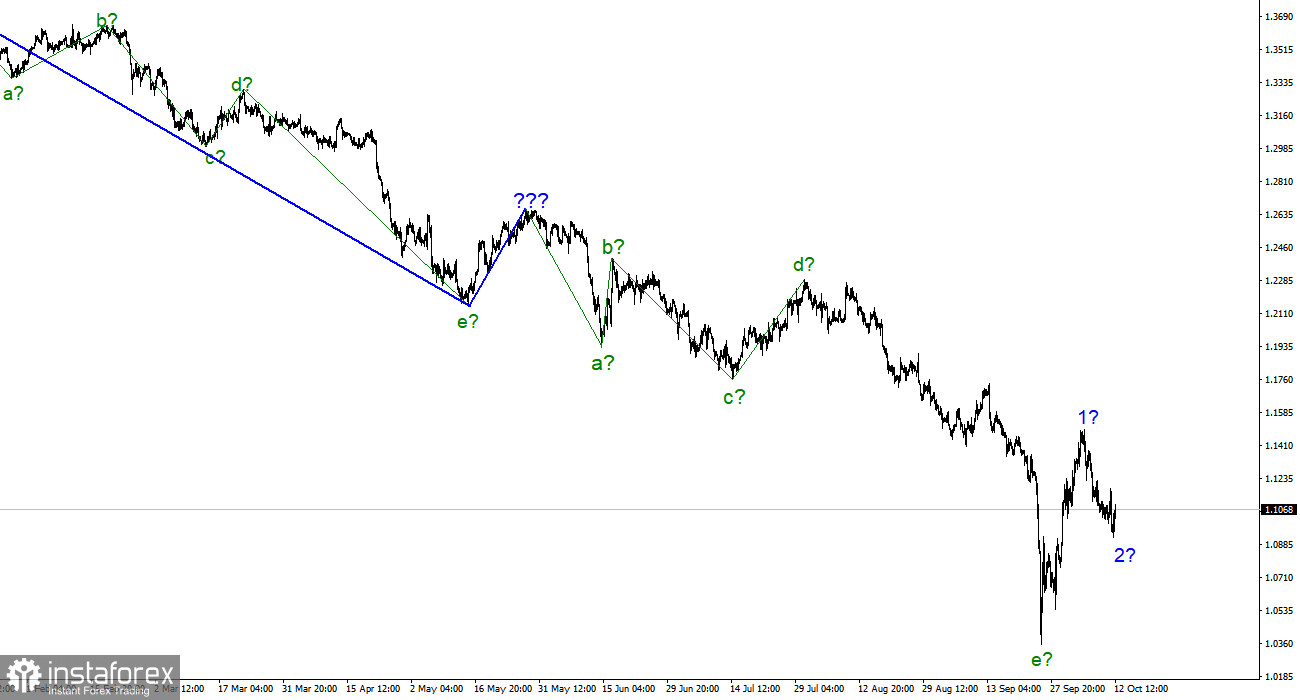

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but still does not require any clarification. We have a supposedly completed downward trend segment consisting of five waves a-b-c-d-e. If this is indeed the case, then the construction of a new upward trend section has begun. The first wave is supposedly completed, and the construction of wave 2 has begun. Unfortunately, there is no confidence in this particular scenario since the instrument must go beyond the peak of the last wave to show us its readiness to build an upward section of the trend and not complicate the downward one once again. The peak of the nearest wave is located at about 23 figures. Thus, even after the pound has increased by 1000 points, you need to go up another 1000 points to reach this peak. I also want to note that the wave markings of the euro and the pound are different now. Many have seen strong British growth in a short time, so they are "itching" to make purchases. However, let me remind you that even if the upward section has started building now, we should see another downward correction wave (after completing 1). If the quotes do not fall below the low wave e (which is very difficult, but not impossible), then you can also expect to build a new upward wave 3 and buy.

British statistics are still bad.

