Bitcoin is getting boring. Despite the strong reaction of the leader of the cryptocurrency sector to the release of US inflation data for September, it has become the exception rather than the rule. BTCUSD volatility has fallen to its lowest level since the spring, which, along with the decline in daily trading volumes from $100 billion at the beginning of the year to $47 billion, says only one thing: interest in the token has seriously fallen. Those who came to it for the sake of thrills leave the market. Bitcoin is becoming an ordinary asset, from which one should not expect feats. At least in the near future.

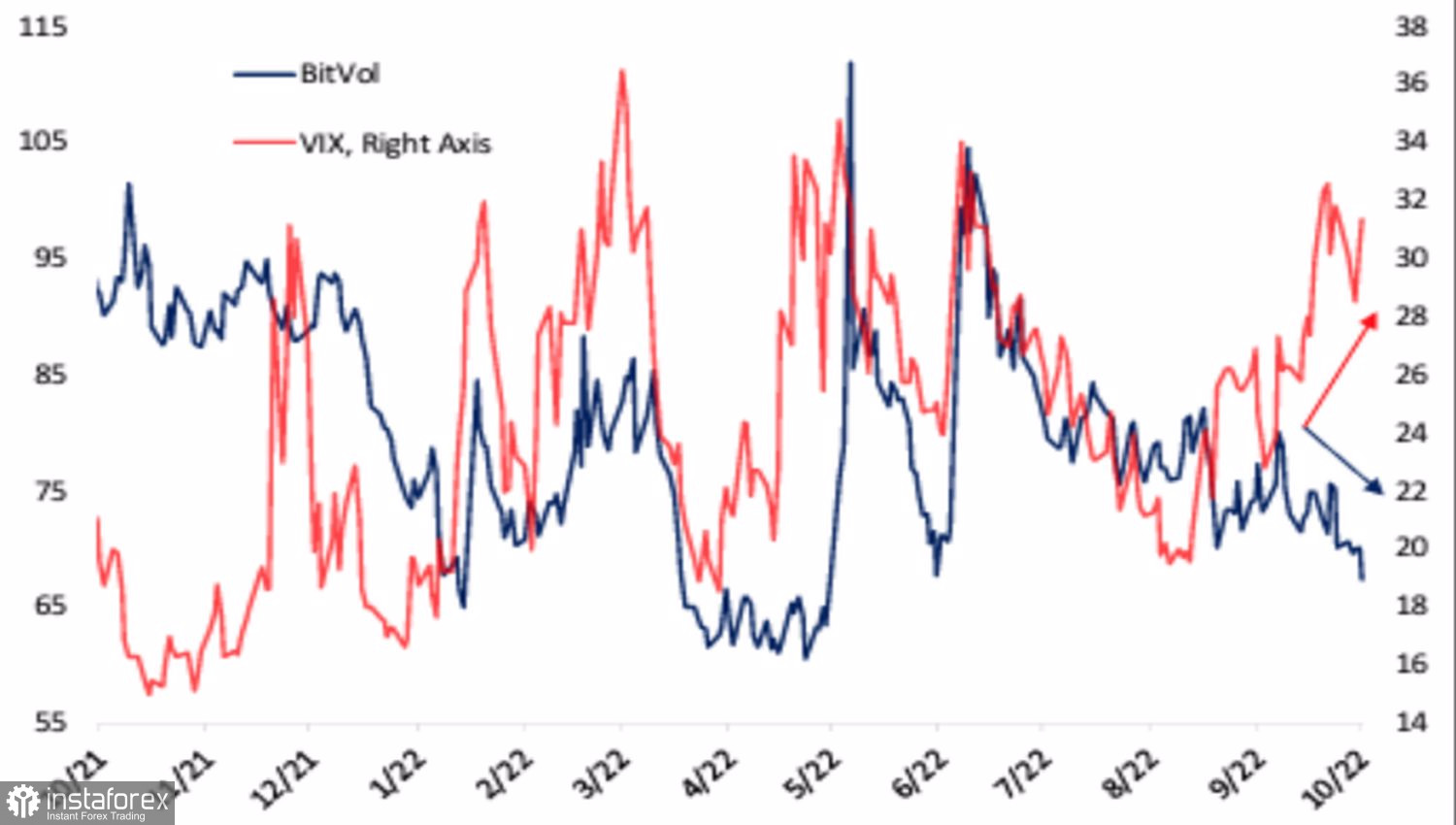

The BitVol (Bitcoin volatility) index is close to 69, although it was 111 in May. In terms of quote volatility, the leader of the cryptocurrency sector loses to US stock indices. And while the decline in volatility is a good sign for the latter, for bitcoin it indicates a loss of interest.

Bitcoin Volatility Dynamics and the VIX Fear Index

Investors remember the end of 2018, when BTCUSD quotes wandered around 6,000 for a long time, many said that the asset was oversold and found the bottom, but boring trading eventually collapsed prices to 3,000.

