Market participants are waiting for the publication (at 12:30 GMT) of fresh data on inflation in the US. The upward dynamics of the dollar is maintained, pushing the DXY towards more than 20-year highs near the 120.00, 121.00 marks.

As for the euro, it continues to actively decline in tandem with the dollar. Despite today's upward correction and recent statements by European Central Bank President Christine Lagarde about the readiness of the regulator to continue raising the interest rate, the euro is under pressure both from weak macro statistics from the eurozone and amid high geopolitical tensions in Europe due to the events in Ukraine, which threatens to intensify the escalation of the military conflict. "I have no indication that with steps up to 75 basis points we would not be able to achieve our price stability mandate of 2% inflation over the medium-term," ECB spokesman Klaas Knot said yesterday.

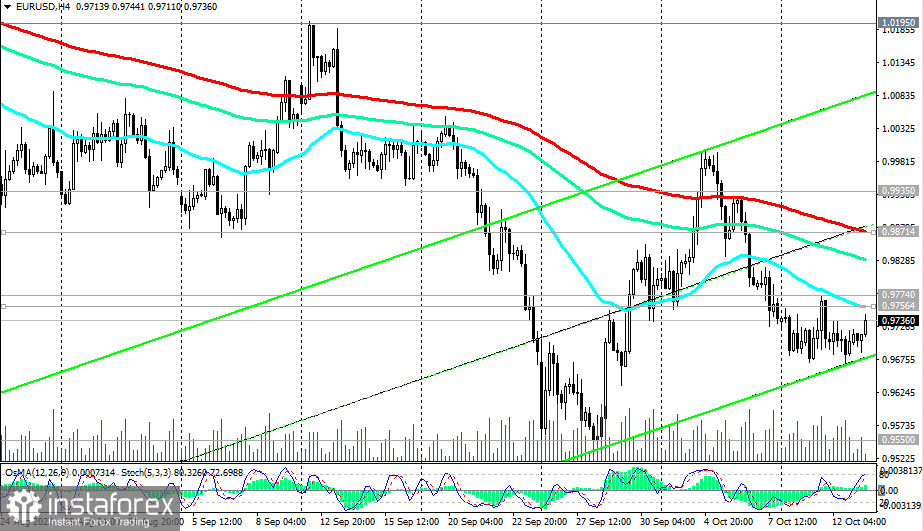

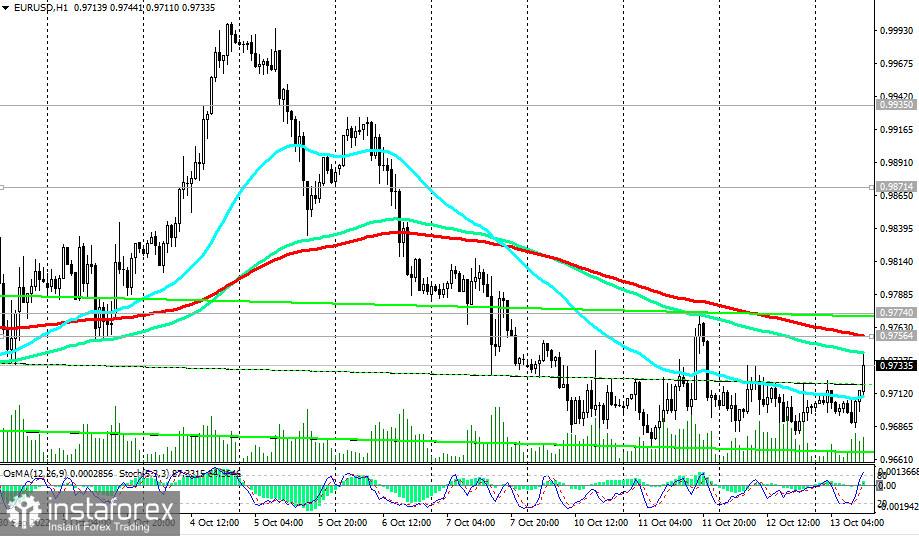

As of writing, EUR/USD was trading near 0.9733, in a sustained bear market. From a fundamental point of view, we should expect at least a strong bearish momentum in the EUR/USD pair, and at a maximum, a further fall of the pair towards 20-year lows, when it was trading near 0.8700, 0.8600. In general, the downward dynamics of EUR/USD remains.

In an alternative scenario, and if today's US CPI disappoints investors, then corrective growth is likely toward resistance levels 0.9935 (50 EMA on the daily chart), 1.0000. Their breakdown will be a signal for a stronger corrective growth with targets at the resistance levels of 1.0315, 1.0485 (200 EMA on the daily chart).

Support levels: 0.9700, 0.9600, 0.9535, 0.9500, 0.9400, 0.9300, 0.9200, 0.9000

Resistance levels: 0.9756, 0.9774, 0.9800, 0.9871, 0.9900, 0.9935, 1.0000, 1.0315, 1.0485

Trading Tips

Sell Stop 0.9675. Stop-Loss 0.9775. Take-Profit 0.9600, 0.9535, 0.9500, 0.9400, 0.9300, 0.9200, 0.9000

Buy Stop 0.9775. Stop-Loss 0.9675. Take-Profit 0.9800, 0.9871, 0.9900, 0.9935, 1.0000, 1.0315, 1.0485