEC's actions to reduce oil production, which could cause a new rise in prices in the energy market. The Fed is yet to consider easing the pace of rate hike as it intends to closely monitor economic data in order to clearly understand how the rate increase affects the economy and inflation. Selling securities off the Fed's balance sheet is a good way to raise rates in the end goal.

These are the main statements of Lael Brainard, from which only one thing can be understood: the Fed will raise interest rates for at least a few more months, which could lead to a new increase in demand in dollar. Together with the difficult geopolitical situation in the world, which in itself increases the demand for dollar, these factors may be enough for euro and pound to fall further.

And even though the ECB and the Bank of England will raise rates at the same time, the market will react to it very reservedly. Little will also depend on the US inflation report this Thursday as the value of the indicator is still too high for the Fed to even slow down the pace of monetary policy tightening.

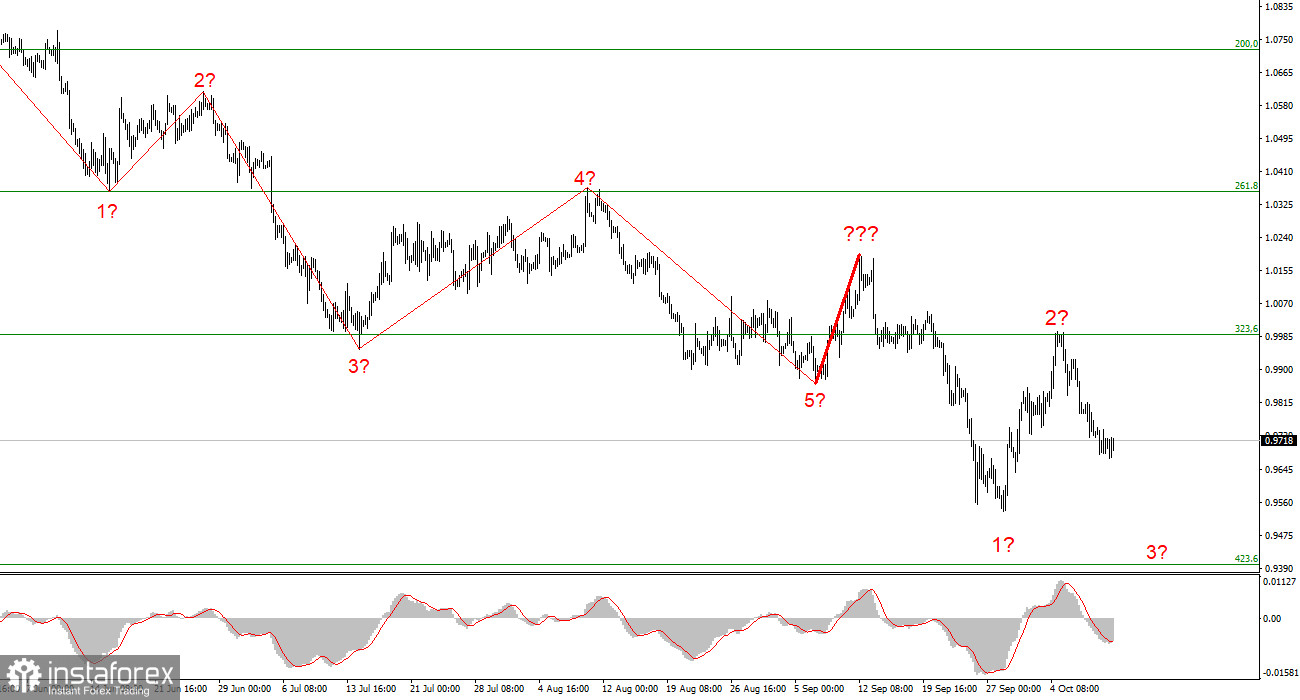

Based on this analysis, it is likely that the downward trend in EUR/USD will continue, but could end at any time. There may be an upward corrective wave, so it is best to sell up to the 423.6% retracement level of 0.9397. There is also need for caution as it is not clear how much longer the decline in euro will continue.