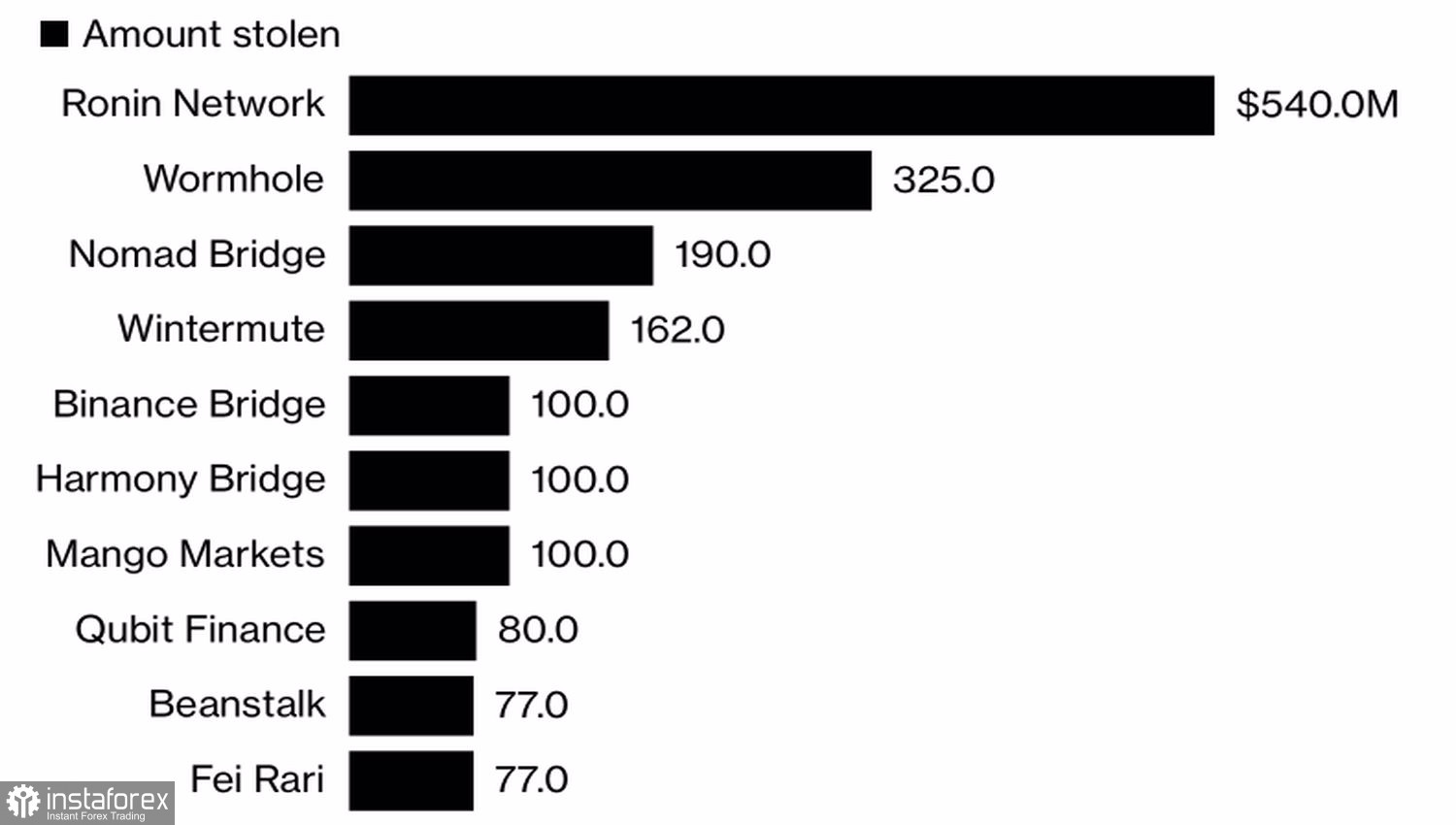

Falling volatility is not the only factor contributing to the loss of interest in the token. In October, there is a surge in thefts from crypto wallets. The amount of theft has already amounted to at least $718 million, as a result of which the figure has exceeded $3 billion since the beginning of the year. 2022 may become a kind of record or anti-record. It is unlikely that bitcoin can be called a bank for money holders, but it has become an ATM for hackers. In the 10 largest exploits, $1.7 billion was stolen.

Theft of crypto assets

As for the market, the dynamics of BTCUSD is still dependent on the macroeconomic background. Bitcoin tries to de-correlate with stock indices from time to time, but for now, all ties remain strong. In this regard, the reaction of the leader of the cryptocurrency sector to the release of inflation data in the United States is indicative. The rise of the base indicator to 6.6%, the highest level in 40 years, provoked a roller coaster not only for the Dow Jones index, S&P 500, and Nasdaq Composite but also for BTCUSD.

