US inflation surprised again. All components of the report came out in the green zone, exceeding the rather bold forecasts of most experts. It was not without new long-term records - for example, core inflation in annual terms reached its 40-year high. However, such records are by no means encouraging – neither Americans nor members of the US central bank. The latest figures showed that the Federal Reserve has not been able to curb inflation at the moment. Despite the aggressive pace of monetary policy tightening, key inflation indicators continue to show upward dynamics. It is obvious that the latest report will not go unnoticed by members of the Fed. The only question is exactly how the Fed will react, given the not-so-large arsenal of available levers of influence.

Speaking in the language of dry numbers, the situation looks like this. The overall consumer price index in September increased by 0.4% on a monthly basis, and by 8.2% on an annual basis. On the one hand, there is a slow downward trend (experts expected a decline to 8.0%). But! Here it is necessary to note an important aspect: this component of the release slowed down only due to lower energy prices. Thus, the structure of the report suggests that the growth rate of energy prices in September slowed to 19% after a jump of almost 24% in the previous month. In this context, it should be recalled that last week OPEC+ members decided to reduce oil production by 2 million barrels per day. This fact is likely to affect the cost of fuel, including in America. According to preliminary estimates, the decline in oil production will lead to a rise in the price of gasoline in the United States by 30-50 cents per gallon. In addition, the OPEC+ decision will hit those Americans who independently heat their homes in winter: fuel oil, which is used for individual heating, will rise in price. It is obvious that the increase in fuel prices will pull many other components, which will affect the dynamics of the consumer price index. We will most likely see echoes of the OPEC+ decision in November and December.

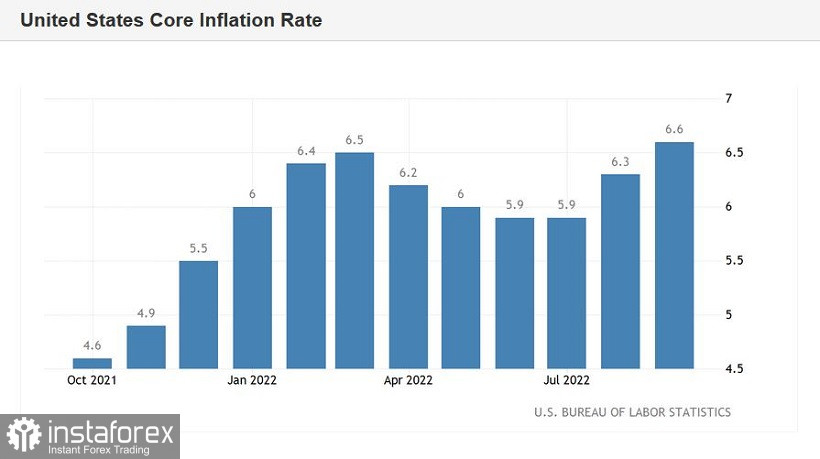

Therefore, loud headlines about the slowdown in overall inflation in the United States should be viewed through the prism of the latest decisions of the oil cartel. Not to mention the fact that the very fact of slowing down is minimal. While core inflation, which does not take into account food and energy prices, jumped by 6.6% year-on-year in September. This is the strongest growth rate since 1982. The upward dynamics of the core index has been fixed for the second consecutive month.

I repeat – all components of the latest report came out in the green zone, being above the consensus forecast. This fact destroyed the hopes of stock market traders that the trend towards slowing price growth could convince the Fed to slow down the pace of monetary policy tightening. By the way, the stock market reacted to the release accordingly: the key Wall Street indexes turned down.

The dollar, in turn, strengthened its position throughout the market. Paired with the euro, the greenback is trying to gain a foothold within the 96th figure, despite the opposition of the bulls on the pair. However, if we ignore the intraday volatility, we can come to the obvious conclusion that EUR/USD bears are the beneficiaries of the current situation in the medium term.

After all, in the green zone this week, not only the consumer price index was released, but also the producer price index. You can also recall the recently published inflation report on PCE growth. As you know, this is one of the main inflation indicators monitored by the Fed. It also reflected the acceleration of inflation growth: on an annualized basis, the basic price index of personal consumption expenditures updated a multi-month high, rising to 4.9%.

Plus, there are good Nonfarm. According to the latest data, unemployment in America decreased to 3.5%, the number of people employed in the non-agricultural sector increased by 260,000, and the average hourly wage rose by 5.0%.

All this suggests that the rhetoric of the Fed representatives will tighten again. The option of a 100-point hike is unlikely to be discussed, but a 75-point scenario in the context of the November meeting can be safely included in current prices. In addition, now they will probably talk about the prospects of a 75-point rate hike in December, following the results of the last Fed meeting this year. In other words, the flywheel of hawkish expectations will only unwind, supporting the US currency.

Therefore, short positions on the EUR/USD pair remain relevant. The prevailing fundamental background contributes to the pair's succeeding decline. From a technical point of view, the price on the daily chart is located under all the lines of the Ichimoku indicator (including under the Kumo cloud), as well as between the middle and lower lines of the Bollinger Bands indicator. All this indicates the priority of the bearish scenario. The main targets are the 0.9600 and 0.9560 marks (the lower line of the Bollinger Bands indicator on the same timeframe).