EUR/USD

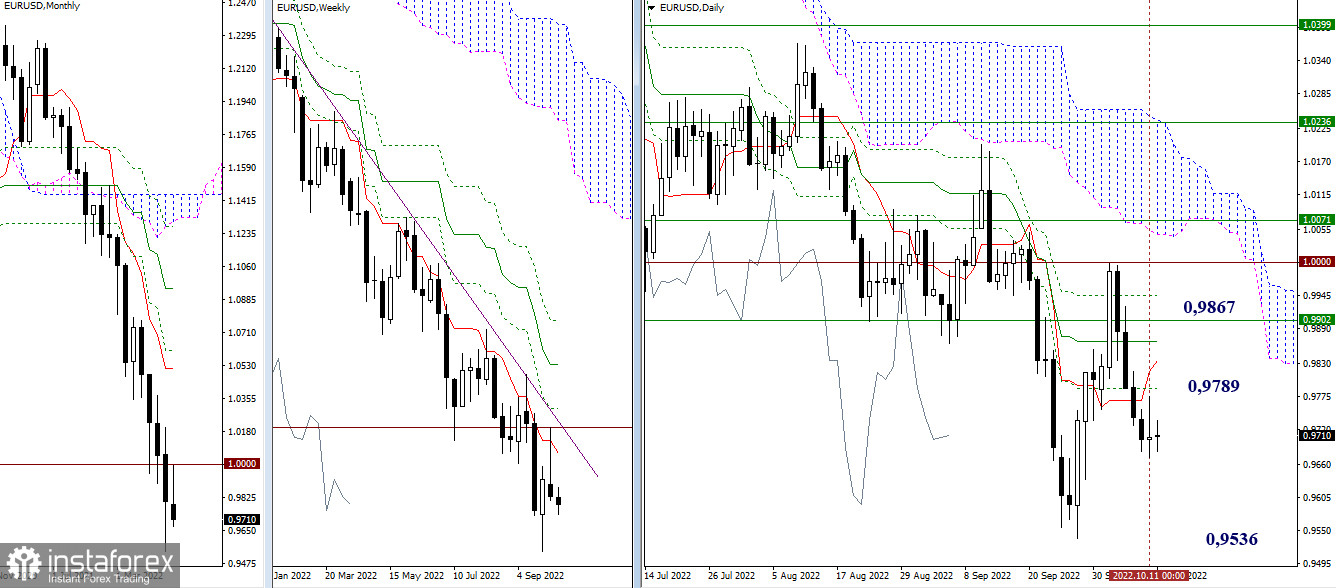

Higher time frames

Yesterday's trading brought no visible results. Market activity is sluggish due to persistent uncertainty. Buyers are ready to regain ground. The levels of the Ichimoku Cross (0.9789 – 0.9835 – 0.9867) and the level of the weekly short-term trend (0.9902) may serve as resistance today. If sellers begin to act, their main target for today will be the lowest extremum point at 0.9536.