Obviously, such sharp movements are based on the principle "buy the US dollar on rumors, sell on facts," but the market again goes against the Fed, which has already ended sadly three times. CME derivatives give a 65% chance of a 75 bps increase in the federal funds rate at the December FOMC meeting and expect a 5% ceiling on borrowing costs.

However, assuming US inflation drops significantly in 2023 and the economy avoids a recession, this could be a good sign for the entire risky asset class, including bitcoin.

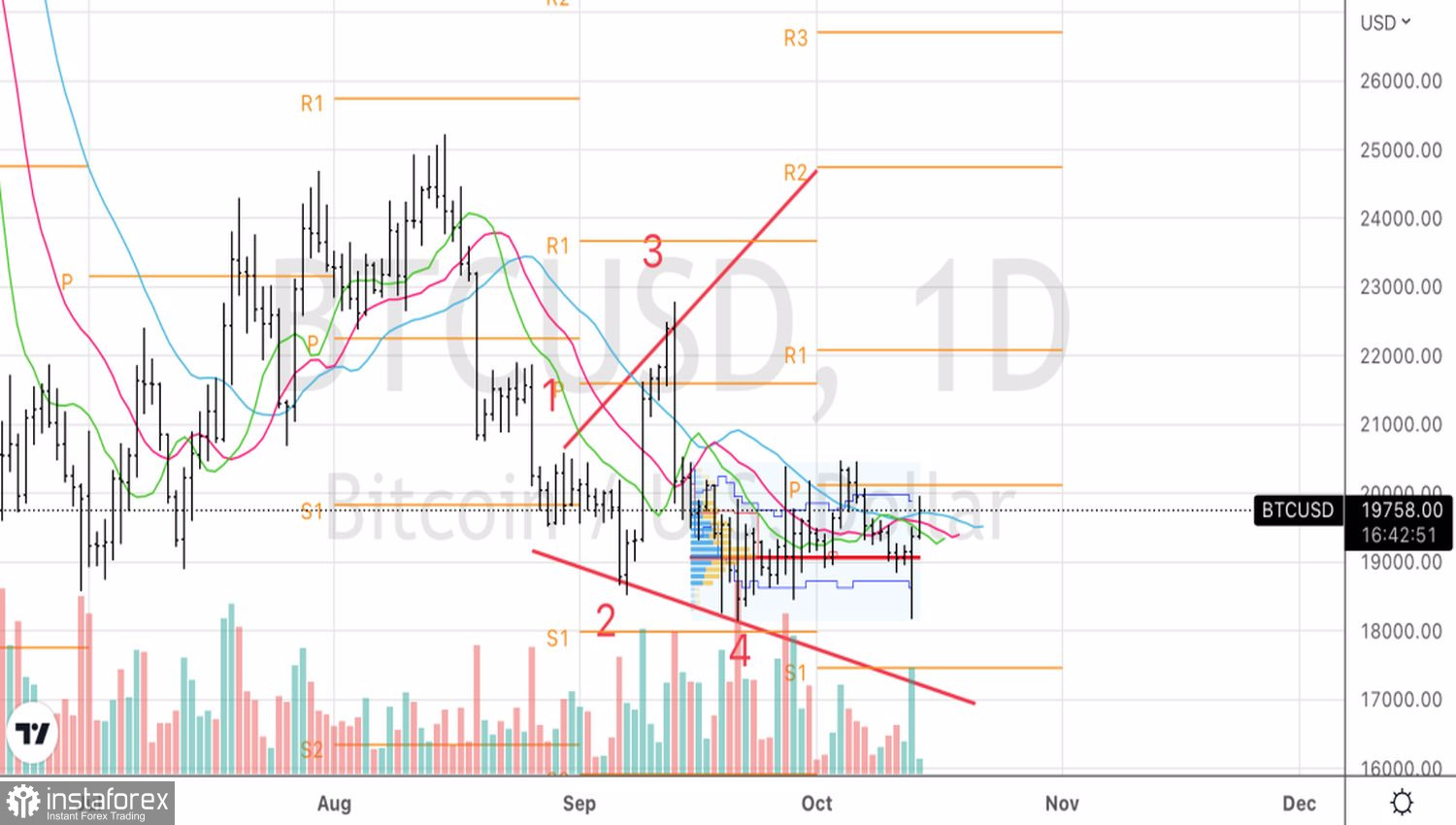

Technically, on the daily chart, BTCUSD continues to consolidate in the range of 18,200–20,500. In such conditions, against the background of falling volatility, it makes sense to buy a token on the rebound from the supports at 19,100, 18,600 and sell in case of unsuccessful assaults on the resistances at 19,800 and 20,100.