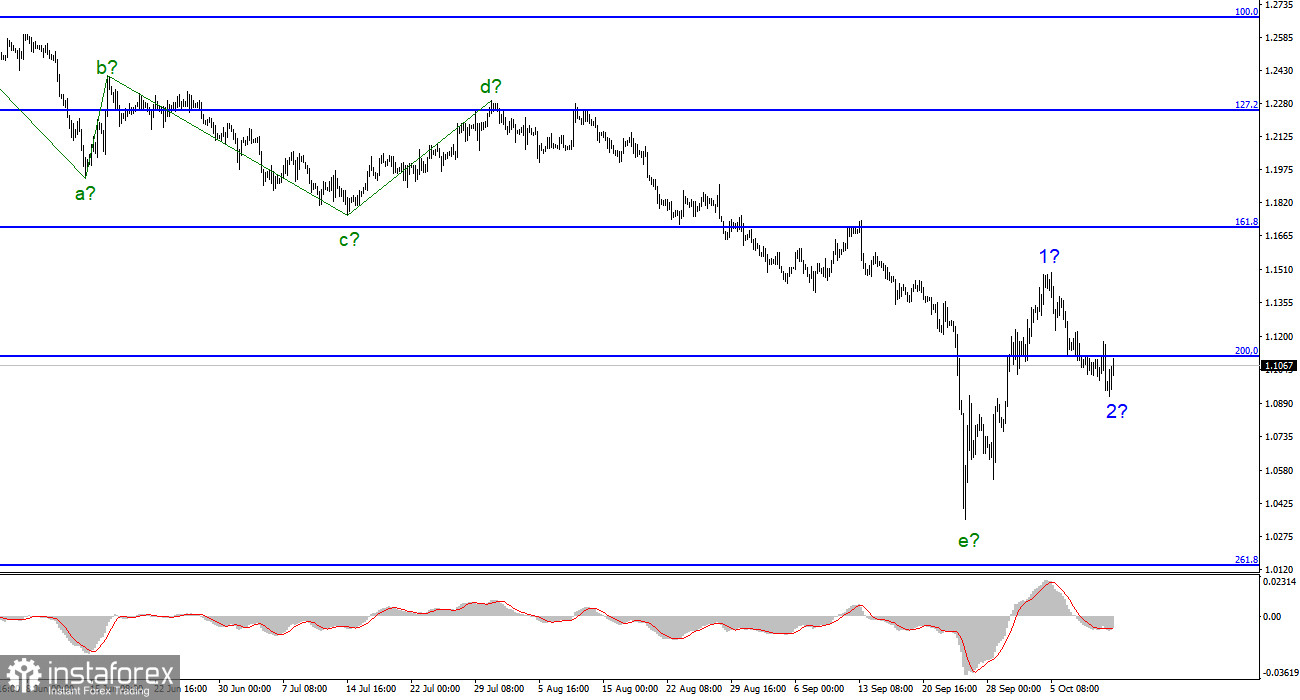

The exchange rate of the pound/dollar instrument increased by 100 basis points on October 12. A day earlier, it had risen by 160 points, but by the end of the day, it had also managed to fall by 220. Thus, the British pound has no stability now. Demand for it has been mainly declining in the last few days, but from a wave point of view, it is still unclear which part of the trend is being built. I have already said that the issue is the discrepancy between the wave markings of the euro and the pound, although they usually move very similarly. However, now we expect growth in the pound and a fall in the euro, and the probability of such a scenario is low.

If yesterday the statistics in the UK were quite good, today they were already quite bad. GDP in August decreased by 0.3%, worse than market expectations, and industrial production decreased by 1.8%, which is much worse than market expectations. Nevertheless, in the first half of the day, the British rose, which tells me that the market did not pay any attention to the morning reports. Consequently, he could not pay any attention to yesterday's reports, and the rise of the Briton could be a coincidence.

One way or another, a successful attempt to break through the 200.0% Fibonacci level indicates that the market is ready for new sales. The geopolitical situation in Europe and Ukraine is not improving. Russia launched missile strikes on Ukraine's critical infrastructure on Monday and Tuesday. The US responded by saying it would provide Kyiv with more air defense systems and weapons. The results of the G-7 summit on the Ukrainian issue should be known today, and new EU sanctions against Russia should be approved. For the British pound, this may be a new reason to decline.

General conclusions.

The wave pattern of the pound/dollar instrument suggests a new decline in demand for the pound. I advise now selling the instrument, as before, on the MACD reversals "down." It is necessary to sell more cautiously since constructing a downward trend section could be completed. A successful attempt to break through the 1.1110 mark, which corresponds to 200.0% Fibonacci, may indicate the completion of the construction of a corrective wave 2.

The picture is similar to the euro/dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, and the same five waves down after it. The downward section of the trend can turn out to be almost any length, but it may already be completed.