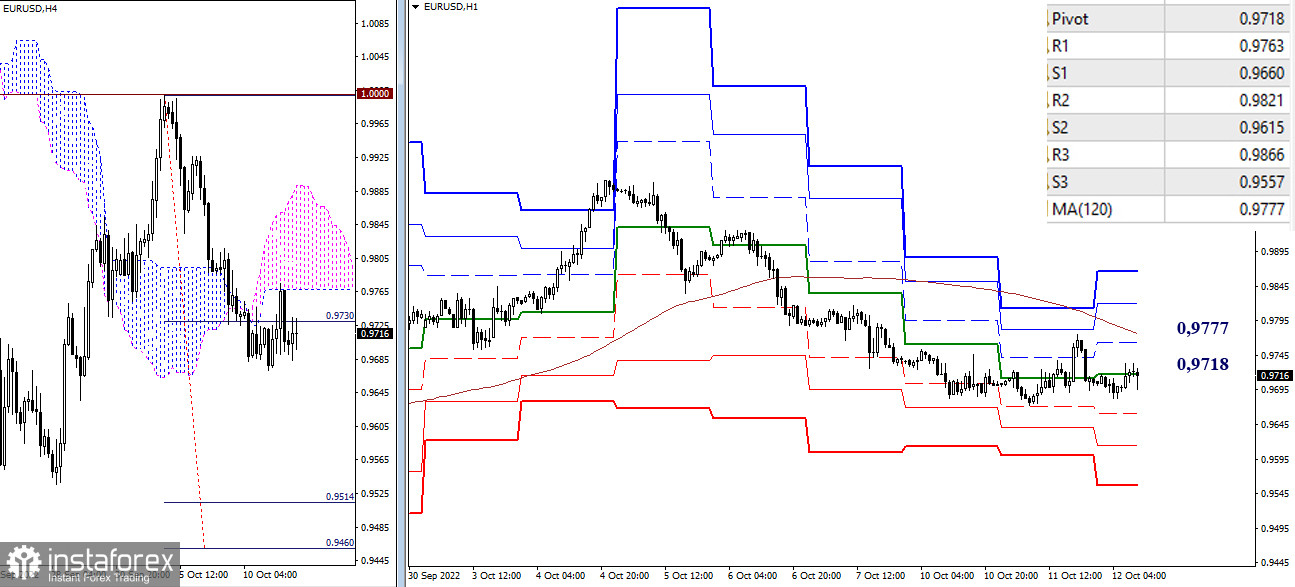

H4 – H1

On lower time frames, the pair is going through a correction phase. At the moment, the price is testing the central pivot level of 0.9718. The key level for the correction is the resistance of the long-term trend at 0.9777. A strong hold above this level and a reversal of the moving average may change the current balance in the market in favor of the bulls. Another upside intraday target is seen at the resistance level where standard pivot points are found (0.9821 – 0.9866). Downside targets can be found at the support levels where pivot points are located (0.9660 – 0.9615 – 0.9557).

