The UK has recently stepped up efforts to prevent financial market chaos from spreading beyond the $1 trillion part of the pension industry after the government of Prime Minister Liz Truss alarmed investors with its proposals. In his speech, Finance Minister Kwasi Kwarteng said he would present his fiscal strategy, along with economic forecasts approved by the budget oversight body, on October 31, almost a month earlier than planned. This led to a surge in volatility in the markets, especially after the Bank of England seemed to be going to extend emergency measures to support the bond market until early next month. These moves were expected to be part of the government's efforts to restore investor confidence.

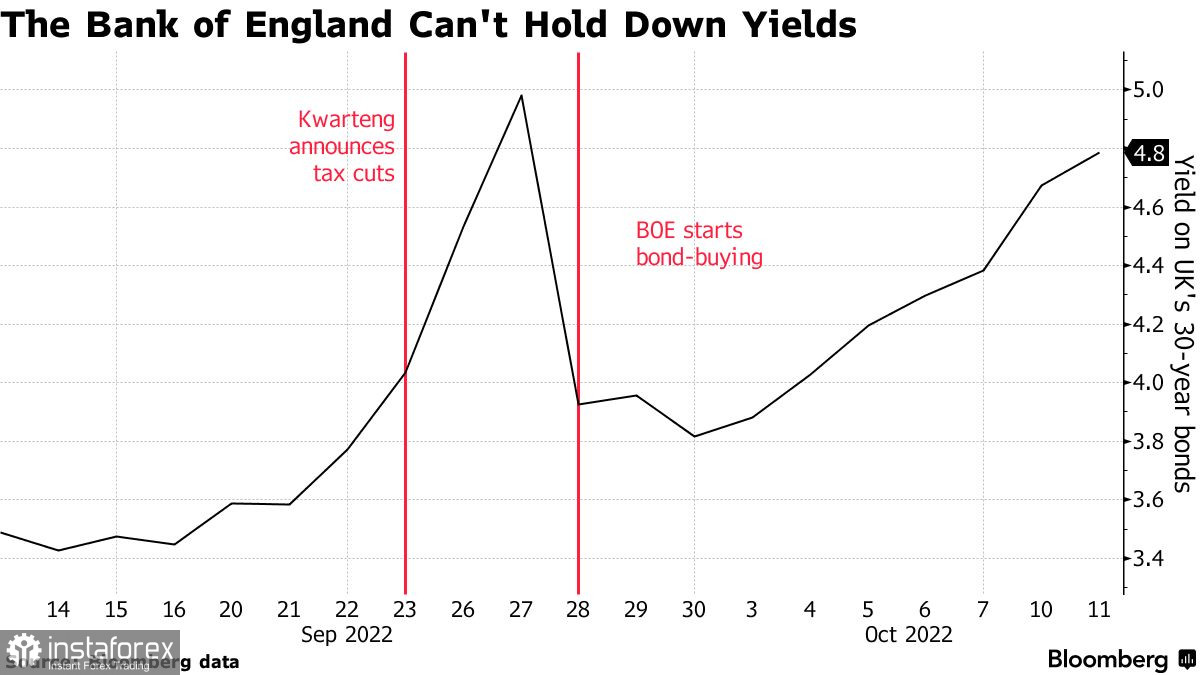

Last month, the finance minister sparked a collapse in pound by announcing a £45 billion unfunded stimulus package that undermined the Bank of England's inflation-fighting program.

Kwarteng obviously acted under increasing pressure from politicians and the government, as everyone expected more effective action to stabilize public finances. The proposals, including economic forecasts, were also supposed to be released on November 23, but the finance ministry said on Twitter earlier this week that they would come out sooner, which led to another spike in market volatility.

Against this news, 30-year yields rose 17 basis points to 4.56%, especially since the market doubts that the BoE will deliver on its promises to extend its temporary bond purchases during an aggressive rate hike.

pension funds exposed to liability-based investment risks can clear their positions after the UK government triggered a market crash by announcing the allocation of £45 billion ($50 billion), which they wanted to receive due to tax cuts.

After yesterday's statements, pound continued to lose positions one by one, so now buyers are focused on defending the support level of 1.0930 and resistance level of 1.1050. Only the breakdown of the latter will open the path to 1.1120, 1.1180 and 1.1215. Meanwhile, a return of pressure and decline below 1.0930 will push GBP/USD down to 1.0870 and 1.0800.