Yesterday, the euro was seriously influenced by the events that determined the pound's trend. Notably, the British currency showed extremely high volatility, making the euro follow it. Such a situation was primarily caused by the publication of the UK labor market report. The pound sterling increased amid a decline in the UK unemployment rate to 3.5% from 3.6%. However, such data could hardly lead to a 100-pip rise. Meanwhile, the euro showed a much smaller rise, which proves the fact that it was just following its counterpart. The magnitude of the pound's appreciation could be explained by oversold conditions. During previous days, the British pound lost almost 400 pips. At the beginning of the US trade, the currency started falling. As a result, it slid by approximately 200 pips. Such a slump was spurred by concerns about the UK financial security. Fears about possible bankruptcies of British pension funds are rapidly rising. The fact is that pension funds are the main purchasers of government bonds. At the moment, the Bank of England is actively buying bonds from these pension funds. However, the purchase program will last only until October 14 and 40 billion pounds could hardly be not enough to support the economy. Nevertheless, the BoE stated yesterday that it had no intention to expand or extend the program. In this light, the pound sterling tumbled, dragging the euro.

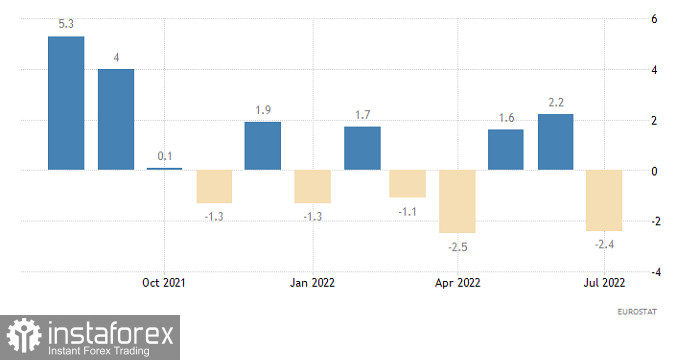

At the start of the Asian trade, both the euro and the pound sterling increased. However, it was just a rebound. Nerveless, the euro may develop the trend and intensify its position. The price could be boosted by the industrial production report. The indicator is expected to advance by 0.7% after a drop of 2.4%.

Eurozone Industrial Production

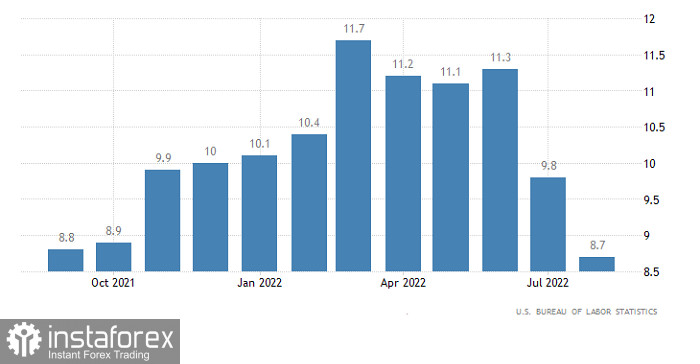

What is more, today, the US is going to publish the PPI data. The growth pace may slacken to 8.4% from 8.7%. That is why inflation may also slow down. It means that the Fed will have one more reason to switch to a slower pace of the key interest rate hike. However, the process itself is likely to continue even in the next year. Nevertheless, that was enough to cause a decline in the US dollar.

