The pound against the dollar continues to defend the psychologically significant price level of 1.1000, although the fundamental picture for GBP/USD is still not in favor of buyers. The good data on the growth of the labor market in the UK, which were published yesterday, were completely leveled by today's data on the growth of the British economy. All components of the report came out in the "red zone," putting pressure on the pound. The British currency once again demonstrated vulnerability, and the current situation eloquently illustrated the unreliability of long positions in the GBP/USD pair.

Today, we learned the official data on the growth of the UK economy. The release is somewhat late (August), but its "red color" speaks volumes. The pessimistic forecasts of many experts, which were voiced a few months ago, are beginning to come to life: the UK economy may "go into a tailspin" at the end of the year, against the background of the energy crisis and spasmodic inflationary growth. Recall that in September, the Bank of England announced that the country's economy had already entered a technical recession, and inflation in the second half of autumn this year could peak at around 11%. The figures published today confirm the forecasts announced by the central bank.

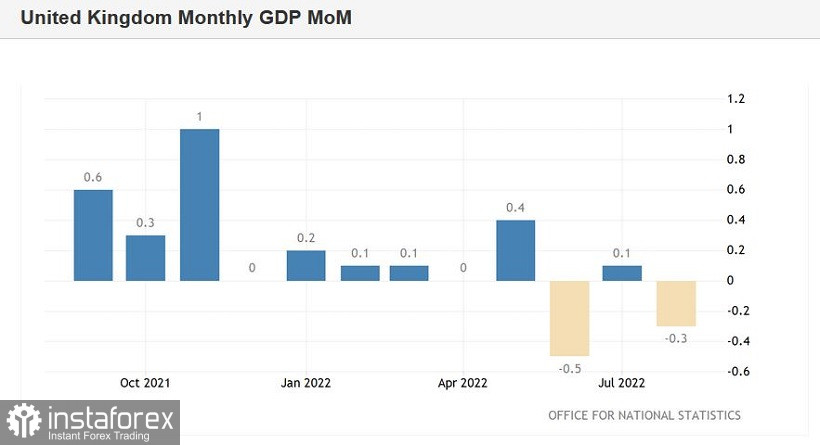

The volume of the UK GDP decreased by 0.3% on a monthly basis. The indicator showed similar dynamics (-0.3%) in quarterly terms. The indicators of industrial production also disappointed. On a monthly basis, the indicator again "dived" into the negative area, ending at -1.8% (with a 0.2% decline forecast). This component is in the negative area for the third month in a row. On an annualized basis, negative dynamics was also recorded: instead of the projected growth of 0.6%, the indicator collapsed to -5.2% (there was also a decline of 3.2% in the previous month). A similar situation has developed in the processing industry (-1.6% MoM, -6.7% YoY). In the service sector, the indicator came out in the "red zone" – in quarterly terms, the indicator returned to the negative area. The same can be said about the construction sector. In general, almost all of the above releases came out in the "red zone" today, significantly falling short of the forecast values.

Despite the fact that the published data on GDP growth refer to "lagging" indicators, they had a corresponding impact on the GBP/USD pair. The price has updated the two-week low by testing the 9th figure. But the bears could not gain a foothold in the occupied positions. After reaching 1.0925, the pair turned 180 degrees and returned to the area of the 10th figure.

The main reason is the decline in the US dollar index. Greenback dipped across the market ahead of the publication of the producer price index. In addition, the minutes of the September meeting of the Fed will be published on Wednesday, and on Thursday—the consumer price index. Even though the probability of a rate hike at the November Fed meeting is now 81% (according to the CME FedWatch Tool), traders seem to be in no hurry to invest in the greenback before the publication of key inflation reports this week.

In addition, buyers of GBP/USD found support via information from the Financial Times. According to insider data, the Bank of England will extend the emergency bond purchase program. The English regulator today indirectly confirmed the published insider information. The representatives of the central bank reported that the purchase of bonds is a temporary program, but they added that it would be rolled out "smoothly and in an orderly manner."

But in general, in my opinion, the GBP/USD pair retains the potential for further decline. Current corrective pullbacks should be used to open short positions. Firstly, the caution of dollar bulls is rather formal. I doubt that inflation reports (even if they come out in the "red zone") will cancel the 75-point Fed rate hike scenario in November. Here you can refer to two representatives of the Fed, who this week voiced their positions. Fed Vice Chair Lael Brainard and Cleveland Fed President Loretta Mester (who have voting rights on the committee) joined the chorus of hawks, reaffirming their determination in the context of further tightening of monetary policy.

As for the actions of the BoE, in this case, I want to recall the opinion of Brown Brothers Harriman analysts. According to them, the English regulator is only trying to eliminate the symptoms of market instability. But at the same time, the central bank is unable to eliminate the causes. Economists at BBH believe that only the British government can reverse the situation if it stops pursuing "irresponsible" and "adventurous" fiscal policies.

Thus, in my opinion, there are no grounds for GBP/USD buyers to reverse the trend. Therefore, the current corrective growth should be used to open short positions from the first, and so far the main target of 1.1000. This is a key price point that should be treated with some caution.