On Thursday, the pound/dollar pair showed a considerable rise and consolidated above the moving average. In the first part of the day, the macroeconomic calendar was not rich in events that may cause a rise. It is easy to explain any price movement after it happened, but almost impossible to predict it. This week, the UK has published a bulk of information that could be defined as moderately negative. The fact is that the most important data on industrial production and GDP was well below the forecast. However, on Thursday, the pound sterling started gaining in value amid the absence of news. It is a very important fact since traders decided not to wait for the US inflation figures.

Let us figure out the current market situation. The pound sterling jumped by 1,100 after a collapse. After that, it dropped by 560 pips, which is 50%, and resumed rising. Judging by the situation, the British pound may form a new uptrend. However, during the last few days, we have had doubts about it. On the daily chart, the pair settled below the critical level for some time, then returned and rebounded. If it is true, the British currency has favorable conditions for a jump of at least 600-700 pips. It is obvious that from a fundamental and geopolitical point of view, the pound may resume falling at any moment. However, its movement in the last 2-3 days points to the fact that it may form a new uptrend.

Huw Pill supports further rise in benchmark rate

Yesterday's growth in the pound sterling could be explained by two factors. Firstly, it became known that on October 14, the BoE would end its bond-buying program. Secondly, Chief economist of the Bank of England Huw Pill stated that in November, the regulator would raise interest rates by 0.75% or even more. Let us take a closer look at these events. The market is always sensitive to various stimulus programs and policy tightening. The bond-purchasing program amid the combat against high inflation is almost the same as pushing down brakes and an accelerator at the same time. The pound sterling dropped amid news about a possible decrease in UK taxes, which may lead to a budget gap of 250 billion pounds.

When the BoE started buying bonds, the pound was already rising. However, the currency might have jumped by 1,100 thanks to the announcement that changes in the tax system would be revised. In any case, the end of the stimulus program is very good for the British pound. Meanwhile, Huw Pill said that in November, the BoE had to take into account all the events which took place in financial markets in the last few weeks. He also noted that from April, inflation expectations were falling. However, now, inflation continues rising, seriously affecting UK financial markets. He also pinpointed that inflationary pressure is increasing amid higher prices of energy. It means that an interest rate hike is the only way to combat inflation. Thus, interest rates will surely be hiked by 0.75% or more. In the US, the benchmark rate will also be raised by 0.75%. That is why the pound sterling may show only technical growth.

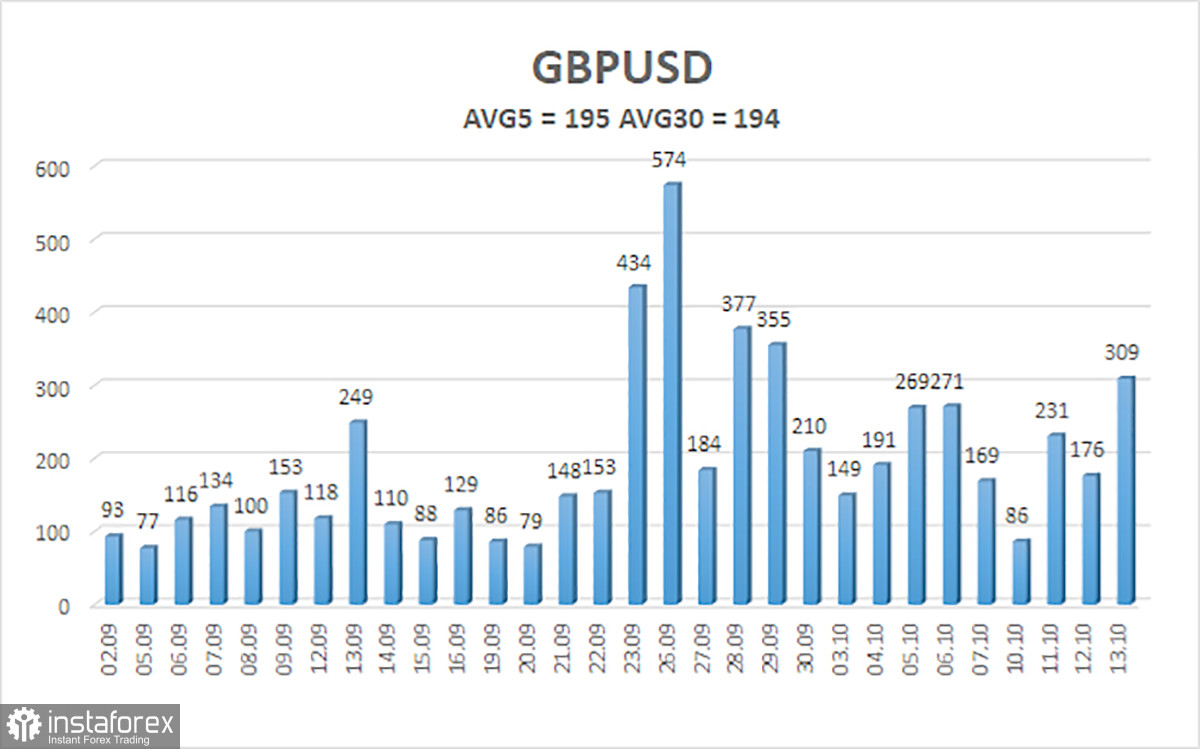

In the last 5 days, the average volatility of the pound/dollar pair totals 195 pips. It is a really high reading for this pair. On Friday, we suppose that the pair will move within the channel of 1.1148/1.1538.