US Producer Price Index

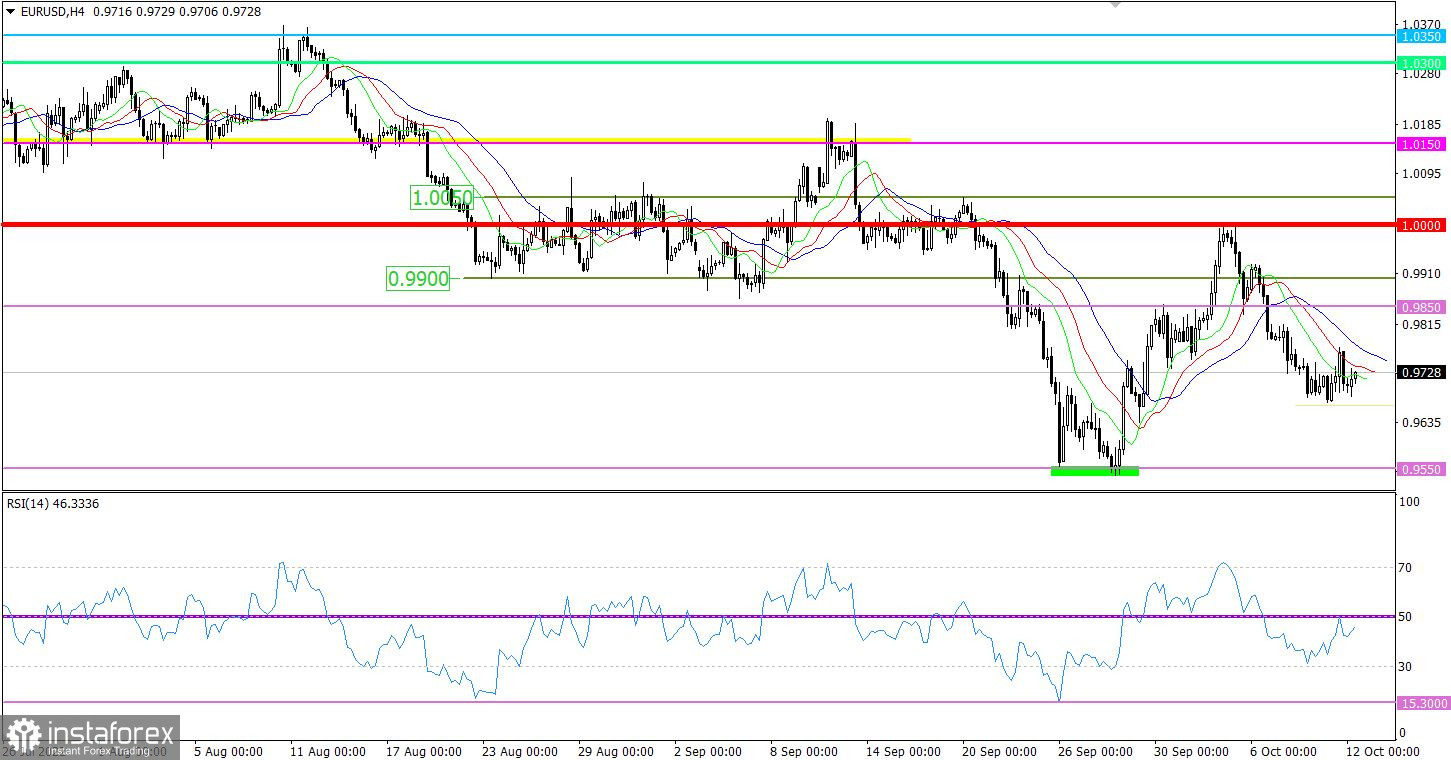

The euro/dollar pair goes on hovering near 0.9700 despite local surges in speculative activity recorded yesterday. This movement points to stagnation that may encourage speculators again.

On the four-hour and daily charts, the RSI technical indicators are moving in the lower area of 30/50, which points to the mainly bearish sentiment among traders.

In the same periods, the Alligator's MAs are ignoring the recent price swings and stagnation. The MAs are headed downward, which corresponds to the general market sentiment.

Outlook

If the price settles below 0.9650 at least in the four-hour period, it may touch a new low of the downtrend.

Until then, traders will continue monitoring the price behavior near 0.9700, defining stagnation as an accumulation process.

In terms of the complex indicator analysis, in the short-term period, we see mixed signals due to stagnation near 0.9700. In the intraday and short-term periods, indicators are reflecting a downtrend.