Market players remain anxious over the pound sterling's situation, despite all measures by the UK government and the Bank of England. GBP/USD could still reach parity, and the pound's downside risks continue to rise with each passing day.

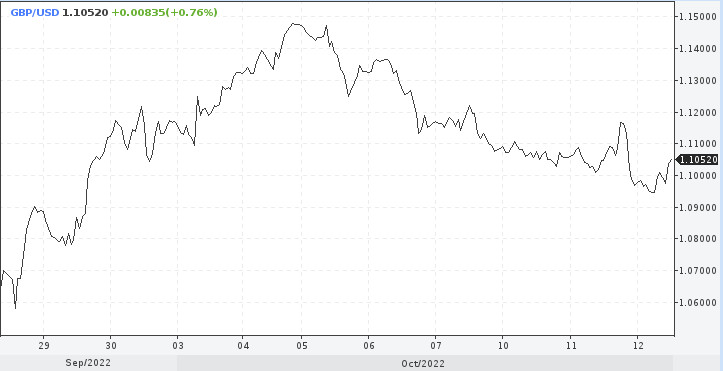

Over the past several trading days, GBP has failed to advance upwards. It continues to hover near the 1.1000 level, which currently serves as a barometer of sorts for market players. If the pound sterling is holding to this level, its situation remains more or less stable. If GBP/USD dives below this level, it will lead to renewed speculation about the pair diving towards parity.

Bearish traders tested 1.1000 on Tuesday, but the pound sterling managed to hold onto this level. Nevertheless, the UK currency remains shaky, and any negative information could send GBP downwards.

Earlier, Andrew Bailey, the governor of the Bank of England, stated that the UK regulator would stop its emergency measures aimed at supporting UK pension funds on Friday, as stated earlier. This announcement caught investors off-guard, as they expected the BoE to continue its bond purchases. As market players realize the UK central bank's real plans, the pound could drop below 1.1000 by the end of the week. There are other factors that could push down GBP as well.

On Wednesday, traders will assess the latest UK GDP data, followed by the US CPI report later on. If the US dollar matches expectations and extends its rally, it would send the pound sterling downwards. There are almost no factors that could give GBP support at this point.

However, traders could focus their attention on the next policy measures by the Bank of England. The BoE is expected to hike the interest rate by 1% at its next meeting, supported by strong UK labor market data.

According to the latest data, the UK labor market remains robust. Unemployment fell to 3.5% from 3.6% in the previous three months, while average wages jumped to 6% from 5.5%, surpassing the 5.9% forecast. However, inflation remained at 9.9%, which severely affected real wages in the UK.

The UK economic data suggest that the chances of further decline of GDP remain high, complicating matters for the pound sterling.

Recession has come

The UK economy slid down at its fastest pace since April, falling below August's data. The lower-than-anticipated data caught economists off guard, signalling that the UK economy will likely continue to fall in Q3 2022 as well.

Most UK economic sectors finished the quarter in negative territory. Manufacturing output posted a decline both y/y and m/m. Some economists earlier predicted that manufacturing output would remain unchanged at 0%.

According to the Office for National Statistics, manufacturing decreased by 1.6%, well below the forecast of 0% growth. Production fell by 1.8% in August after declining by 1.1% in the previous month. Year over year, UK industrial production fell by 5.2%, greatly exceeding the forecasted 0.6% decline.

Manufacturing was the main driver of the GDP decline, alongside drops in the pharmaceutical sector, as well as transportation, energy, mining, and quarrying sectors. Energy production decreased due to maintenance work that slowed the oil and gas sector.

The construction sector increased by 0.4% in August, but it was not enough to improve the overall situation.

The latest GDP data has signalled that a recession has already begun in the UK.

The Bank of England earlier warned in its August monetary policy report about an upcoming recession. The regulator expected economic growth to become negative in the 4th quarter of 2022 and that the downturn would continue for at least 5 quarters afterwards.

The economic slump in the UK could be just as deep and long-lasting as the recessions of the 1980s and early 1990s.

August's GDP drop is likely a prelude to a further decline later.

"GDP likely will continue to decline over the coming months, now that around one-third of households no longer have meaningful savings left, and the 30% that have a mortgage reduce expenditure in response to, or in advance of, a sharp rise in their monthly loan payments. In addition, the deterioration in businesses' borrowing costs is consistent on past form with both investment and employment falling next year," Samuel Tombs, chief UK economist at Pantheon Macroeconomics said.

The pound sterling's trajectory

The fundamental picture and the US dollar's prospects for continued growth suggest that traders will continue to go short on GBP.

The base inflation is expected to increase in the US in September, which would allow the Fed to increase interest rates once again at its next meeting on November 2. This hike would likely send GBP/USD towards new lows.

In an alternative scenario, GBP/USD's breakout through the resistance at 1.1149 could trigger a bounce towards other resistance levels at 1.1355 and 1.1480. This is likely to be the extent of the pound's upward movement in the current conditions, with any further growth being unlikely.

Today, pound sterling traders are likely to try and ignore weak UK economic data. In the meantime, the pair continues to hover near 1.1000, halting the downtrend of the past 5 days. Falling yields and hopes of further stimulus by the UK authorities could be preventing GBP/USD from falling down.