Nearest support levels:

S1 – 1.1230

S2 – 1.1108

S3 – 1.0986

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1475

R3 – 1.1597

Trading recommendations:

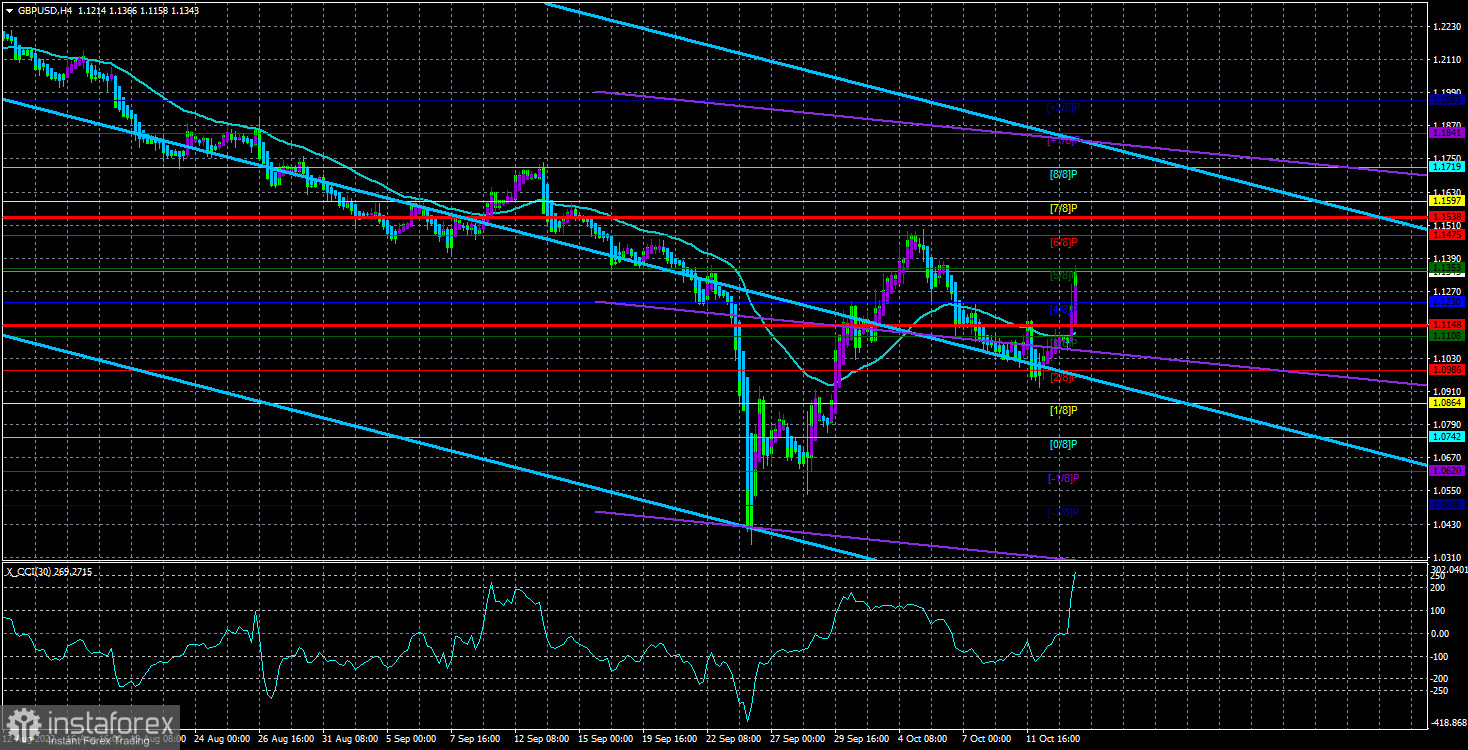

On the four-hour chart, the pound/dollar pair initiated a new upward cycle. That is why at the moment, traders should continue buying the asset with the target at 1.1475 and 1.1538 until the Heiken Ashi indicator downwardly reverses. Traders may go short if the price settles below the MA with the target at 1.0986 and 1.0864.

What we see on the chart:

Linear regression channels help determine the current trend. If both are headed in the same direction, the trend is strong now.

A moving average (settings 20.0, smoothed) determines a short-term trend and trading direction.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator: its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal will take place soon.