***

GBP/USD

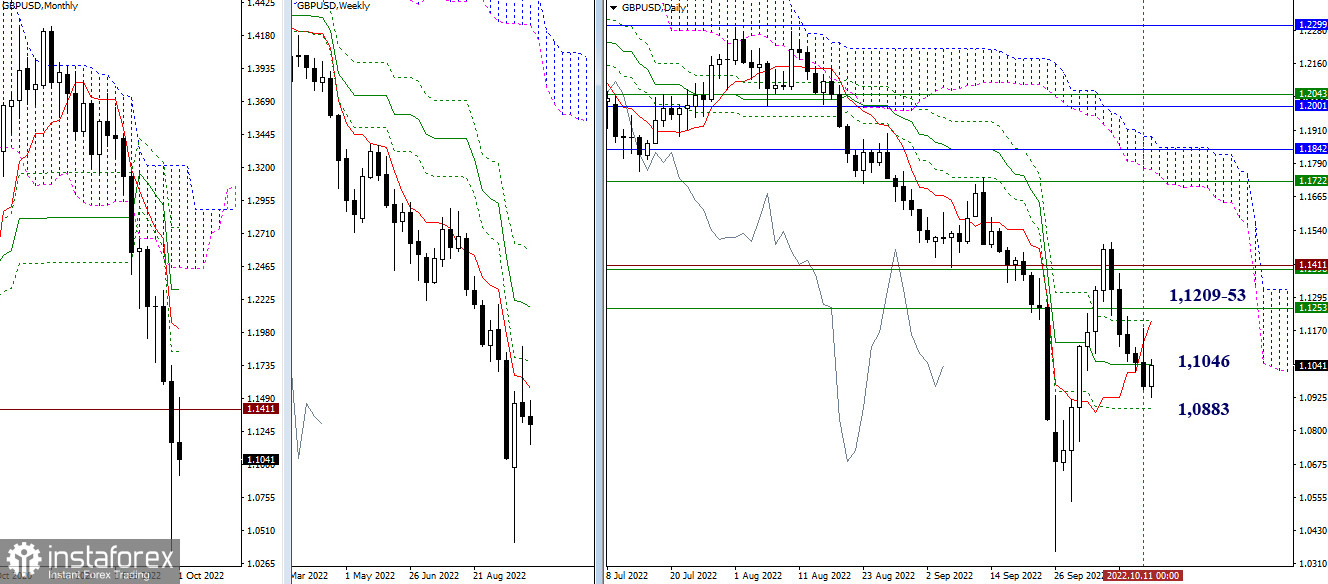

Higher time frames

The daily candlestick that was formed yesterday is bearish. The levels of the daily Ichimoku Cross as well as the level of the medium-term trend (1.1046) serve as the main targets today. The Fibo Kijun line at 1.0883 acts as support. Several resistance levels have been accumulated in the range of 1.1209-53 together with the weekly short-term trend.

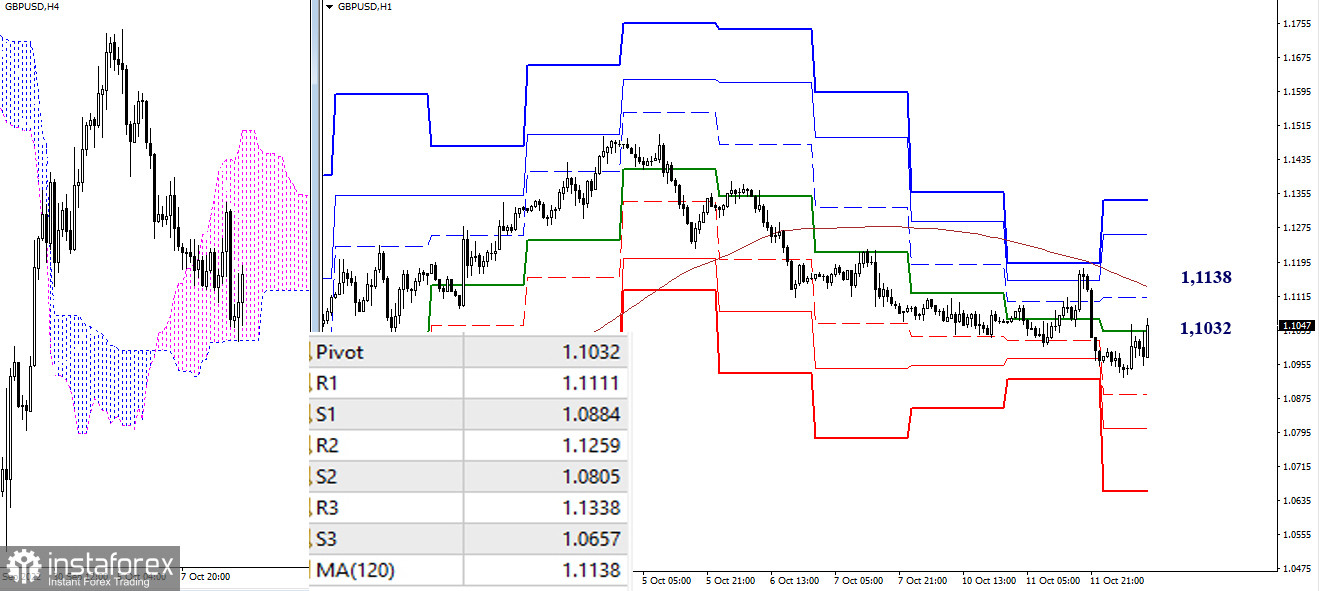

H4 – H1

Bears are in control of the market now. At the same time, we can see that an upside correction is being formed. The price is testing the central pivot level of 1.1032. The resistance is found at 1.1138, which is the weekly long-term trend, determining the balance in the market. The next upward targets are the standard pivot levels of 1.1259 – 1.1338. In case of a decline, the downward targets are located at the pivot points of 1.0884 – 1.0805 – 1.0657.

***

Technical analysis is based on:

Higher time frames – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – Pivot Points (standard) + 120-day Moving Average (weekly long-term trend)